Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

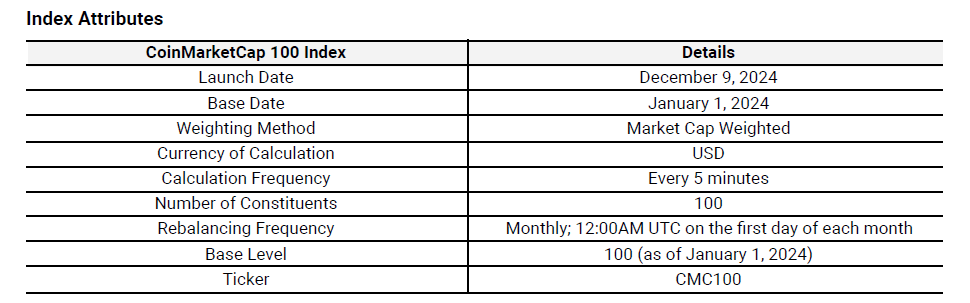

CoinMarketCap, a major provider of crypto market data, has launched the CoinMarketCap 100 Index (CMC100 Index), which measures the performance of the top 100 cryptocurrencies by market capitalization.

According to the press release shared with Cryptonews, the novel index aggregates market prices from validated CoinMarketCap data sources. It’s refreshed every five minutes and calculated in USD.

Notably, the index is rebalanced monthly, with the selection of coins based on their market capitalization ranking.

Additionally, the index is calculated as a market capitalization-weighted index. Unsurprisingly, the weight of the top 10 coins per market cap is 90.11%.

Source: CoinMarketCap

The team noted that, thanks to the index being calculated every five minutes, it provides “real-time transparency into the cryptocurrency market’s most significant players.”

They described the CMC100 as “the first crypto index to cover such a wide range of assets,” including emerging sectors like gaming and meme coins.

However, it excludes stablecoins and asset-backed wrapper tokens to keep the focus on volatile, market-driven assets. The index is freely accessible and can be embedded into publications and websites through an API.

That said, per the team, with a base level of 100 set on 1 January 2024, “backtested performance data is available to provide historical insights and aid in market analysis.”

Meanwhile, the index is governed by CoinMarketCap’s Benchmark Oversight Committee to ensure compliance with industry standards, manage methodology changes, and address conflicts of interest.

You might also like

‘Visibility Into Over $3 Trillion in Digital Assets’

The CoinMarketCap team noted that the crypto market continues to evolve. As such, it requires accurate and reliable benchmarks. They argued that the lack of standardized performance metrics has hindered institutional adoption and market transparency.

Therefore, the team claims the CoinMarketCap 100 Index works to address this need through several key features.

As mentioned above, it comes with real-time updates and monthly rebalances to ensure continued representation of the market. Additionally, it covers approximately 87% of the total crypto market capitalization, as well as various blockchain projects and technologies.

The index weights assets based on their market value to provide a proportional view of the market.

Moreover, the Benchmark Oversight Committee conducts monthly methodology reviews, said the announcement.

Source: CoinMarketCap

Meanwhile, in November this year, major crypto exchange Coinbase unveiled its Coinbase 50 Index (COIN50), a benchmark representing the top 50 digital assets listed on the exchange.

It also excludes stablecoins and privacy coins to ensure investability, it said. The index is rebalanced quarterly and currently covers around 80% of the total crypto market cap.

Read more below.

You might also like