Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Major crypto exchange Coinbase has unveiled the Coinbase 50 Index (COIN50), a benchmark representing the top 50 digital assets listed on the exchange.

These coins, per the announcement, must meet key criteria to qualify for inclusion in the benchmark. The fundamental criteria include token economics, blockchain architecture, and security.

It excludes stablecoins and privacy coins, to ensure investability, the website states.

Additionally, the market cap-weighted index has been developed in partnership with Coinbase Asset Management and Market Vector Indexes.

It came as a response to the growing need for “efficient ways to gain diversified exposure” to the novel asset class.

TradFi indices have “long provided a simple yet effective way for investors to gain broad exposure and benchmark their portfolios. Crypto is now ready for the same,” Coinbase stated.

Therefore, crypto traders can use the new index to track the broader market’s performance and benchmark the coins’ returns.

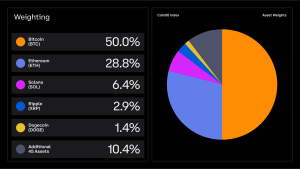

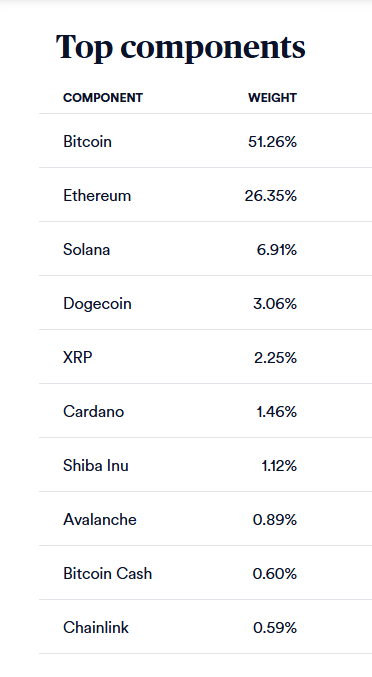

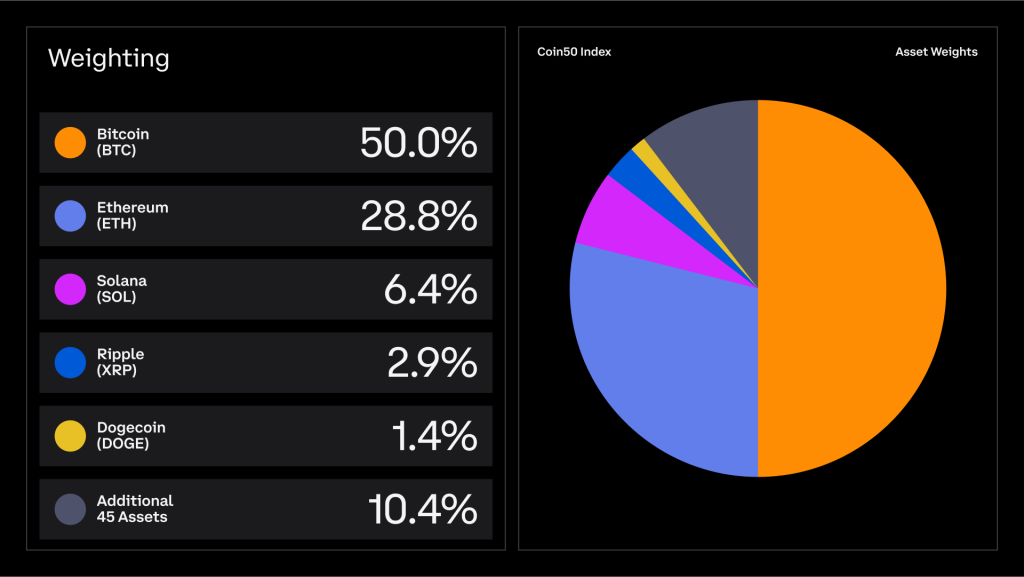

Expectedly, Bitcoin (BTC) and Ethereum (ETH) have taken the largest shares, weighing 51.26% and 26.35%, respectively.

Head of institutional products at Coinbase Greg Tusar told Fortune the exchange is trying to “establish a benchmark that is not specific to any asset, that’s trying to give what is the broad basket of crypto assets doing, the same way that you gauge the performance of the equity markets through the S&P 500.”

Rather than relying only on Bitcoin as a benchmark, especially as its dominance will decrease over time, Tusar argued, investors can use the Coin50 that “provides a more comprehensive view of the market.”

You might also like

‘Just the Beginning’

The index is rebalanced quarterly and currently covers some 80% of the total crypto market cap.

But “this is just the beginning,” the exchange said.

The crypto market is still young, but it is rapidly growing and maturing. Therefore, Coinbase said it plans to launch “a significantly broader index.”

This expanded index would be able to support both the ever-changing size and diversity of the unique market.

“This path sets the foundation for our indices to evolve alongside the industry, ensuring they provide critical price discovery and remain a comprehensive benchmark for the cryptoeconomy,” Coinbase argued.

Moreover, the exchange has additional plans as well.

For now, and starting today, the service will be available to eligible users in eligible jurisdictions outside the US, UK, and Canada.

They will be able to trade the Coinbase 50 Index through a COIN50 perpetual futures contract (COIN50-PERP) with up to 20x leverage on Coinbase International Exchange for institutional users and Coinbase Advanced for retail users, it said.

However, the team noted that it is “exploring additional ways to allow users to gain exposure to the Index.”

It is uncertain if the exchange will be able to expand geographically any time soon, depending on regulatory circumstances, but it could potentially enable more avenues for users in existing jurisdictions to take.

You might also like

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.