Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

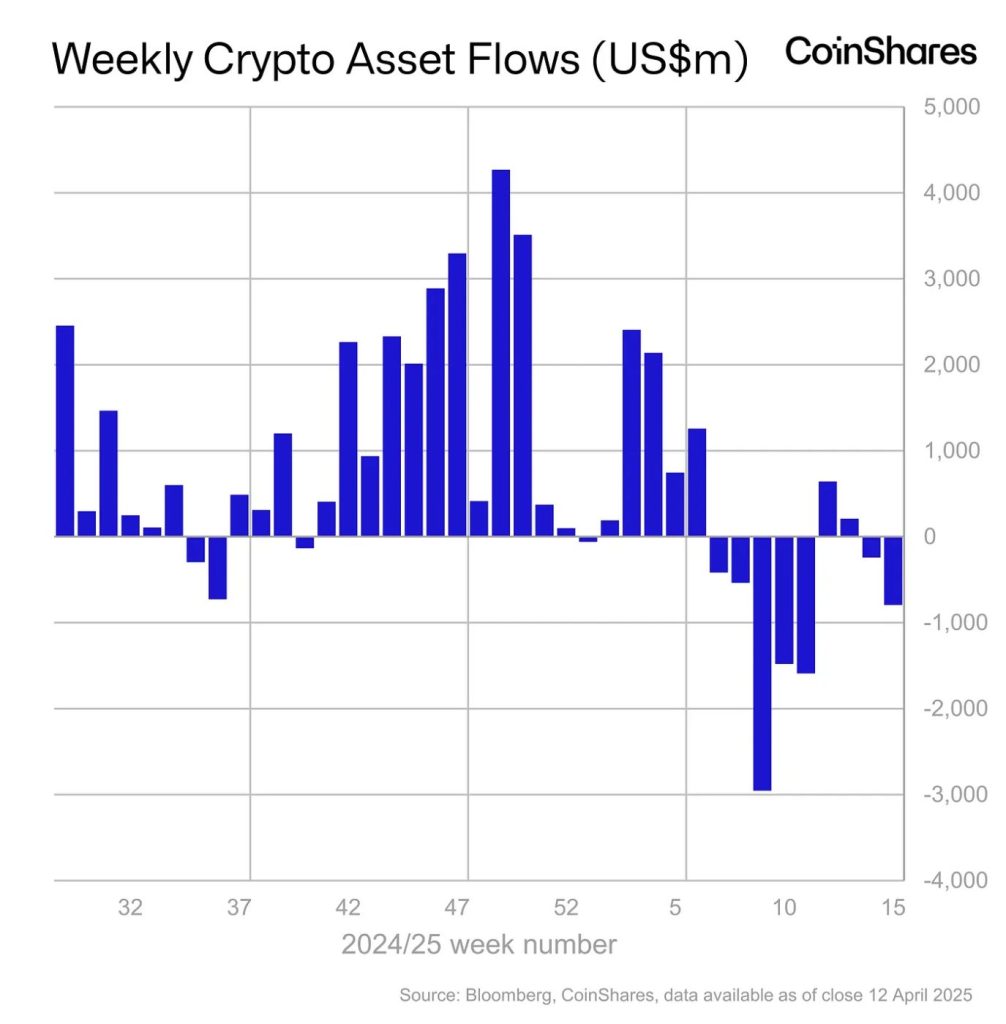

Digital asset investment products experienced another tough week, recording $795 million in outflows, the third consecutive week of declines.

Mounting pressure from recent tariff-related developments continues to dampen investor confidence across the crypto sector, according to a Monday report from CoinShares.

Since early February, the outflows have totaled $7.2 billion, nearly wiping out all 2024 year-to-date gains. Net inflows for the year now stand at just $165 million.

Crypto Markets Rebound After Trump Eases Tariffs

Notably, a late-week recovery in crypto prices helped boost total assets under management (AuM) to $130 billion — an 8% rebound from the April 8 low, following President Trump’s partial rollback of controversial tariffs.

Bitcoin bore the brunt of last week’s withdrawals, with $751 million in outflows.

Despite this, the leading cryptocurrency still shows $545 million in YTD inflows.

Ethereum followed with $37.6 million in outflows, while Solana, Aave, and Sui also posted smaller losses.

Interestingly, even short-bitcoin products saw outflows of $4.6 million, suggesting an overall risk-off sentiment rather than directional bets.

A few altcoins defied the trend: XRP led inflows with $3.5 million, while Ondo, Algorand, and Avalanche each attracted modest investor interest.

The outflows signal continued caution among digital asset investors amid macroeconomic and geopolitical uncertainty.

Meanwhile, BlackRock’s crypto ETF inflows plummeted by 83% in Q1 2025, following a strong end to 2024.

While the firm still attracted $3 billion into Bitcoin and Ether ETFs, investor enthusiasm sharply declined amid stagnant crypto prices and rising market volatility, according to the company’s first quarter earning report.

The inflows represented just 2.8% of iShares’ total for the quarter, indicating a broader investor shift toward caution under current economic conditions.

The crypto slowdown mirrored broader weakness across BlackRock’s ETF business, with total iShares inflows falling over 70% to $84 billion from $281 billion in the previous quarter.

Despite holding $50.3 billion in digital asset AUM, crypto contributed less than 1% to BlackRock’s long-term revenue.

Market volatility and shifting sentiment under the Trump administration were cited as key reasons behind the investor retreat.

Mechanism Capital’s Andrew Kang Takes $200M Long Position on Bitcoin

Despite weak ETF market performance, crypto traders are still bullish on Bitcoin.

For one, Andrew Kang, founder of crypto venture firm Mechanism Capital, has doubled his bullish bet on Bitcoin, taking a $200 million long position.

As reported, a wallet tied to Kang made a second $100 million leveraged long bet on Bitcoin on Monday, bringing his total position to $200 million.

The recent trade carries an estimated potential gain or loss of around $6.8 million, reflecting Kang’s confidence in a near-term Bitcoin rally.

Last week, Bitwise Chief Investment Officer Matt Hougan reiterated his December prediction that Bitcoin could hit $200,000 before the close of 2025.

Hougan argued that recent developments in U.S. trade policy, particularly under former President Donald Trump’s renewed tariff push, could act as tailwinds for Bitcoin.