Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

El Salvador is reportedly revising its crypto policy, making Bitcoin acceptance optional as part of a $1.3 billion loan agreement with the International Monetary Fund (IMF).

According to a recent report by the Financial Times, the agreement includes dropping the legal requirement for businesses to accept Bitcoin as payment. This move addresses concerns raised by the IMF regarding financial concerns in the country’s economy.

El Salvador’s Financial Concerns

El Salvador’s decision to alter its Bitcoin policy would be part of broader financial commitments required to secure the IMF loan. The government also plans to reduce its budget deficit by 3.5 percentage points of GDP over three years through spending cuts and tax reforms.

An IMF mission is currently in San Salvador to finalize the terms of the agreement with President Nayib Bukele’s administration, as revealed by two people close to the talks.

The deal is expected to bring additional financial support, including $1 billion from the World Bank and another $1 billion from the Inter-American Development Bank.

The IMF has consistently opposed El Salvador’s decision to adopt Bitcoin as legal tender, citing risks to financial stability. The country’s 2021 law mandating Bitcoin acceptance as payment had been a point of contention in negotiations with the IMF.

Nayib Bukele’s Push for Bitcoin Adoption

Under the new agreement, businesses will no longer be legally required to accept Bitcoin as payment. The government has also committed to increasing its financial reserves from $11 billion to $15 billion to strengthen economic stability.

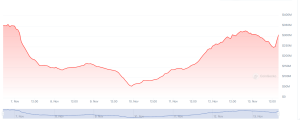

El Salvador has accumulated Bitcoin in its national reserves, with President Bukele frequently purchasing during price dips. The value of these reserves was reported at over $600 million last month, representing a 127% gain, according to Bukele’s social media updates.

Based on the report, while Bitcoin adoption has been promoted as part of El Salvador’s efforts to rebrand itself as a global crypto hub, the majority of Salvadorans continue to rely on the US dollar for daily transactions.