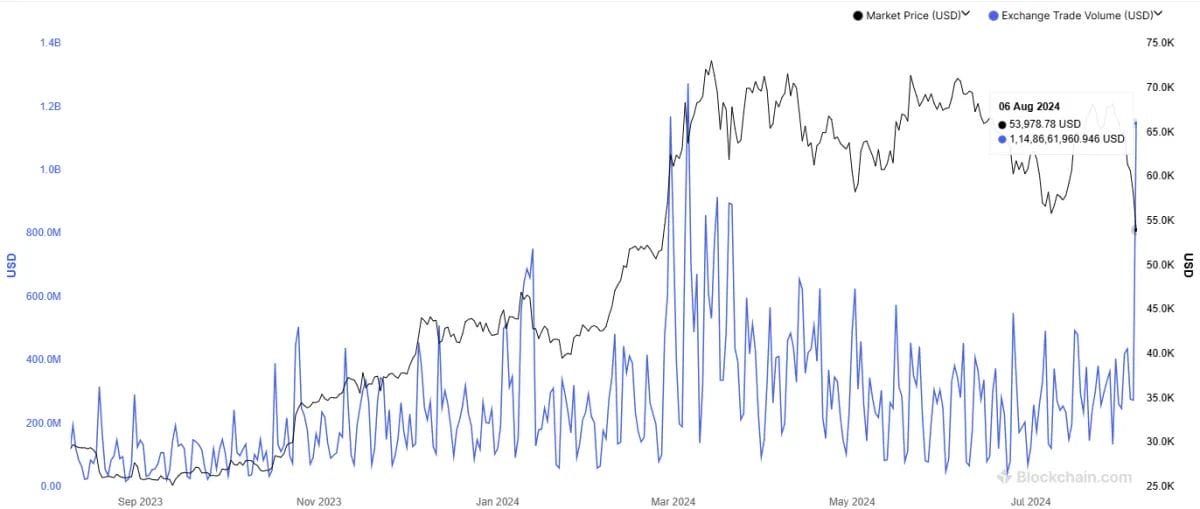

Bitcoin trading volumes reached unprecedented levels amid market turmoil, with the Bitcoin fear and greed index showing the lowest levels since July 2022.

Bitcoin transactions on crypto exchanges surged amid turbulent market conditions, marking a new all-time high in trading volume during this fourth Bitcoin-halving cycle.

On August 5th, crypto traders suffered significant losses, with over $600 million in leveraged long positions wiped out due to falling prices of prominent cryptocurrencies.

Considering this, the crypto community saw the Bitcoin fear and greed index fall to 17 out of 100, marking ‘extreme fear’ in the lowest reading since July 12, 2022.

As a result, some investors sold their Bitcoin holdings to minimize losses, while others bought the heavily discounted BTC in the $50,000 range.

According to Blockchain.com data, the total USD value of trading volume on major Bitcoin exchanges exceeded $1.14 billion on August 6th.

It is important to note that Blockchain.com collects data from top crypto exchanges and some OTC (over-the-counter) markets. Therefore, the actual total trading volume is much higher than reported.

US Economic Data and Middle East Tensions Weigh on Crypto Prices

The recent downturn in the cryptocurrency market is largely due to growing concerns over a potential U.S. recession.

This worry arises from last week’s disappointing job data, with the US unemployment rate at 4.30%, compared to 4.10% last month. This represents the highest since November 2021. Meanwhile, hourly earnings grew by just 0.2%, below the anticipated 0.3%.

As a result, global stock and crypto markets, including those in Europe, Asia, and the Middle East, experienced declines.

The situation is further complicated by weak economic data from Germany and Japan’s recent interest rate hikes, which have intensified market turmoil. Analysts are concerned that further signs of economic weakness might increase market volatility.

In addition to economic challenges, escalating tensions in the Middle East are adding to market uncertainty.

U.S. Secretary of State Antony Blinken has warned of potential attacks on Israel by Iran and Hezbollah, prompting President Biden to consult with the National Security Council.

Meanwhile, Israel is considering a preemptive strike on Iran, and Hezbollah has pledged to escalate its attacks.

WAR SCENARIO IN THE MIDDLE EAST!

In the event of a conflict between Israel and Iran, Israel will not be able to protect itself against incoming missiles.

If Iran coordinates its attack with Hezbollah then the consequences will be huge for Israel.

The US will help Israel with… pic.twitter.com/kVF3cmJNga

— WORLD AT WAR (@World_At_War_6) August 5, 2024

Bitcoin ETFs Bleed while Ether ETFs Thrive

Bitcoin ETFs have been equally affected by elevated economic concerns, recording $168 million in outflows on August 5th.

Grayscale Bitcoin Trust and the ARK 21Shares Bitcoin ETF were the main contributors, shedding $69.1 million and $69 million, respectively, Farside Investors data shows.

However, the Grayscale Bitcoin Mini Trust, VanEck Bitcoin ETF, and Bitwise Bitcoin ETF recorded inflows of $21.8 million, $3 million, and $2.9 million, respectively, while BlackRock’s iShares Bitcoin Trust recorded zero.

However, the spot Ether ETFs saw $48.8 million of net inflows led by BlackRock’s iShares Ethereum Trust at $47.1 million, according to Farside data.

VanEck and Fidelity’s Ether products also saw inflows of $16.6 million and $16.2 million, respectively.

This disparity highlights the current indecision among investors, with some dumping their holdings to minimize losses, while others double down on their positions.