Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

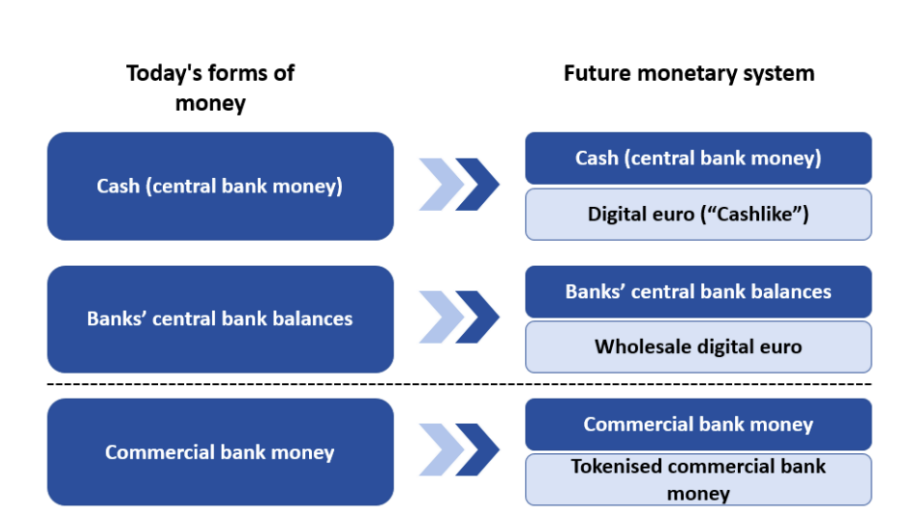

The digital euro proposed by the European Central Bank (ECB) is too complex, offers limited benefits and could undermine the competitiveness of European payment systems. These are the key findings of an August 2024 study commissioned by the Association of German Cooperative Banks (BVR) and conducted by payment consultancy Paysys.

Researchers from Paysys, including CEO Hugo Godschalk and professors Malte Krüger and Franz Seitz, conducted a thorough review of all published documents and regulatory proposals from the Eurosystem and the European Commission up until June 2024. Their analysis focused on the consistency and feasibility of the digital euro within the European financial market, particularly from the perspective of retailers and consumers.

Digital Euro: Overly Complex and Costly

The researchers conclude that the digital euro, as currently proposed, offers little added value for consumers and businesses. The construct is too complex and incomprehensible for users both in front of and behind the cash register. “For example, the number of parties involved in a payment transaction would increase from the current four (payer, payee and their respective payment service providers) to up to eight, which would complicate and slow down the settlement process,” the three experts criticize.

This added complexity could lead to slower and more expensive transactions. The low costs targeted by the ECB and EU policy are unrealistic, the report says, and incompatible with increasing Europe’s competitiveness.

Professor Malte Krüger of the Technical University of Aschaffenburg, one of the study’s authors, emphasized that the digital euro, as currently designed, would primarily compete with existing cashless payment methods rather than serving as an innovative replacement for physical cash. He highlighted numerous unanswered questions and inconsistencies between the ECB’s documents and the EU Commission’s regulatory proposals:

“In particular, there are open questions regarding the design of the compensation model, the regulation of liability issues, the design of the offline digital euro, the level of holding limits, and the design of a proposed digital euro card. The strong focus on the smartphone as a payment instrument is also subject to criticism.”

No Full Anonymity for the Digital Euro

The ECB has made it clear that the digital euro will not offer complete anonymity. Despite the potential for offline use, all digital euro users will be required to undergo identification during the onboarding process.

This decision aligns the digital euro with existing European Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations that apply to traditional payment accounts. While there might be some flexibility for simplified due diligence under certain low-risk conditions, full anonymity is off the table.

The study suggests that focusing on transaction monitoring for offline digital euros, rather than mandating user identification, could be a more effective way to prevent AML/CFT while also preserving user privacy. This approach, according to the researchers, would also simplify the overall system and allow for the implementation of inter-PSP fees to compensate providers.

German Banks Call for User-Centric Approach

Tanja Müller-Ziegler, a board member of the BVR, stressed the importance of a digital euro that offers tangible benefits to consumers and businesses.

Eine vom BVR beauftragte Studie „Der digitale Euro aus Sicht des Verbrauchers, des Handels und der Industrie“ unterzieht die bislang vorliegenden Ideen zur Ausgestaltung eines digitalen Euro einem Realitätscheck. Zur Studie: https://t.co/1kGT7ii1JU pic.twitter.com/lV8C5ZaNfq

— BVR (@BVRPresse) August 6, 2024

Müller-Ziegler argued the ECB’s current approach, which aims to create a parallel state-run system alongside the existing private-sector payment infrastructure, is misguided.

“The focus of all considerations should be on the benefits for users, including anonymity, stability, and data protection. Banking practice must be much more closely involved in the conception of a digital euro; we continue to offer our intensive cooperation.”