Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

When compared to BTC price action, Bitcoin hash price seems to be pointing toward a Bitcoin bottom as it mirrors the conditions that preceded the 2021 breakout to new all-time highs.

In an August 30th Quicktake blog post, on-chain analytics platform CryptoQuant suggested that Bitcoin price action may be approaching a bottom.

CryptoQuant noted that Bitcoin’s hash price, which measures the revenue miners earn per terahash per second, is conspicuously low.

The major pattern underscores a recurring relationship where “historically, lower Hash Price periods have coincided with Bitcoin price bottoms.” A notable example of this pattern occurred in 2020 following the COVID-19-induced cross-market crash.

Bitcoin’s price hit significant lows during this time, coinciding with a sharp decline in hashprice. However, as the year progressed, especially after the halving event, Bitcoin’s price began a robust upward trajectory, culminating in a breakout to new all-time highs.

Bitcoin Miners Start Accumulating: Is the Bitcoin Price Stabilizing?

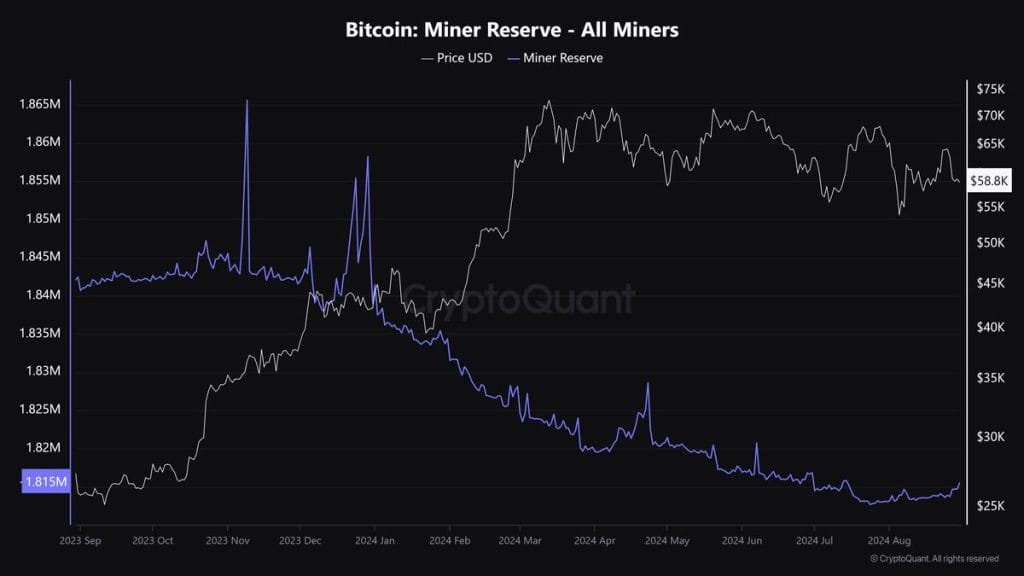

According to CryptoQuant data, miner behavior seems to support a potential turnaround. They seem to have started accumulating again after a long period of outflows.

Miner reserves have recovered levels unseen since June, with notable pick-up since August 24th.

Earlier this month, CryptoQuant CEO Ki Young Ju highlighted a notable development in the US mining sector, suggesting that it paints a picture of sustainability.

He pointed out that “miner capitulation is nearly over, with hash rate nearing all-time highs,” referencing the post-halving events captured by the Hash Ribbons indicator.

Ju also noted that the cost of mining in the US stands at approximately $43,000 per Bitcoin. He suggested that the current hash rate will likely stay stable if Bitcoin prices don’t dip below this threshold.

This reinforces the potential for Bitcoin’s price to stabilize and recover in line with historical trends following periods of miner capitulation.

When Could We See A Bitcoin Surge?

Long-term Bitcoin metrics continue to buoy the bullish narrative this month — though the timing of the next leg of this bull cycle remains a hot topic in the crypto community, especially given current market conditions.

The Bitcoin halving could be a benchmark for predicting the next surge. In an August 21 X post, CryptoQuant CEO Ki Young Ju noted that past post-halving rallies have typically started in the fourth quarter (Q4) of each halving year.

Young Ju further emphasized that, in his view, “whales won’t let Q4 be boring with a flat YoY performance,” implying that major market movements are expected as we approach the end of the year.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.