Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

BlackRock, the world’s largest asset manager, now holds 567,000 Bitcoin worth $47.8 billion, strengthening its dominance in the crypto space. Recent data from Arkham Intelligence shows BlackRock added 268 BTC ($22 million) on March 14, despite ongoing market fluctuations.

Beyond Bitcoin, BlackRock also owns 1.2 million ETH ($2.3 billion) alongside other altcoins, showcasing its diversified crypto strategy.

More notably, in February 2025, BlackRock integrated its Bitcoin ETF (IBIT) into its model portfolio, a move that could attract institutional investors seeking indirect BTC exposure.

Market Implications of BlackRock’s Moves

- Institutional confidence in BTC remains strong despite ETF outflows.

- BTC price stability may improve as BlackRock continues accumulation.

- Inclusion in model portfolios signals Bitcoin’s long-term viability in traditional finance.

While short-term Bitcoin ETF outflows have spurred market uncertainty, BlackRock’s strategic accumulation suggests long-term confidence, potentially supporting price stability and renewed bullish momentum.

U.S. Lawmaker Moves to Secure Bitcoin as National Reserve

In a pivotal legislative push, U.S. Representative Byron Donalds is drafting a bill to legalize former President Donald Trump’s executive order establishing the U.S. Strategic Bitcoin Reserve.

Trump’s directive, signed on March 7, mandates the government to utilize seized BTC as a national reserve asset.

Donalds’ proposal aims to prevent future administrations from dismantling the Bitcoin reserve, ensuring long-term government involvement in digital assets.

The bill requires Senate and House approval, and with Republican leadership, the chances of passage appear strong.

Why This Matters for BTC

- 23 U.S. states are considering similar legislation, signaling growing bipartisan interest in Bitcoin adoption.

- A government-backed Bitcoin reserve could enhance BTC’s legitimacy in the U.S. financial system.

- Regulatory clarity may emerge, strengthening institutional confidence.

The announcement has boosted market sentiment, despite ongoing volatility. Greater governmental integration of BTC could provide a more structured regulatory framework, easing institutional concerns.

REX Launches Bitcoin Treasury Convertible Bond ETF

REX Shares, a leading ETF provider managing $6 billion in assets, has introduced the Bitcoin Corporate Treasury Convertible Bond ETF (BMAX). This ETF offers exposure to companies holding BTC in their treasuries—most notably MicroStrategy, which has aggressively accumulated BTC.

BMAX invests in convertible bonds, financial instruments that allow bondholders to convert debt into equity. This structure enables investors, particularly institutional funds and pension plans, to gain Bitcoin exposure without direct ownership.

How BMAX Strengthens Bitcoin’s Position

- Bridges traditional finance and Bitcoin investment, appealing to risk-averse institutions.

- MicroStrategy’s inclusion makes BTC more accessible to pension funds—12 U.S. states already hold MicroStrategy stock in their portfolios.

- Encourages long-term BTC adoption by providing an alternative investment vehicle.

Daily Technical Outlook: Bitcoin (BTC/USD) – March 15, 2025

The Bitcoin price today is $83,657, with a 24-hour trading volume of $28.33 billion. Bitcoin has gained 1.46% in the last 24 hours, holding the #1 market ranking with a $1.66 trillion market cap. The circulating supply stands at 19,837,137 BTC, with a fixed maximum of 21 million BTC.

Technical Analysis

Bitcoin recently broke above a descending trendline, signaling bullish momentum above $82,640—where the 50-period EMA has acted as a key support level. The breakout pushed BTC toward $85,312, its immediate resistance, but momentum has slowed, raising the possibility of a short-term consolidation or a pullback.

A break above $85,312 would clear the path toward $88,046 and $91,117, potentially triggering a new leg up in the bull cycle. However, failure to maintain momentum could result in a pullback to $82,640 or lower support levels.

Conclusion

Bitcoin remains in a critical breakout phase, with $85,312 acting as the make-or-break level. A sustained push higher could send BTC toward $88K-$91K, while a failure to hold momentum may trigger a retracement to $82,640 or lower.

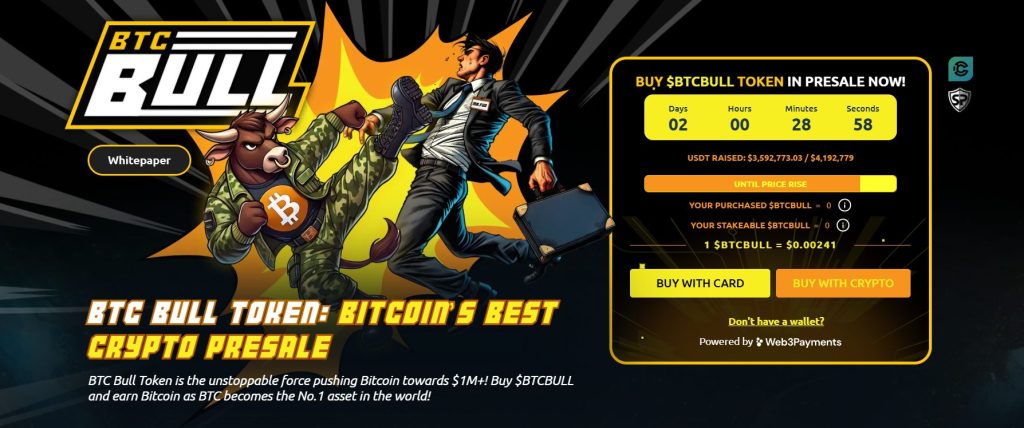

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.00241 per BTCBULL

- Total Raised: $3.5M / $4.1M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.