Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

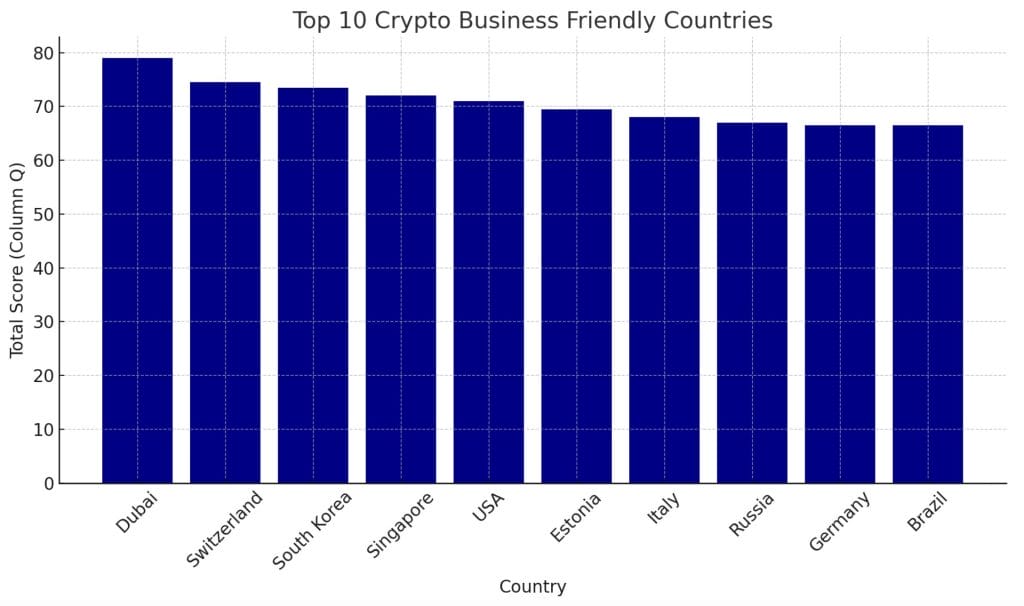

Dubai, Switzerland and South Korea have been identified as prime destinations for crypto business in 2024.

According to a Social Capital Markets report, these countries rank high in providing legal clarity. They also impose favorable capital gains and corporate tax rates. Further, these countries host a significant number of registered crypto firms. They also have widespread acceptance of cryptocurrency payments.

Each factor received a score out of 20, totaling 100 points, leading to the ranking of the top 10 crypto-friendly countries.

Dubai’s Forward-Thinking Crypto Policies Earn It Top Position in Global Rankings

Dubai secured the highest spot with a score of 79, excelling in regulatory clarity, absence of capital gains tax, a favorable 9% corporate tax and affordable licensing fees.

Dubai has established itself as a leading hub for cryptocurrency and blockchain ventures by adopting a forward-thinking regulatory framework and favorable tax policies. Creating the Virtual Asset Regulatory Authority (VARA) and the Dubai Financial Services Authority (DFSA) ensures a clear legal environment, encouraging innovation in the crypto space.

Further, the DMCC Crypto Centre plays a key role in supporting the growth of crypto and blockchain firms. It provides specialized infrastructure for these companies. Dubai has no capital gains tax on crypto transactions. The corporate tax threshold is set at AED 375,000. This tax strategy enhances Dubai’s global appeal to crypto businesses.

Image Source: Social Capital Markets

Switzerland’s ‘Crypto Valley’ Thrives with 900 Companies and Investor-Friendly Tax System

Switzerland holds the second spot with a score of 74.5, boasting 900 registered crypto companies and offering a 7.8% capital gains tax for long-term investors.

FINMA, Switzerland’s financial regulator, has created a clear and accommodating regulatory framework for crypto businesses. This framework is especially strong in regions like Zug, known as “Crypto Valley.” Mandatory registration with FINMA provides legal certainty. This has helped over 900 crypto companies thrive in Switzerland.

Switzerland’s tax system further strengthens its crypto appeal, with a 7% capital gains tax and corporate taxes between 12% to 21%, offering a more favorable tax climate than global averages. Additionally, over 400 companies accepting cryptocurrencies for transactions highlights the deep integration of crypto into the country’s economy.

South Korea’s Evolving Crypto Framework and Tax Relief Propel It to #3

South Korea ranks third with a score of 73.5 and plays an active role in shaping the global cryptocurrency landscape.

The Korea Financial Intelligence Unit (KFIU), under the Financial Services Commission (FSC), has established a developing regulatory framework aimed at integrating cryptocurrencies into the financial system. By requiring crypto businesses to register with the FSC, the country ensures regulatory oversight and legitimacy for operations.

South Korea’s tax policy further enhances its appeal for crypto ventures. The delay in capital gains tax on cryptocurrency, along with plans to introduce corporate tax in 2025, offers a temporary tax relief, potentially attracting more businesses.

With over 376 active crypto companies, South Korea is expanding its market and setting a regional example. Supported by state-backed initiatives like CBDC exploration, the country blends regulatory clarity, business potential, and technological growth, solidifying its influence in the global crypto landscape.