Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

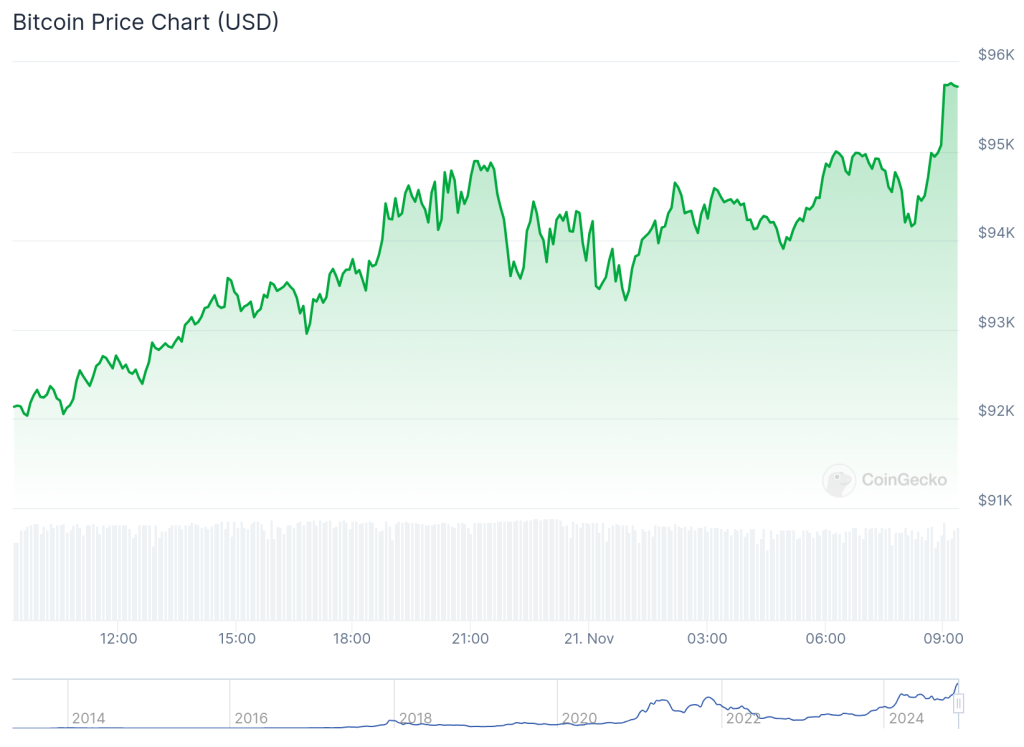

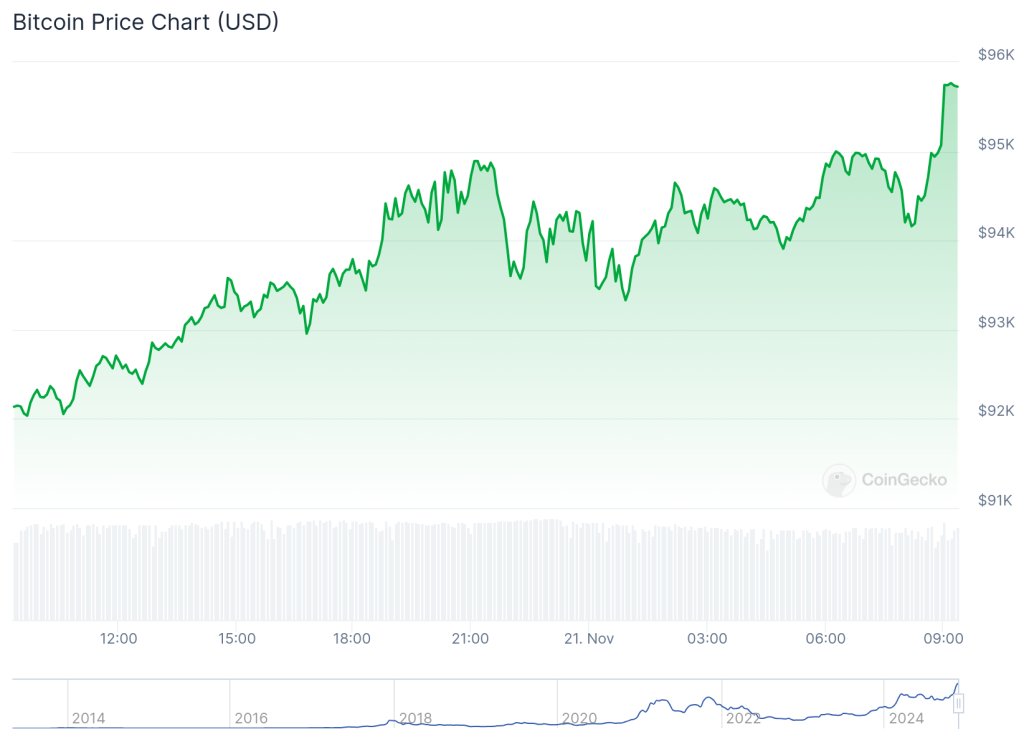

Bitcoin soared to a new all-time high of $95,000 on Thursday, November 21, 2024, during early Asian trading hours. Bitcoin is trading above $95,700 at the time of writing, as per Coingecko data. This milestone marks an impressive 125% gain for the leading cryptocurrency in 2024.

Despite a surge in the leading cryptocurrency’s price, meme coins fell across the board with the total meme market cap falling 4.9% in the last 24 hrs.

Trump Team Mulls White House Crypto Policy Role

As reported earlier, President-elect Donald Trump’s team is reportedly exploring a White House role dedicated to crypto policy. The team is vetting candidates as Trump, a crypto advocate, pledged to fire SEC Chair Gary Gensler on day one of his presidency during his campaign. If created, it would be the first-ever crypto-specific White House job and would mark a significant milestone for the industry’s growing mainstream presence.

Bitcoin Price: From $70,000 to $95,000 in Two Weeks

The combined impact of Trump’s win and the Federal Reserve’s 25-basis-point rate cut initially propelled Bitcoin’s rapid ascent.

Before the US elections, Bitcoin traded around $68,000. Following Trump’s victory, the digital asset embarked on a rapid ascent, breaking through multiple resistance levels.

In just two weeks, it surpassed $75,000, $80,000, $85,000, and $90,000, finally reaching the $95,000 milestone.

This bullish trajectory was predicted months earlier by crypto commentator BitQuant.

In a May 15 post on X, he confidently stated, “$95K will be achieved in just one move, and that is quite obvious.”

This prediction proved remarkably accurate, with Bitcoin surging from approximately $68,000 in a mere fortnight.

BitQuant’s forecast stemmed from an analysis by fellow commentator Mikybull Crypto, who identified a “cup and handle” formation on weekly timeframes.

This pattern, characterized by a consolidation period after a significant uptrend, a reversal, and a subsequent breakout, signaled a potential return to price discovery for Bitcoin.

Mikybull Crypto anticipated an “explosive” breakout, propelling the Bitcoin price toward a new cycle peak.

Trump’s Pro-Crypto Stance and Bitcoin Price Implications

President-elect Donald Trump has continued to show support for cryptocurrencies. Reports indicate that Trump Media & Technology (DJT) is nearing a deal to acquire the crypto trading platform Bakkt.

Adding to these developments, Trump met with Coinbase CEO Brian Armstrong on Tuesday.

While the specifics of their discussion remain undisclosed, the meeting occurred as Trump finalises his cabinet appointments.

During his campaign, Trump expressed his intent to create a presidential advisory council on Bitcoin and crypto to develop industry regulations.

Since the election, Coinbase CEO Brian Armstrong has publicly endorsed Hester Peirce, a Trump-appointed SEC commissioner, to lead the regulatory body.

The Wall Street Journal reported that Coinbase contributed over $100 million to political action committees during the election cycle.

Many of these funds went to Fairshake, a crypto-focused PAC that allocated more than $40 million to support congressional candidates.

Bitcoin Price and MicroStrategy’s Bullish Outlook

MicroStrategy’s billionaire Executive Chairman, Michael Saylor, remains steadfastly bullish on cryptocurrency.

Last week, MicroStrategy acquired an additional $4.6 billion worth of Bitcoin. Under Saylor’s leadership, the company’s initial $250 million Bitcoin investment in 2020 has ballooned to 279,420 Bitcoins by November 10, 2024, representing a total purchase price of $11.9 billion and a market value of $24.5 billion.

MicroStrategy’s Bitcoin holdings now equate to approximately one-third of the company’s $73.3 billion enterprise value and roughly 1.4% of Bitcoin’s $2.2 trillion market cap.

Saylor projects a $100,000 Bitcoin price by the end of 2024, with a potential long-term surge to $13 million over the next 21 years.

This ambitious forecast implies a nearly 15,000% gain from the current Bitcoin price.

In a CNBC interview, Saylor predicted Bitcoin’s eventual growth from 0.1% to 7% of global capital, driven by increased adoption by financial institutions.

He also envisions Bitcoin surpassing the S&P 500 in trading volume, attracting investors with its open, global, and unrestricted approach to capital markets.