Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

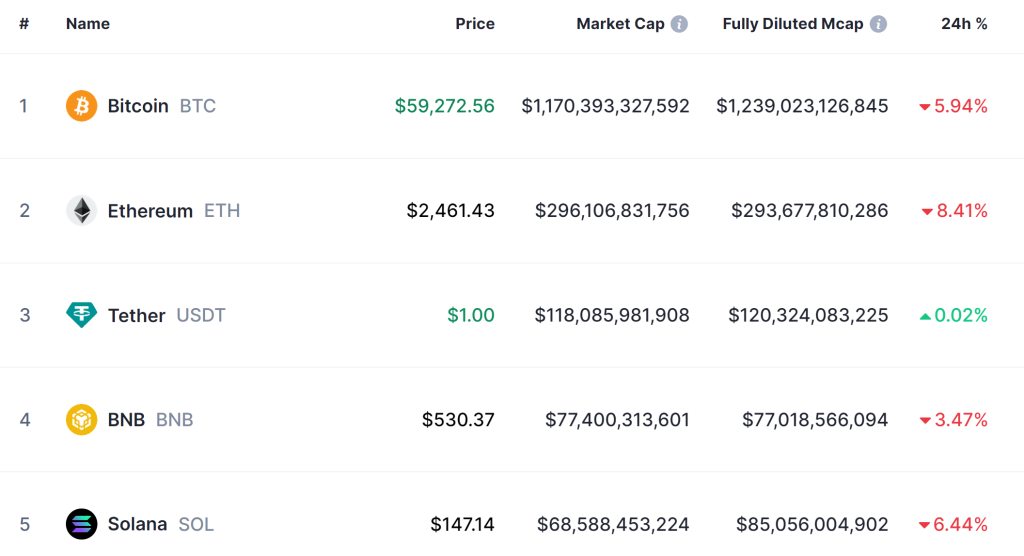

Crypto prices have dumped hard in the last few hours since the close to US marts on Tuesday, with Bitcoin (BTC) dipping 6%, Ethereum (ETH) 9% and Solana (SOL) 7% in the last 24 hours as per CoinMarketCap.

The sudden sell-off commenced at just after 5pm Eastern time.

Over the course of about one hour, Bitcoin had slumped all the way from just under $62,000 to lows around $58,000.

BTC has since recovered back to the $59,000s.

ETH, meanwhile, dipped from the upper $2,500s to the mid-$2,400s. And SOL dove from above $154 to its current level near $147.

Per CoinGlass, levered futures positions worth $205 million were liquidated in the past 4 hours.

That meant liquidations were over $300 million in the past 24 hours, the most since August 4th.

Technicals Caused the Sudden Drop in Crypto Prices?

There was no obvious catalyst for the sudden drop in crypto prices.

But technicals could have played a part, at least for Bitcoin.

Bitcoin’s sudden drop occurred after the crypto’s price dipped below its 50DMA.

The 50DMA has been a key level of resistance throughout most of August.

It was then flipped to support during last Friday’s rally in crypto prices that saw BTC reach as high as $65,000.

But that support has now gone, as has an uptrend from the mid-month lows.

Chart analysis suggests a near-term test of $56,000 is a possibility.

Where Next for Crypto Prices?

Tuesday’s sharp drop in crypto prices could prove very short-lived if Wednesday’s Nvidia earnings report beats expectations.

Nvidia, one of the world’s largest companies, is at the leading edge of the AI boom.

And their strong earnings performance in the past 12 months has been a key driver of the US equity bull market.

This bull market has, unsurprisingly, bled into the correlated crypto space.

So strong earnings tomorrow could be a major tailwind for crypto majors. Bitcoin may not remain below $60,000 for long.

US Core PCE inflation data scheduled for release later in the week could also support sentiment.

That’s because it is expected to further add to the Fed’s confidence that a series of rate cuts in the next few quarters is appropriate.

That should support the recent dovish shift in the Fed’s language and guidance.

Easing liquidity conditions are expected to be another major tailwind for crypto prices in the years ahead.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.