Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Decentralized finance (DeFi), stablecoins, and altcoins have found a home in the Middle East and North Africa (MENA) region, according to blockchain analytics firm Chainalysis.

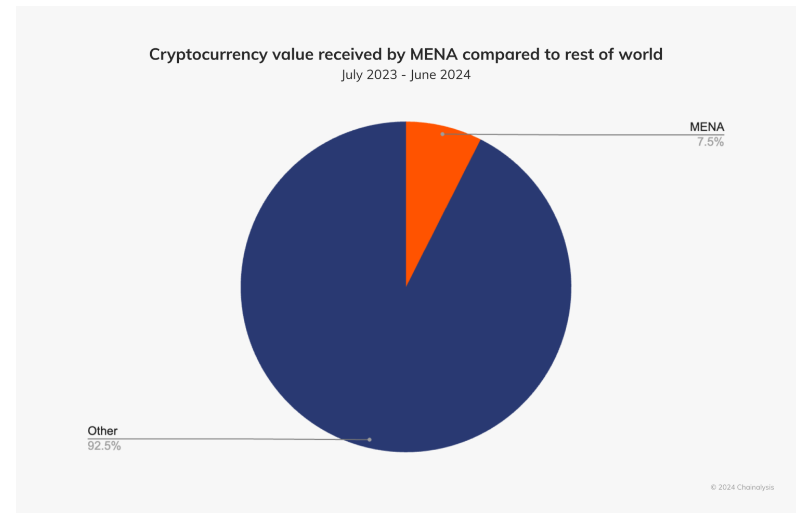

MENA is the seventh-largest crypto market globally this year.

Between July 2023 and June 2024, its on-chain value was $338.7 billion, or 7.5% of the world’s total transaction volume.

According to its latest ‘2024 Geography of Cryptocurrency Report,’ MENA’s primary source of crypto inflows is still centralized exchanges (CEXs).

However, “decentralized platforms and DeFi applications are steadily gaining traction,” the researchers said.

DeFi has a multitude of benefits for the region. It fosters innovation and provides an alternative financial system for the unbanked and underbanked.

Moreover, it does not require any intermediaries, which is crucial for people in underserved areas.

All these factors are key for financial inclusion, given that, as of 2021, only 50% of adults in the region (excluding high-income countries) had a bank account.

DeFi adoption is not widespread in some of these areas, but these benefits “could drive future financial inclusion.” Individuals gain the ability to access savings, loans, and investment tools.

Notably, Saudi Arabia and the UAE demonstrate high interest in decentralized platforms.

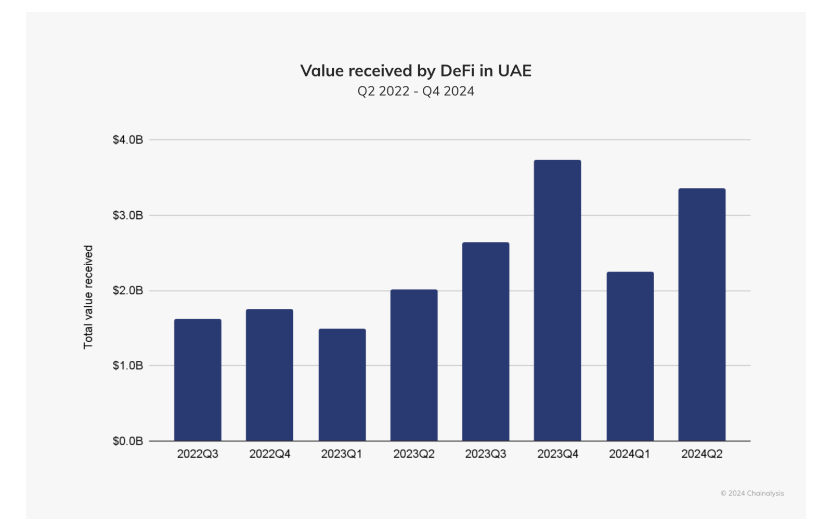

Particularly, the UAE shows higher DeFi adoption than the global average. It has seen “rapid growth,” boasting a diversified crypto ecosystem.

This is the result of regulatory innovation, institutional interest, and expanding market activity, said the report.

Between July 2023 and June 2024, the UAE received over $30 billion in crypto, making it MENA’s third-largest crypto economy and one of the top 40 worldwide.

DeFi services saw the total value increase by 74% compared to last year.

DEXs alone recorded an 87% value increase from an estimated $6 billion to $11.3 billion.

Regulatory strides made across key markets in 2024 are “likely to further shape the distribution of DeFi and CEX platforms, impacting financial inclusion and the broader adoption” of DeFi, the report said.

You might also like

Stablecoins and Altcoins Make Significant Gains Across MENA

Stablecoins and altcoins are gaining market share in MENA over “traditionally preferred assets” like Bitcoin (BTC) and Ethereum (ETH), the report remarked.

Türkiye, Saudi Arabia, and the UAE have recorded higher shares of stablecoin volume.

In the UAE, the Emirati dirham is pegged to the US dollar. Therefore, the rising stablecoin adoption “likely reflects their popularity as an on-ramp to broader crypto services and trading.”

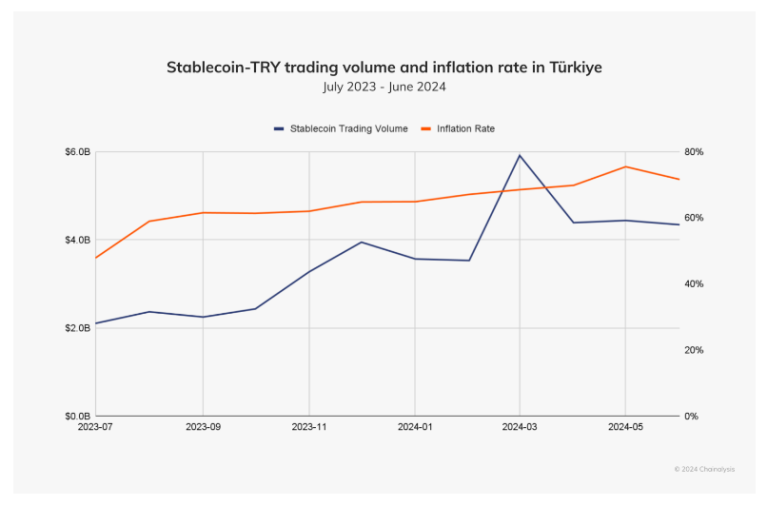

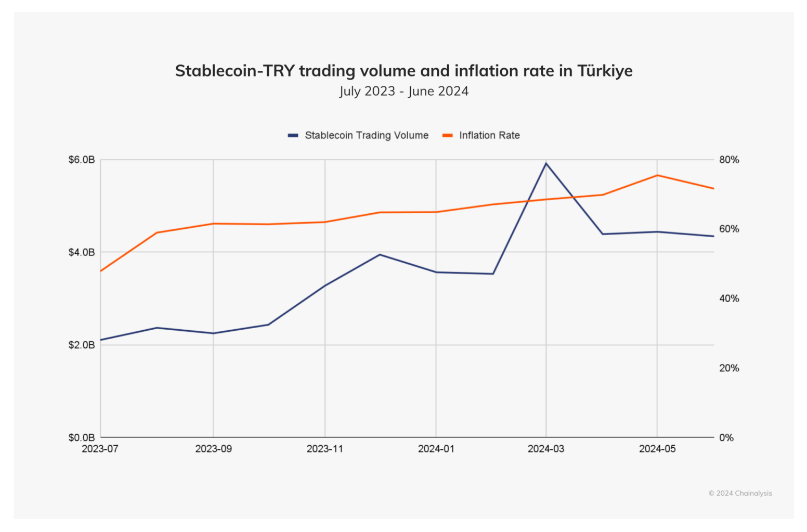

On the other hand, in Türkiye, retail users rely on stablecoins due to economic instability, high inflation, volatility concerns, and a need for consistent stores of value.

Researchers have noted that individuals have turned to stablecoins and altcoins to hedge against currency devaluation and seek higher returns.

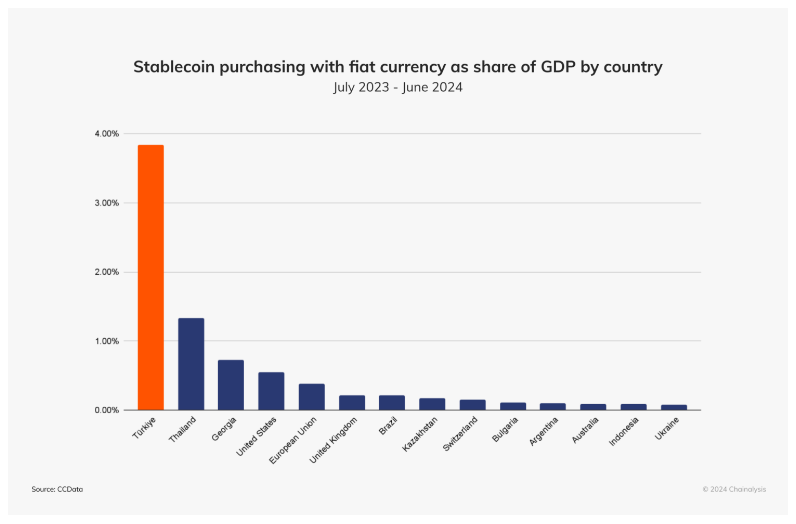

“Türkiye is number one in the world in stablecoin trading volume as a percentage of GDP, by a large margin,” the report said. “Stablecoins consistently represent the majority of crypto assets purchased with the Turkish Lira, approaching nearly $6 billion in purchases in March of this year.”

Additionally, Türkiye is the largest crypto market in MENA and seventh globally. It received $136.8 billion in value between July 2023 and June 2024.

Meanwhile, Saudi Arabia shows “a strong interest in altcoins, well above the global average.”

This may indicate a higher risk appetite and interest in assets beyond the major coins.

Speaking of major coins, the use of ETH in the region is “relatively consistent.” However, it “falls below the global average.” Türkiye leads this engagement, the research concluded.

You might also like