Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

In February 2025, losses in the crypto ecosystem increased by 20x month-over-month compared with January 2025, according to the latest report by major blockchain security platform Immunefi.

In January, registered losses stood at $73,915,700. Just a month later, this figure jumped to $1,528,342,400. The latter was the result of nine hacks.

Additionally, the February number is an 18x increase from the same time a year prior. In February 2024, registered losses were $81,603,400, Immunefi researchers found.

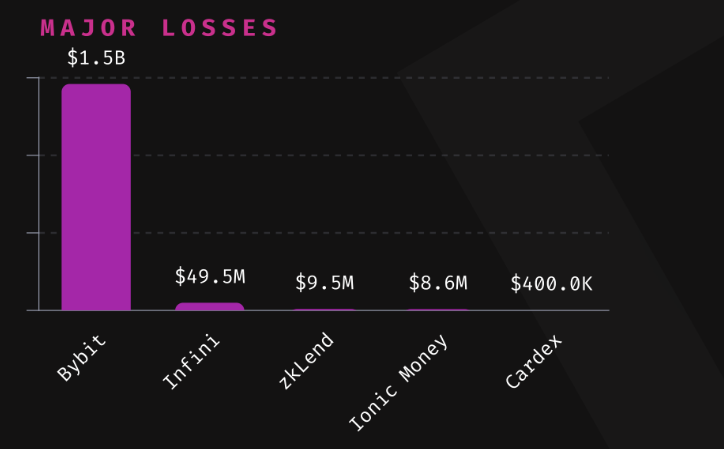

Notably, the majority of this sum was the result of a single hack. Crypto exchange Bybit lost $1.46 billion in the biggest hack in crypto’s history.

This is followed by stablecoin bank Infini’s loss of $49.5 million.

The top five losses also include zkLend ($9.5 million), Ionic Money ($8.6 million), and Cardex ($400,000).

Meanwhile, observing the total losses year-to-date, the ecosystem lost $1,602,258,100 in 2025 so far. Immunefi found that this represents an 8x increase compared to $200 million during the same period last year.

Additionally, it already surpassed the total losses for 2024 at $1.49 billion.

You might also like

CeFi Leads in Total Amount Lost, DeFi in Number of Hacks

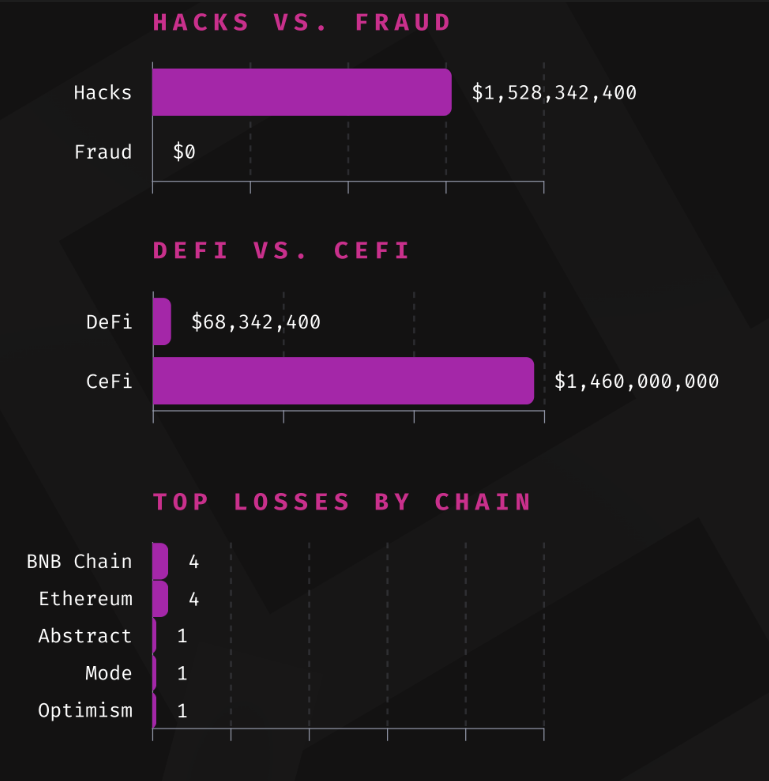

Unsurprisingly, hacks are still the main cause of losses compared to fraud. Actually, hacks account for 100% of the total losses – all of the $1.5 billion across the nine incidents.

In the same time period, centralized finance (CeFi) again surpassed decentralized finance (DeFi) per the total amount lost, while DeFi still leads in the number of attacks.

CeFi accounted for $1.46 billion or 95.5% of the total losses with a single incident (Bybit), while DeFi accounted for $68,342,400 or 4.5% across eight cases.

At the same time, BNB Chain was the most targeted chain in February. More specifically, BNB Chain and Ethereum suffered four individual attacks each, which represents 72.8% of the total losses across targeted chains.

Abstract, Mode, and Optimism suffered one attack each.

Meanwhile, Immunefi says it has paid out over $112 million in total bounties so far, while saving over $25 billion in user funds.

Several days ago, it launched Magnus, its AI-powered security orchestration platform that unites threat intelligence and automates security operations across a protocol’s security stack.

In other words, the novel platform unifies security into a single platform that enables protocols to access, automate, and coordinate best-in-class security tools, Immunefi said.

You might also like