Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships. Read more

Kaiko, a leading cryptocurrency market data provider, announced on Wednesday through its CEO, Ambre Soubiran, that it received a strategic investment from the Uggla Family Office, the private investment firm of Lance Uggla.

Lance Uggla, the founder and former CEO of IHS Markit, played a key role in shaping financial data services before the company’s $44 billion acquisition by S&P Global in 2022. His investment signals confidence in Kaiko’s ability to expand its institutional market data offerings.

Kaiko provides real-time and historical digital asset market data, quantitative analytics, and regulatory-compliant benchmark rates, positioning itself as a key infrastructure provider for institutional investors in the crypto space.

Kaiko’s Institutional Growth Strategy

Kaiko follows a similar trajectory to IHS Markit by focusing on institutional-grade infrastructure, enhancing transparency, and mitigating financial risk in digital asset markets.

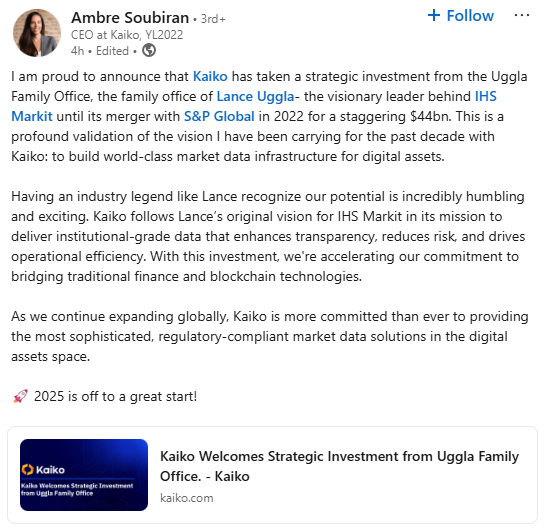

In a LinkedIn post, Soubiran highlighted the significance of the investment:

“Having an industry legend like Lance recognize our potential is incredibly humbling and exciting. Kaiko follows Lance’s original vision for IHS Markit in its mission to deliver institutional-grade data that enhances transparency, reduces risk, and drives operational efficiency. With this investment, we’re accelerating our commitment to bridging traditional finance and blockchain technologies.”

Soubiran also noted that the Uggla Family Office’s backing represents more than just financial support, calling it a validation of Kaiko’s strategic focus on delivering institutional-grade, regulatory-compliant solutions for the digital assets industry.

Uggla, in his own statement, emphasized Kaiko’s role in advancing the crypto data market:

“It is with particular excitement that I see the investment by the Uggla Family Office in Kaiko to support its information-based mission, which is one I understand well. The digital assets space requires the level of sophisticated data infrastructure and market intelligence that Kaiko offers to institutional market participants.”

With institutional backing strengthening its expansion efforts, the company has also pursued acquisitions to enhance its data offerings.

Expansion Continues with Vinter Acquisition

In November, Kaiko announced the acquisition of European crypto index provider Vinter for an undisclosed amount.

Vinter is one of the largest index providers for exchange-traded product (ETP) issuers in Europe.

Vinter supplies index data to several European crypto ETPs, including products from 21Shares, one of the largest issuers of exchange-traded products in the sector.

This acquisition aligns with Kaiko’s strategy of expanding its institutional services and strengthening its role in the digital asset market.