Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ethereum may be nearing a local bottom, as several popular on-chain indicators suggest that we could be in the ‘late stages’ of the correction that dragged Ethereum below the $3,000 level.

In an August 19th CryptoQuant report, author Burak Kesmeci cited the buy-sell ratio and open interest (OI) as compelling indicators that “Buyers are starting to regain strength in Ether.”

He noted that the taker buy-sell ratio is “positive again,” which calculates the ratio of buyers to sellers of Ether across all major cryptocurrency exchanges.

According to CoinGlass data, while the larger 24-hour period shows a slight edge for short-sellers of Ether, the most recent 12-hour period has turned positive, with 51.21% of positions being long.

Open Interest Mirrors Past Highs

Meanwhile, the total open interest (OI) for Ethereum futures, representing the number of contracts that have yet to be settled, topped $10.69 billion, up approximately 10% since the previous day, Aug. 18.

However, Kesmeci cautioned that for “significant upward movement in price, leveraged players will need to return to the scene.”

Something that would encourage more traders to open bullish positions. With this additional leverage within the market positive price movements would be amplified.

On March 12, when Ethereum reached its year-to-date all-time high of $4,066, OI was $13.67 billion. Likewise, when it retested those levels again in June, at $3,800, OI soared even higher above $15 billion.

“This indicated a market correction was likely, and indeed, the correction occurred,” Kesmeci added.

Etherium ETFs Remain Complacent

Despite the much-anticipated launch of the first US-based spot Ether exchange-traded funds (ETFs) on July 23, the historical debut has yet to bolster Ether’s price.

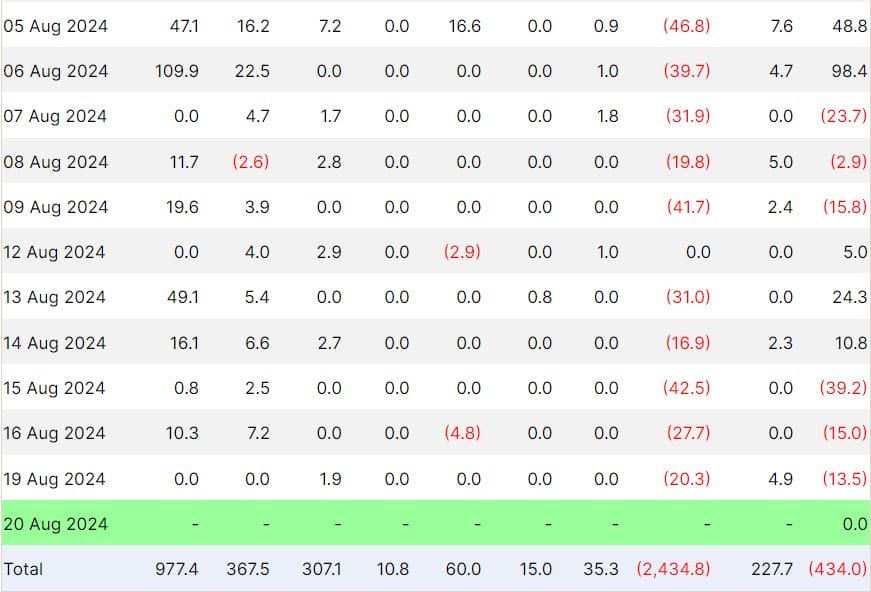

In fact, the ETFs may have contributed to Ether’s recent decline. Since their launch, the ETFs have seen cumulative net outflows of $434 million, adding significant selling pressure. This has been one of the reasons for Ether’s 13% drop below the key $3,000 level.

Notably, this mirrors Bitcoin’s performance when spot Bitcoin ETFs were introduced. Over the same period, Bitcoin’s price fell by approximately 15% before rebounding to its $69,000 level from launch day. Ether’s price could follow a similar recovery trajectory as markets adjust.

However, the current state of Ether ETFs appears stagnant amid significant outflows, which have swung back negative after a brief positive trend, according to Farside data.

The week beginning August 5th marked the first net-positive week for these ETFs, but the momentum has since subsided as accumulation has tapered off.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.