Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

October 2024 saw the second-lowest loss year-to-date (YTD) but a 114% increase from October 2023, according to the latest report by major bug bounty and security services platform Immunefi.

Over the past 30 days, the space lost $55,138,600 in hacks across seven incidents.

Notably, per the report, this is the second-lowest loss YTD.

At the same time, it represents a 114% increase from October 2023. Registered losses at that time stood at $25,706,429, which was a 56.6% decrease month-over-month.

Most of the $55.2 million was lost in hacks related to two projects.

DeFi lending protocol Radiant Capital lost $50 million, while DeFi protocol Tapioca DAO lost considerably less but still a substantial sum of $4.4 million.

Other incidents include P719’s $328,000, MorphoLabs’ $230,000, Ramses Exchange’s $93,000, HYDT’s $58,000, and Fire’s $24,000.

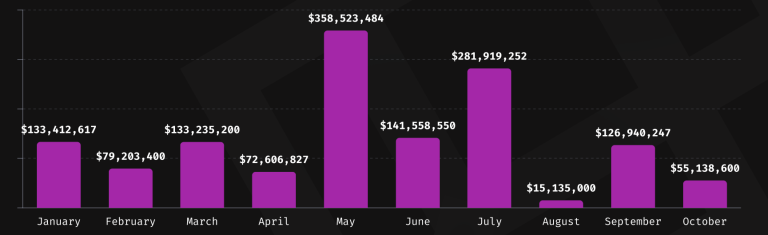

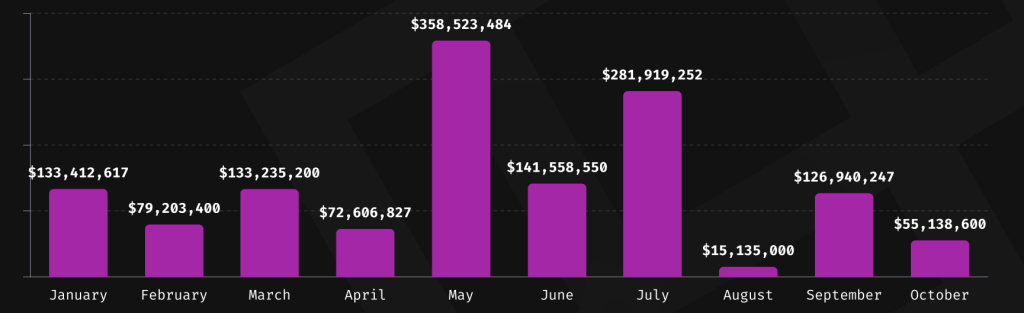

Looking at the YTD losses in 2024, hacks and rug pulls cost the space a total of $1,400,073,177 across 179 specific incidents.

Nonetheless, this is a 1% decrease compared to the same period in 2023, when losses totaled $1,414,641,935.

This year’s losses were primarily driven by over $358 million drained in May and over $281 million in July, the report noted.

You might also like

100% DeFi Hacks

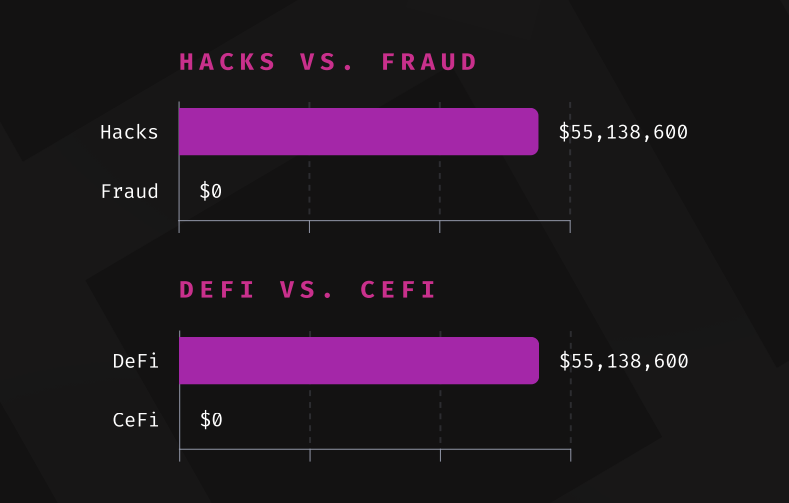

Perhaps unsurprisingly, hacks remained the predominant cause of losses in October 2024.

100% of the recorded sum was lost in hacks.

At the same time, there were no reported fraud incidents in this time frame.

Furthermore, all these hacks occurred in the decentralized finance (DeFi) space.

“DeFi again surpassed CeFi, representing 100% of the total volume of funds lost,” Immunefi said.

Meanwhile, BNB Chain was the most targeted chain this past month.

It was hit with four of the seven attacks, which together represent 50% of the total losses across targeted chains.

Ethereum and Arbitrum suffered two attacks each, representing 25% of the total, respectively, the researchers said.

Note: There have been seven specific incidents. However, Radiant was affected on the BNB Chain and Arbitrum.

Meanwhile, Immunefi noted that it offers over $167 million in available bounty rewards. So far, it has paid out more than $100 million in bounties and saved over $25 billion in user funds.

“Immunefi has facilitated the largest bug bounty payments in the history of software,” the team stated.

These include $10 million for a vulnerability discovered in the cross-chain messaging protocol Wormhole, $6 million for a vulnerability in the Aurora bridge, and $2.2 million for a vulnerability in the decentralized Ethereum scaling platform Polygon.

You might also like