Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Crypto exchange Kraken is exploring raising up to $1b in debt as it gears up for a potential initial public offering, Bloomberg reported Tuesday.

The move signals growing confidence within the company as it eyes a public debut amid a shifting regulatory landscape in the US.

Kraken has reportedly enlisted Wall Street heavyweights Goldman Sachs and JPMorgan Chase to lead the effort. The fundraising discussions are still in early stages. These two banks are reportedly in talks with additional lenders and financial institutions.

Sources told Bloomberg the company may raise as little as $200m. The final amount will depend on market conditions and investor appetite.

Kraken didn’t return Cryptonews’ request for comment by press time.

Funds to Support Expansion, Not Operations

This debt raise is not meant to cover operating costs, unlike typical emergency funding in crypto. Kraken plans to use the money for growth and expansion. This could include acquisitions, new products and scaling in key markets.

Kraken is also said to be weighing an equity raise alongside the debt package. However, no final decisions have been made. Both the size and structure of the capital raise remain subject to change.

With Legal Overhang Reduced, Kraken Resumes IPO Readiness Efforts

An IPO has been on Kraken’s radar for years. Earlier this month, Bloomberg reported that the company is preparing for a possible public listing as soon as Q1 2025. A more crypto-friendly regulatory environment under President Donald Trump could help clear the path, after prior ambitions were slowed by stricter enforcement under the Biden administration.

The company has previously faced legal hurdles, including enforcement actions from the US SEC. Kraken settled one case and saw another dropped without penalties, allowing it to move forward with less regulatory overhang.

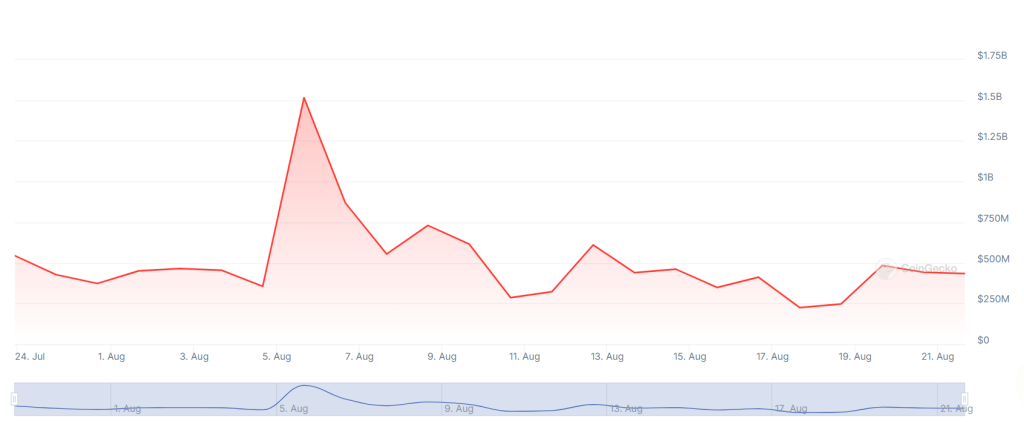

In a sign of its broader ambitions, Kraken announced just last week it would acquire retail futures trading platform NinjaTrader for $1.5b.

That deal, along with the ongoing fundraising discussions, indicates Kraken is preparing to expand its footprint ahead of a potential public listing.