Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The South Korean crypto exchange GOPAX is in a race against time to avoid a potentially existential “date with destiny” in mid-November.

Per News1, GOPAX, one of South Korea’s five fiat-trading crypto exchanges, has been ordered to reorganize its management structure by the middle of November.

The firm has been battling financial difficulties and hoped to resolve these through a sale to the global crypto exchange giant Binance.

Can Crypto Exchange GOPAX Survive as Challenges Mount?

However, regulators blocked a Binance takeover, leading a domestic cloud service provider named Megazone to submit its own takeover proposal.

This bid has also hit obstacles, with regulators concerned about the Seoul-based Megazone’s own debt-related issues.

A further problem comes in the form of the exchange’s deal with its financial services provider Jeonbuk Bank.

Jeonbuk provides GOPAX with real-name bank account services for its customers. These services are a legal requirement for all domestic exchanges.

Without them, South Korean crypto exchanges cannot offer their clients crypto-fiat pairings.

After considerable deliberation, Jeonbuk eventually extended its GOPAX deal in August this year.

However, rather than striking a new two-year deal with the crypto exchange, GOPAX was instead forced to accept a nine-month extension.

The deal is also conditional and stipulates that GOPAX must restructure its “management” by “mid-November.”

This restructuring essentially requires Binance and GOPAX to complete the sale to Megazone.

However, the media outlet said the “sale negotiations” are “currently experiencing a period of difficulty.”

Megazone Takeover Deal in Danger?

The outlet said the exchange sent its virtual asset business registration renewal application to the regulatory Financial Intelligence Unit (FIU) on October 24.

The FIU has previously warned GOPAX that it will not consider a renewal unless Binance’s stake is lowered to under 10%.

Binance currently owns a 67.45% stake in GOPAX, and wants to sell 58% of its holdings to Megazone.

However, the outlet said the “negotiations” are now “at risk of falling through.”

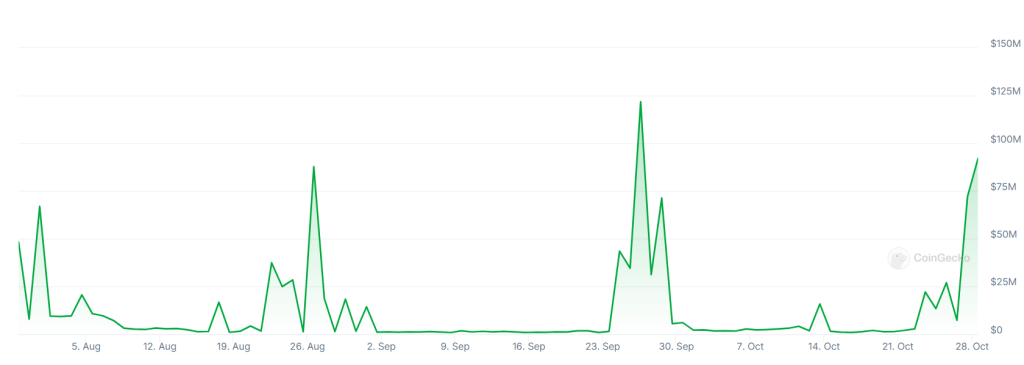

GOPAX has debts of around $72.3 million. These stem back to the fall of the FTX crypto exchange, which forced the collapse of GOPAX’s GoPay crypto deposit service.

The outlet reported that Megazone’s intention to complete the takeover was initially “clear.”

However, the newspaper claimed that there is now “opposition” to the deal “within the company” as Megazone officials are worried about the scale of GOPAX’s debt.

A spokesperson for the cloud services provider refused to rule out the possibility of completing the takeover.

“We are still reviewing the acquisition proposal in detail.”

Megazone

Binance to Try Again?

The outlet claimed that if the Megazone bid fails, Binance may try to convince regulators to reassess its own takeover bid.

Regulators say that they are concerned that Binance executives have “criminal records,” and have served jail time “overseas.”

GOPAX’s legal team has accused regulators of “shadow regulation.” They claim that there are currently no laws preventing firms whose executives have criminal records from holding shares in South Korean crypto firms.

The Financial Services Commission (FSC) is aware of this fact. But it wants lawmakers’ help in addressing the situation.

The FSC Governor Kim Byung-hwan told the National Assembly’s Political Affairs Committee on October 24:

“There is no legal basis under the current law to review major shareholders regarding the protection of cryptoasset users. Accordingly, I have submitted a special law amendment bill. This would let [regulators] launch investigations into proposed major shareholders.”

GOPAX has tried to break up a “monopoly” of South Korean crypto exchanges that is currently dominated by the “big four” exchanges: the market leader Upbit, Bithumb, Korbit, and Coinone.