Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The BNB (BNB) price remains stuck close to $600, well within its recent multi-month ranges, as traders assess the impact of the US strategic Bitcoin reserve’s on the broader crypto market, and wait to hear more from the White House about their plans towards the crypto industry at today’s summit event.

US President Donald Trump signed an executive order on Thursday establishing a strategic Bitcoin reserve and a national stockpile of other crypto assets currently held by the US government.

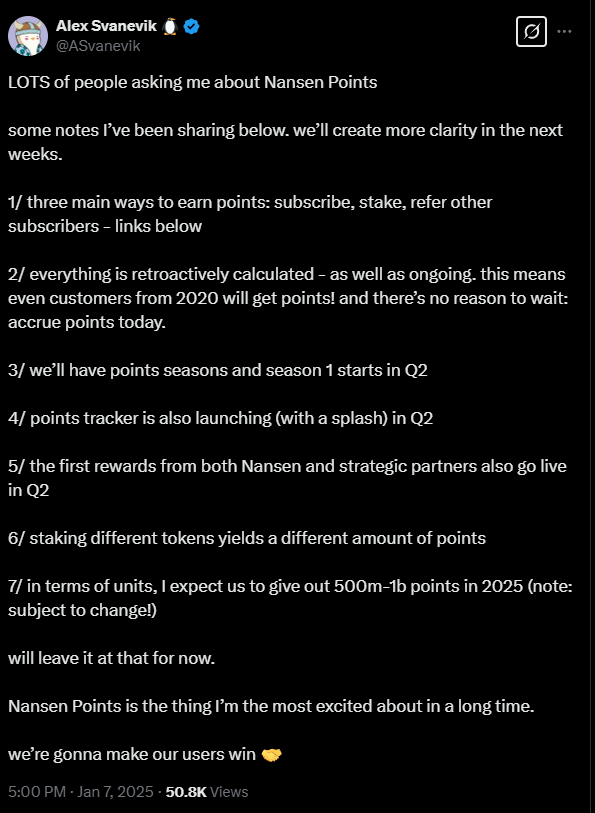

This includes close to $40 million dollars worth of BNB and wrapped BNB, per X user Berit.

Since topping out close to $800 last December, BNB has spent the last few months stagnating.

Its short-term technical bias tilts bearish, with the BNB price current below all of its major moving averages and seemingly in a short-term bearish trend.

But looking at the BNB price over a longer time horizon reveals the price is at a key cross roads.

Where Next for the BNB Price?

BNB’s chop either side of its 200DMA in recent weeks is telling that the market is very indecisive right now.

But decision time is coming. The BNB price has formed a pennant structure in recent months, and these tend to form ahead of meaningful bullish or bearish breakouts.

Deteriorating broader macro conditions suggest risks are tilted toward a downside breakout for the BNB price.

Stocks have been in a strong downtrend in recent weeks as investors anticipate a weaker US economy ahead thanks to D.O.G.E.-related spending cuts and the impact of Trump’s trade wars.

Markets have been pricing in more Fed rate cuts, and US bond yields have been collapsing, but with inflation still uncomfortably high, uncertainty about the Fed’s reaction function to weakening growth remains elevated.

Chart analysis suggests a bearish breakout of the current pennant could precede a drop to 2025 lows at $500.

If things get really panicked, a drop all the way back to mid-2024 lows around $400 would also be possible.

Buy the BNB Dip?

However, in the longer-run, BNB price dips should be looked at as an opportunity to accumulate the asset for the long-term.

The arrival of the pro-crypto Trump administration means its a new era for not just Bitcoin, but also major altcoins like BNB.

A friendlier regulatory touch to the industry ought to accelerate its long-term growth and adoption, and market leaders like BNB will continue to thrive.

A weaker economy would also mean an eventual favorable shift in financial conditions. Prior alt seasons have relied upon easing financial conditions, and this could be a major theme lifting BNB later in 2025.

By the end of Trump’s four year term, we could easily be looking at a BNB price to the north of $2,000.

That would mean BNB hitting the 3.618 Fibonacci extension from its 2022 lows back beyond its 2021 highs at $700, a very reasonable long-term target.

But BNB buyers need to be prepared to hold through a lot of short-term turbulence, this is crypto after all.