Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Following Donald Trump’s re-election, Bitcoin price surged to $80,000, marking a new milestone and sparking optimism in the crypto market.

Investors anticipate that Trump’s administration could bring more crypto-friendly regulations, as he has voiced support for making the U.S. a leader in digital currencies.

This sentiment has pushed Bitcoin up by 4.5%, while other cryptocurrencies like Ether and XRP have also gained.

Bitcoin Hits $80,000 as Trump’s Win Sparks Investor Optimism

In the wake of President-elect Donald Trump’s second-term victory, Bitcoin surged to $80,000 for the first time, lifting investor sentiment.

This increase reflects market anticipation of more crypto-friendly regulations under Trump, who has expressed interest in positioning the U.S. as a global leader in cryptocurrency.

Bitcoin rose 4.5% to $80,000, while Ether gained 3%. XRP and Cardano also saw notable gains. Trump’s team includes pro-crypto advocates, fueling optimism for a “golden era” in the industry.

Proposed policies, such as creating a national Bitcoin reserve, are expected to drive further growth. Since the election, Bitcoin has risen 18% and Ether 32%.

Key Points:

- Bitcoin hits $80,000, Ether up 3%.

- Trump’s pro-crypto stance fuels investor optimism.

- Analysts forecast significant growth in response to crypto-friendly policies.

Robert Kiyosaki Aims to Own 100 Bitcoins by 2025 for Long-Term Growth

Robert Kiyosaki, author and investor, plans to increase his Bitcoin holdings from 73 to 100 by 2025. He shared on social media that he doesn’t wait for Bitcoin prices to drop, as he believes waiting to invest reflects a “poor person’s mindset.”

Kiyosaki first invested in Bitcoin at $6,000 and silver at $1 an ounce. Although he wishes Bitcoin could return to $10, he prioritizes steady investing and diversification across assets like gold, silver, and real estate.

Key Points:

- Kiyosaki plans to hold 100 Bitcoins by 2025.

- He values steady investing over timing the market.

- Diversified strategy includes gold, silver, and real estate.

Bitcoin Hits $80,770; Michael Saylor Reaffirms Confidence

Bitcoin recently surged 6% in a day to reach an all-time high of $80,770. Former MicroStrategy CEO Michael Saylor responded by sharing the song “There Is No Second Best,” underscoring his belief in Bitcoin as the top investment.

With Bitcoin’s price rise, MicroStrategy’s Bitcoin holdings are now valued at $20.3 billion.

Peter Thiel, CEO of Marathon Digital, also commented, criticizing Germany’s Saxony region for selling 50,000 Bitcoins at $53,000 each, missing out on $1.3 billion in potential revenue.

Key Points:

- Bitcoin reaches new high of $80,772, up 6%.

- MicroStrategy’s Bitcoin holdings now worth $20.3 billion.

- Marathon Digital’s CEO criticizes missed profit by Saxony, Germany.

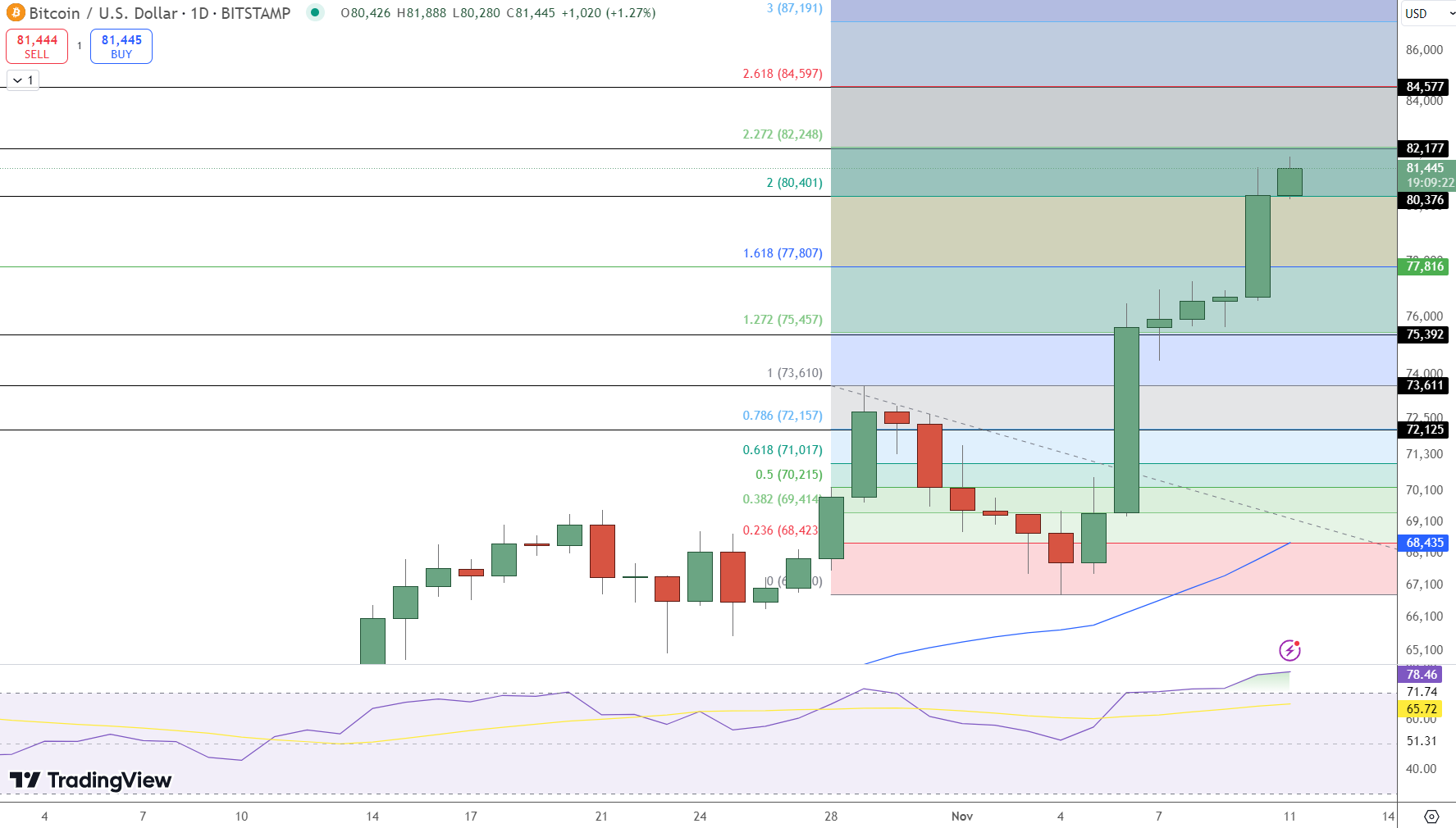

Bitcoin Price Rally Nears $82,250 as Bullish Momentum Strengthens

Bitcoin has rallied past the $80,000 mark, propelled by a bullish engulfing candle that pushed prices to the 200% Fibonacci extension level around $80,400.

Now, BTC is approaching the 227% Fibonacci level near $82,250, a crucial resistance zone.

If Bitcoin maintains this upward momentum, the next resistance to watch will be at $84,580, near the 262% Fibonacci extension.

Immediate support lies around $77,810, aligning with the 162% Fibonacci extension. Should prices fall below this level, BTC could test support at $75,460 and $73,610.

The Relative Strength Index (RSI) is at 78.5, indicating overbought conditions, which may lead to short-term profit-taking.

Meanwhile, the 50-day Exponential Moving Average (EMA) at $68,440 remains a strong support level, highlighting the strength of the ongoing rally.

Conclusion: Bitcoin’s bullish momentum remains strong, though overbought conditions suggest caution.

Pepe Unchained ($PEPU): Why It’s a Strong Buy for Crypto Investors Right Now

With the rise of meme coins, Pepe Unchained ($PEPU) is quickly emerging as a standout opportunity for potential gains. Currently in its presale phase, $PEPU offers investors several compelling reasons to take notice.

Presale Advantage: Crypto experts, including popular YouTuber Jacob Crypto Bury, suggest that buying in the presale could yield substantial returns.

With $26.50 million raised out of a $26.70 million goal, $PEPU is nearing its funding target, adding to its appeal.

High Staking Rewards: Offering an impressive 499% APY, Pepe Unchained presents an attractive passive income stream for investors looking to grow their portfolios.

Investor Trust & Security: With smart contract audits from Coinsult and SolidProof, $PEPU provides a secure investment option, reinforcing investor confidence. The token price currently sits at $0.01239, with the next increase fast approaching.

Don’t miss the chance to buy $PEPU at a lower price before the next presale milestone!

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.