Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

With Ethereum’s price hovering around the $2,500 mark, all eyes are on whether it can maintain its momentum and continue its upward trajectory.

As the second-largest cryptocurrency stages a potential comeback, this article will dive into the latest ETH price trends and assess whether Ethereum is the best altcoin to buy in September or if a newer coin holds even greater upside potential.

When sizing up Ethereum’s performance in 2024, many complained about lackluster growth, especially across a challenging Q2/3 period, which has seen significant trading volume on rival blockchains like Solana and TRON.

At the heart of this growth in competitor market share has been the sustained astronomical interest in meme coin trading throughout the year (indeed, meme coins outperformed all other verticals in H1.

The picture worsens when you compare the relative performance of Solana and Ethereum meme coins, with data suggesting Solana meme coins performed 8x better.

Overall, this has resulted in slower-than-expected growth in ETH price with some questioning whether Ethereum will hit $10,000 in 2024.

ETH Price Analysis: Will Ethereum Hit $10,000 in 2024 Or Is ETH Bust?

As ETH price pushes to recover recent losses, Ethereum is currently trading at a market price of $2,455 (Representing a 24-hour change of -3.28%).

This comes in the aftermath of a significant decline in Ethereum price over the summer, with ETH bleeding-out -15% month-on-month.

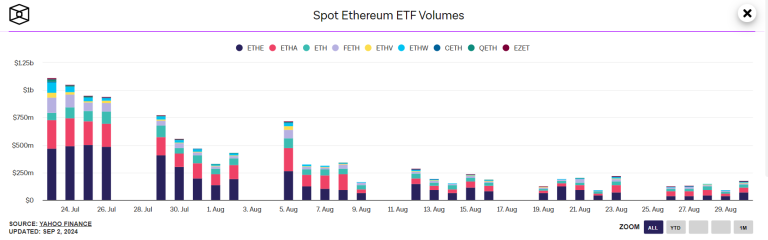

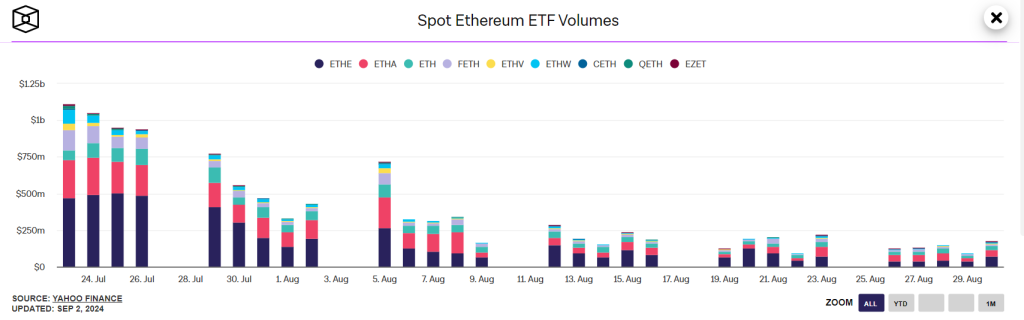

Yet, despite the downside—which has been egged on by a wider crypto market retracement alongside declining Ethereum Spot ETF inflows—things are looking up. Here’s why.

Zooming out to the long-time frame on the daily, it’s easy to see the bullish pendant pattern that’s currently sustaining ETH’s trading channel – which further illuminates a target price of $3,400 as mid-range.

Stepping back and cutting through the noise, this shows that even though ETH price has been struggling on the short-time frame, with huge volatility highlighted by the Bollinger bands, price remains in a healthy and stable technical structure.

Better still, this also demonstrates that despite the appearance of ‘losses’ when you check your portfolio, Ethereum is in sustained growth, with a +54% YTD gain – massively ahead of the S&P500!

Yet, without the huge returns expected from a bull run breakout, the upper trendline also suggests a current topside at around $4,050 – a far cry from the $10,000 many ETH trades anticipate.

How realistic is it that Ethereum price will reach $10,000?

Well, beyond the high hopes of a +300% move up to $10k, Ethereum has a present total supply at 120,308,274.

In cryptocurrency, market cap is total supply x market price; ergo for ETH price to hit $10k, the market cap would need to grow from $304,120,347,535 to $1,203,082,700,000.

That would mean an influx of $898,962,352,465 (a casual $898Bn – equivalent to the entire market cap of the world’s largest microchip manufacturer, TSMC, or almost the entire market cap of Berkshire Hathaway).

So, while long-time frame technical analysis suggests that Ethereum price will grow, albeit at a slower rate as the asset matures, it seems improbable that Ethereum will rocket all the way to $10,000 in the short-term.

Yet, that’s not to say there’s not easy 300% returns available in 2024, in fact, the beauty of market caps means a comparably exciting coin with a $10M market cap would only need a capital influx of $20M for price to triple.

Pepe Unchained Will Be The Coin You Regret Not Buying in 2024

It’s no secret that meme coins have been the strongest performers in the 2024 crypto market. Retail investors flock to the vertical above utility tokens and major layer-1 alts as they pursue potential 100x skyrockets.

Yet, with so many rug-pulls and scam coins afflicting the space, it’s also no secret that trust is at an all-time low in the meme coin space, as retail traders bemoan the dearth of genuine projects with actual use cases.

It’s for this reason that Pepe Unchained ($PEPU) has emerged as one of the strongest performers this August, with a jaw-dropping $11.69M raised ahead of the massive upcoming launch.

The rationale behind investor excitement is easy to see, with the intrepid developers working to deliver a huge innovation on the original Pepecoin ecosystem, which exploded dramatically in April 2023.

The supercharged reboot of the original PEPE aims to tackle one of the major limitations that have muted the growth of the top frog coin—its imprisonment on the slow, clunky, and frankly uncool ERC-20 standard.

While other ERC-20 meme coins, such as Dogecoin, have thrived on their own standalone blockchains, PEPE has been left behind – until now.

Pepe Unchained seeks to liberate PEPE from its shackles by launching a new, low-cost, and highly scalable home for Frog coins via a new Layer-2.

You heard it right; this is your opportunity to get in as an early bird investor in the latest Layer-2.

To keep up-to-date with the latest Pepe Unchained news, make sure to join the Telegram and follow $PEPU on X.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.