Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

While Ethereum makes headway with its recent expansion plans, the bulls are gaining traction. The ETH price has broken its downtrend with a massive 5.53% uptick over the past 24 hours.

The like of which has almost entirely erased the losses incurred since last Tuesday, bringing the weekly decline to just 0.93%. Ethereum seems the last to the party as other notable altcoins have ridden the ‘uptober’ sentiment.

Indeed, the altcoin is attracting significant attention as trading volume surges 68%, reaching $21.4 billion over the past 24 hours.

Ethereum Holders Go Long-Term: What’s Convinced Them?

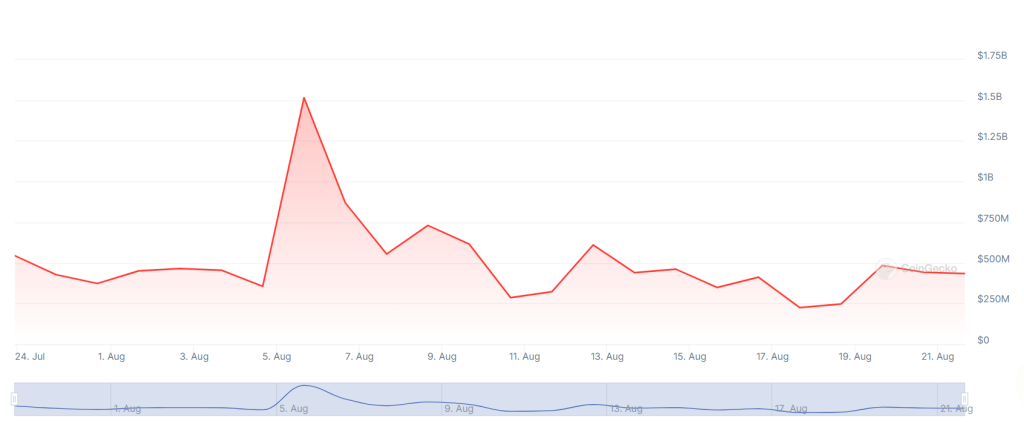

According to CryptoQuant data, ETH exchange reserves have seen a steep decline, with over $4 billion pulled from exchanges, $750 million of which over the past week.

This represents a step back from a two-month high on Ethereum profit-taking, as several holders capitalized on previous gains.

The primary driver of this sentiment appears to be the Ethereum network’s renewed focus on improving its scalability. Ethereum’s co-founder, Vitalik Buterin, recently unveiled “The Purge,” a planned upgrade focusing on streamlining data storage and reducing protocol complexity.

In addition, another upgrade titled “The Verge” will allow Ethereum nodes to run on everyday devices, such as smartphones and smartwatches, drastically reducing the hardware requirements for participation in the network.

These advancements have fostered a more positive long-term outlook for Ethereum, solidifying its position as the largest altcoin after months of stagnancy.

ETH Price Analysis: Can the Rally Last?

While fundamentals stack in Ethereum’s favor, technical indicators suggest an impending breakout from the multi-month downtrend it has suffered under.

Most notably, the bullish ascending triangle pattern that has bound the ETH price in consolidation since August appears to be nearing its end.

This seems all the more likely as the MACD line appears to be amidst a crossover above the signal line, a move that typically coincides with significant upticks in the ETH price.

However, there remain significant challenges ahead, most notably the upper resistance of the descending channel that has held Ethereum in a downtrend since May.

While the 200SMA has provided strong support throughout the recent consolidation, the 50SMA remains a stubborn resistance level. Overcoming it will likely prove critical for solidifying a breakout from the triangle.

Although, it doesn’t seem Ethereum is ready for a breakout just yet as the Relative Strength Index (RSI) has yet to break into bullish territory, currently at 48. An attempt at a breakout could be unsuccessful without underlying buying pressure to support it.

Given that the pattern materializes, $3,400 seems a credible price target by the year’s end. However, with strong fundamentals stacking up, a run for a new high could be in Ethereum’s cards.

This Low Cap Gem Has Higher Gains Potential

Although fundamentals and technical indicators ring bullish for the world’s leading altcoin, fortune favors the bold – emerging opportunities hold the potential for truly substantial gains.

As “meme coin supercycle” sentiment takes hold and coins like $GOAT and $MOODENG experience sudden rises to prominence, strategic investors may find it beneficial to diversify into newer low-cap meme coins with exponential growth potential.

Notably, Memebet Casino’s $MEMEBET token presale is off to a strong start, raising over $500,000 for its new Telegram-based betting platform pioneering meme coins betting.

Crypto enthusiasts are excited about the platform, which offers high stakes, a global sportsbook featuring major leagues like EPL and NBA, and a wide range of crypto-native games.

While other meme coins like Dogecoin, Pepe, Shiba Inu, and Floki – with more on the way – can be used for wagers, the $MEMEBET token is central to the ecosystem and is the only one that enhances the gaming experience for every degen player.

Using $MEMEBET tokens unlocks a range of benefits, including airdrop rewards, special degen bonuses, and access to the upcoming Memebet Casino Lootboxes, featuring real-world prizes and valuable casino bonuses.

Furthermore, Memebet Casino incorporates a play-to-earn (P2E) wagering element, offering higher rewards to players who wager more on the platform.

To stay updated, join the Memebet community on X and Telegram.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.