Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin surged to $99,500 today, marking its highest level in months as market sentiment shifted bullish following the announcement of SEC Chair Gary Gensler’s resignation.

Gensler, known for his critical stance on cryptocurrencies, confirmed he would step down on January 20, 2025, coinciding with President-elect Donald Trump’s inauguration.

Gensler’s tenure was marked by regulatory actions that targeted the crypto sector, earning him a reputation as one of the industry’s most vocal critics.

Prominent crypto investor Anthony Pompliano highlighted the significance of Bitcoin potentially crossing the $100,000 threshold over the weekend, stating on X, “It would be poetic for Bitcoin to hit $100,000 while Wall Street is closed.”

Why Gensler’s Resignation Matters for Crypto

1. A Turning Point in U.S. Crypto Regulation

Gensler’s aggressive regulatory approach, which he often described as a crackdown on the “wild west” of crypto, resulted in multiple lawsuits and enforcement actions against major exchanges. Under his leadership, the SEC sought to expand its authority but faced significant legal defeats, including a Texas federal court ruling invalidating new rules for the $27 trillion Treasury market.

President-elect Trump’s pro-crypto stance has raised hopes for a more favorable regulatory environment. Industry leaders, including Ripple CEO Brad Garlinghouse, have expressed optimism about the future of crypto innovation under a Trump administration.

2. Market Reacts to Regulatory Optimism

Gensler’s resignation news has coincided with a notable rally across major cryptocurrencies:

- Bitcoin (BTC): Up 60% this week, trading near $98,884 with strong resistance at $99,855.

- Ether (ETH): Rose over 7% in 24 hours, maintaining its momentum above $5,000.

- Dogecoin (DOGE): Gained 2%, reflecting broader market enthusiasm.

Market participants are closely watching Trump’s pick for the next SEC Chair, as crypto firms push for legislation favoring clearer and more supportive frameworks.

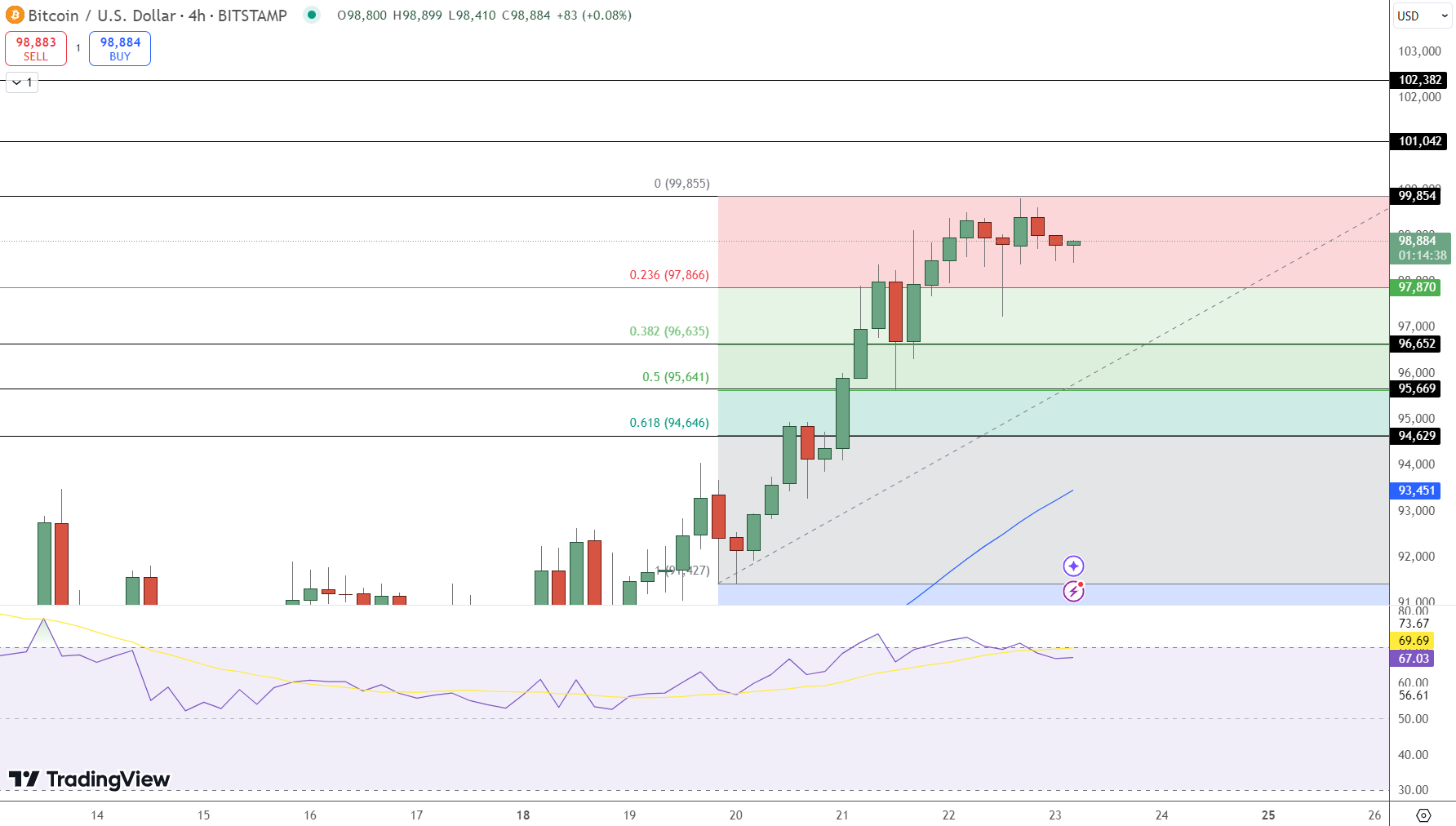

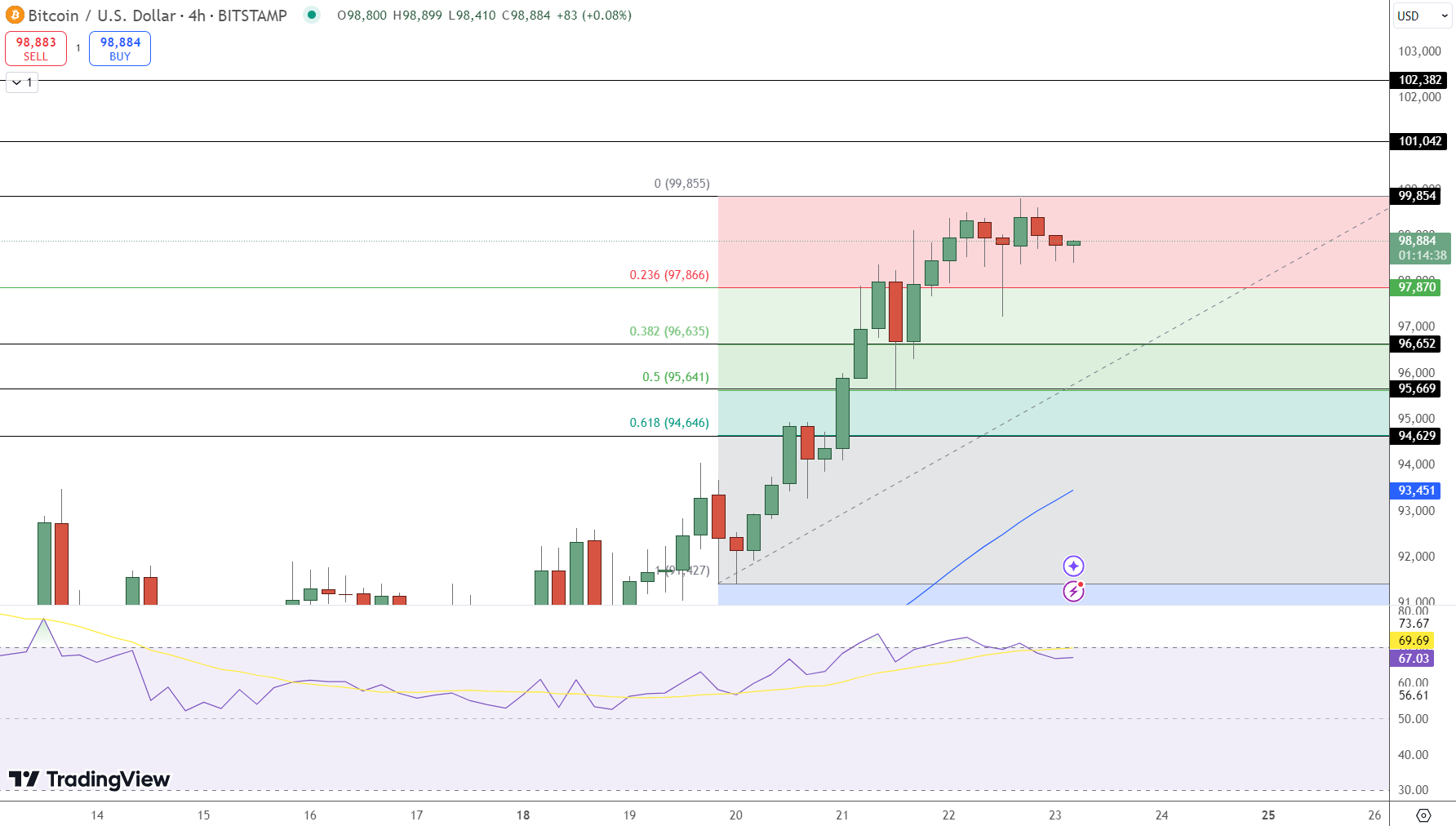

Daily Technical Outlook: Bitcoin (BTC) – November 23, 2024

Bitcoin is currently trading at $98,885, with a 24-hour trading volume of around $72 billion. The cryptocurrency is down 0.22% over the past day, maintaining its position as the top-ranked asset with a live market cap of around $1.96 trillion.

The circulating supply stands at 19,786,181 BTC, with a maximum supply of 21,000,000 BTC.

Technical Analysis: On the 4-hour chart, Bitcoin consolidates near the critical psychological level of $100,000 after an impressive rally. The Fibonacci retracement levels provide key insights, with immediate support identified at the $97,870 mark, corresponding to the 23.6% retracement level.

Stronger supports lie at $96,652 and $95,669, aligning with the 38.2% and 50% Fibonacci levels, respectively.

On the resistance side, Bitcoin faces hurdles at $99,855, the local high, followed by significant barriers at $101,042 and $102,382, levels last tested during 2021’s bull run. The Relative Strength Index (RSI) currently stands at 67, signaling overbought conditions, though momentum remains strong.

Key Insights:

- Bitcoin faces immediate resistance at $99,855, with next targets at $101,042 and $102,382.

- Support levels to watch include $97,870, $96,652, and $95,669.

- RSI at 67 indicates overbought territory, while the 50-day EMA at $93,451 acts as strong support.

–

You might also like

Don’t Miss Out: Pepe Unchained ($PEPU) Presale Nears Its End

Pepe Unchained ($PEPU) is making waves in the crypto market, with its presale raising over $40 million and offering investors a unique opportunity to secure tokens before major exchange listings.

Currently priced at $0.01295, this presale offers early adopters the chance to maximize their returns before the price rises further.

With only 20 days remaining, now is the time to act and take advantage of the following key benefits:

Why Invest in $PEPU?

- 499% APY Staking: Generate passive income through the project’s lucrative staking rewards, making $PEPU a standout in the meme coin market.

- Thoroughly Audited: Security is a priority, with smart contracts audited by Coinsult and SolidProof, ensuring a safe investment opportunity.

- Flexible Payment Options: Purchase $PEPU using ETH, USDT, BNB, or even a credit card, making the process simple and accessible for all investors.

A Secure Investment Opportunity

Pepe Unchained has already attracted significant investor confidence, with over $40 million raised during its presale. Its robust staking feature and transparent security audits make it a compelling addition to any crypto portfolio.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.