Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The U.S. Commodity Futures Trading Commission (CFTC) has faced a setback in its efforts to regulate political prediction markets after a federal judge ruled in favor of Kalshi, a prediction market platform.

If this decision is followed to the peak, it will allow U.S. citizens to legally bet on election outcomes for the first time in a century.

Despite the ruling, the CFTC has filed an emergency motion to delay Kalshi’s launch of election markets. This launch is now entangled with never-ending regulatory challenges and uncertainties.

Legal Battle: Kalshi Vs. CFTC, Who Is Winning?

Kalshi, a financial exchange established in 2018, allows users to bet and trade on real-world event outcomes, ranging from weather forecasts to pop culture trends.

In November 2023, Kalshi filed a lawsuit against the CFTC, challenging the regulator’s decision to bar it from listing contracts related to political outcomes, specifically which party will control each chamber of Congress.

The lawsuit argued that the CFTC’s actions were unjustified and hindered Kalshi’s operations under its regulated framework.

On September 6, 2024, U.S. District Court Judge Jia M. Cobb ruled in favor of Kalshi, denying the CFTC’s cross-motion for summary judgment.

This ruling marked a pivotal moment for the legal status of political prediction markets in the U.S.

Kalshi CEO Tarek Mansour commented on the decision as a historic milestone, stating,

“Election markets are now legal in the United States for the first time in 100 years.”

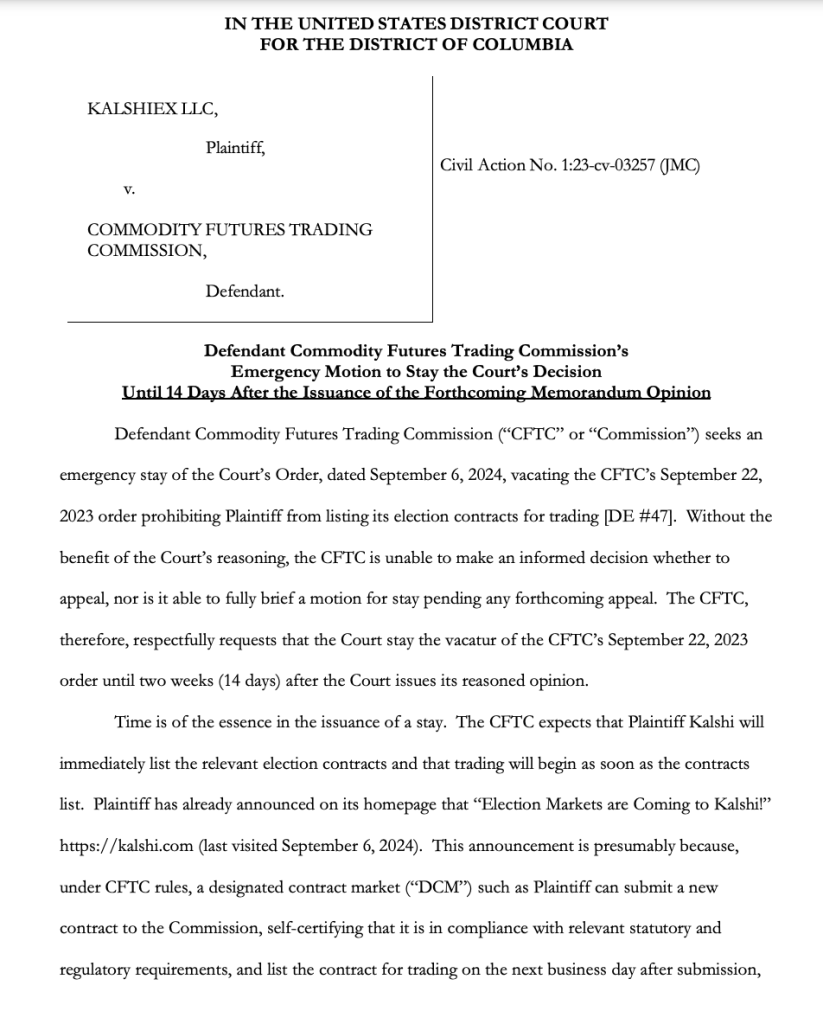

However, the CFTC responded quickly by filing an emergency motion requesting a two-week stay, arguing that it needed more time to consider whether to appeal Judge Cobb’s decision.

The CFTC claimed that without the judge’s written opinion, it could not make an informed decision on the next steps or adequately brief a motion for a stay pending any potential appeal.

Judge Cobb granted a temporary stay, but it only extended through the end of the hearing on Thursday, leaving the door open for Kalshi to launch its election markets soon after.

The Future of Political Prediction Markets On Tiny Rope

The outcome of this legal battle has broader implications for the future of political prediction markets in the U.S.

Currently, PredictIt is the only company legally operating political prediction markets in the country under a narrow regulatory exemption.

Other platforms, like Polymarket, operate outside U.S. jurisdiction, offering betting opportunities through cryptocurrency-based contracts.

Polymarket has seen substantial activity, with $875 million in bets on the upcoming presidential election as of Wednesday.

Kalshi’s potential entry into the market represents a shift towards more regulated and accessible political betting platforms.

Unlike PredictIt, which has strict limits on the number of participants and bet sizes, Kalshi aims to attract institutional investors by allowing positions up to $100 million.

Proponents of regulated prediction markets argue that they provide valuable insights into election outcomes by incentivizing accurate predictions, which reflect the aggregated wisdom of financially invested participants.

However, the CFTC remains cautious about the potential impacts of expanding political prediction markets, particularly regarding election integrity.

CFTC Chair Rostin Benham has expressed concerns that the agency is not equipped to monitor the complexities of election markets, which involve numerous participants and rapidly evolving dynamics.

“Our new authorities would per se include monitoring elections, candidates and countless participants in the political machinations that proliferate in the media and cyberspace.”

The agency’s regulatory mandate traditionally covers futures markets and fraud prevention in commodity transactions, making the oversight of election markets a new and potentially challenging responsibility.

The CFTC is also considering a proposed rule to prohibit election contracts across all exchanges it oversees, which now further complicates things for platforms like Kalshi.