Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Crypto activity is at an all-time high, with the number of monthly active addresses tripling since the end of 2023, according to the recent State of Crypto Report 2024 published by a16z, a Web3 venture capital fund.

As per the report, the crypto industry is experiencing a user boom, with the number of active crypto addresses reaching 220 million by September 2024.

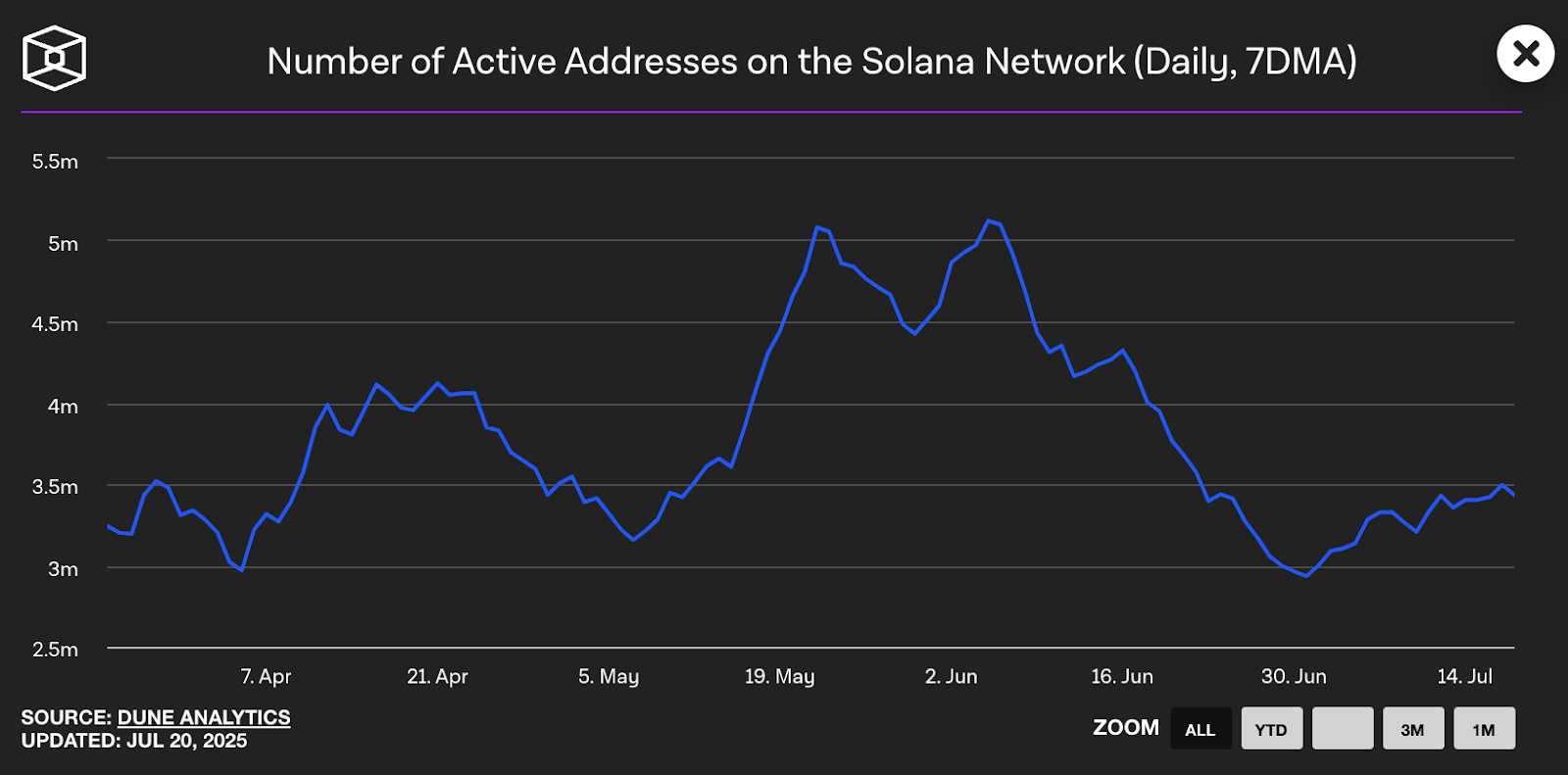

A deeper dive reveals that Solana (SOL) is the primary driver of this surge, accounting for roughly half of the reported active addresses (100 million). This suggests a shift in user preferences, with newer, faster blockchains gaining traction alongside established players like Bitcoin (BTC) with 11 million active addresses. Ethereum (ETH), the dominant blockchain for decentralized applications (DApps), currently sits at 6 million active addresses.

Mobile crypto wallet usage is also soaring, reaching a record 29 million users in June 2024. While the United States (U.S.) still holds the largest share of mobile wallet users (12%), its dominance is waning. This trend reflects the global spread of crypto adoption, with countries like Nigeria, India, and Argentina experiencing significant growth.

However, the report estimates that there are between 30-60 million active crypto users worldwide. This represents only 5-10% of the estimated 617 million crypto owners around the world.

Policymakers Embrace Crypto

Crypto also has gained significant political appeal, with policymakers and politicians increasingly discussing and supporting its potential benefits.

The listing of Bitcoin and Ether exchange-traded funds (ETFs) was a major milestone, as per the report, signaling growing institutional acceptance.

The European Union (E.U.) and the United Kingdom (U.K.) have taken a more proactive approach to engaging the public and shaping crypto policy compared to the U.S. Various European agencies have issued numerous calls for input on crypto-related regulations (like the Markets in Crypto Assets (MiCA)), far exceeding the efforts of the U.S. Securities and Exchange Commission (SEC).

Stablecoins have emerged as a powerful tool for global payments. In Q2 2024, stablecoin transaction volume surpassed that of Visa ($8.5 trillion against Visa’s $3.9 trillion), demonstrating their growing utility and acceptance.

Additionally, stablecoins are becoming a major focus of policy discussions, particularly in the U.S. One driving factor is the recognition that stablecoins can bolster the U.S. dollar’s global standing, especially as its dominance as a reserve currency wanes.

DeFi’s Continued Growth

Decentralized finance (DeFi) remains a leading crypto category, attracting more builders than blockchain infrastructure and accounting for the highest daily crypto usage. Since its emergence in 2020, decentralized exchanges (DEXs) have grown significantly, capturing 10% of spot crypto trading activity, a market previously dominated by centralized exchanges (CEXs).

The report also revealed that over $169 billion is currently locked in various DeFi protocols, with staking and lending among the most popular subcategories.

Ethereum’s transition to proof-of-stake (PoS) in 2022 marked a significant step towards reducing the network’s energy consumption. Since then, the share of staked Ether has increased to 29%, enhancing network security.

The authors of the report conclude that DeFi offers a potential solution to the growing centralization and consolidation of power in the traditional financial system:

“While still in its early stages, DeFi presents a hopeful alternative to the trend of centralization and power consolidation afflicting the U.S. financial system, where the number of banks has dropped by two-thirds since 1990 and where an increasingly small share of big banks dominate assets.”