Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price is gaining significant momentum, trading near $68,350 and hitting an intra-day peak of $68,955. The rally follows the SEC’s approval of Bitcoin ETF options, which has increased liquidity and spurred institutional investment.

This development, combined with rising interest in spot Bitcoin products like BlackRock’s ETF—attracting over $1.05 billion in five days—has driven the price surge. Moreover, the approval sets the stage for potential short squeezes, adding further pressure for upward movement.

SEC Approval of Bitcoin ETF Options Spurs Market Liquidity

On October 18, the U.S. Securities and Exchange Commission (SEC) approved applications for options trading on spot Bitcoin exchange-traded funds (ETFs) from the NYSE and CBOE.

This move greenlights options for 11 ETF providers, including BlackRock’s iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Fund, and ARK21Shares Bitcoin ETF. The approval aligns Bitcoin ETF options with existing commodity-based ETFs, broadening trading opportunities.

The addition of options trading is expected to inject substantial liquidity into the market. Bitwise executive Jeff Park noted that these options could trigger short squeezes, forcing overleveraged traders to buy Bitcoin at higher prices, adding upward pressure.

Tom Dunleavy from MV Global pointed out that options could also help moderate Bitcoin’s volatility by enabling risk management strategies.

This approval marks a crucial step for the crypto sector, boosting institutional confidence and expanding market participation.

BlackRock’s Bitcoin ETF Draws $1.05B Inflows, Driving BTC Surge

BlackRock’s Bitcoin ETF has attracted over $1.05 billion in inflows within just five trading days, signaling increased investor appetite for spot Bitcoin products. Samara Cohen, BlackRock’s Chief Investment Officer of ETFs, highlighted that 80% of direct investors in the iShares Bitcoin Trust (IBIT) were new to iShares, indicating substantial untapped demand.

On October 16 alone, BlackRock saw inflows of approximately $393 million, solidifying its market dominance.

Despite a slight dip on October 18, with inflows totaling $70.4 million, BlackRock maintained its lead, capturing nearly 50% of the total inflows across all Bitcoin ETFs.

Cohen emphasized their focus on investor education, which has played a crucial role in onboarding new participants into the Bitcoin space.

The collective market capitalization of all eleven spot Bitcoin ETFs has now reached $63 billion, with nearly $20 billion attributed to recent inflows.

Bitcoin’s price has reacted positively, trading at around $68,300, reflecting a 9.2% rise over the past week. This surge underscores growing confidence in Bitcoin’s mainstream acceptance.

Bitcoin Price Consolidates Below Key Resistance at $69,000 Amid Neutral RSI

Bitcoin (BTC) is experiencing consolidation around $68,200 after reaching an intra-day high of $68,986. The cryptocurrency faces immediate resistance at $68,990, with additional barriers at $69,780 and $70,520.

On the downside, immediate support lies at $67,985, with subsequent levels at $67,445 and $66,640. BTC remains above its 50-hour Exponential Moving Average (EMA) at $67,980, indicating continued bullish sentiment.

The Relative Strength Index (RSI) is holding steady around 53.8, suggesting neutral market conditions with room for potential upward movement.

For a bullish continuation, Bitcoin needs to break the immediate resistance at $68,990.

However, failure to maintain support at $67,985 could indicate a deeper retracement towards $67,445. Investors should monitor these key levels for potential breakouts or corrections.

Key Insights:

- Immediate Resistance: $68,990; Next Resistance: $69,780

- Immediate Support: $67,985; Next Support: $67,445

- Technical Indicator: RSI holding at 53.8 indicates neutrality, with a bullish bias

Maintaining momentum above the 50-hour EMA will be essential for further price advances.

–

You might also like

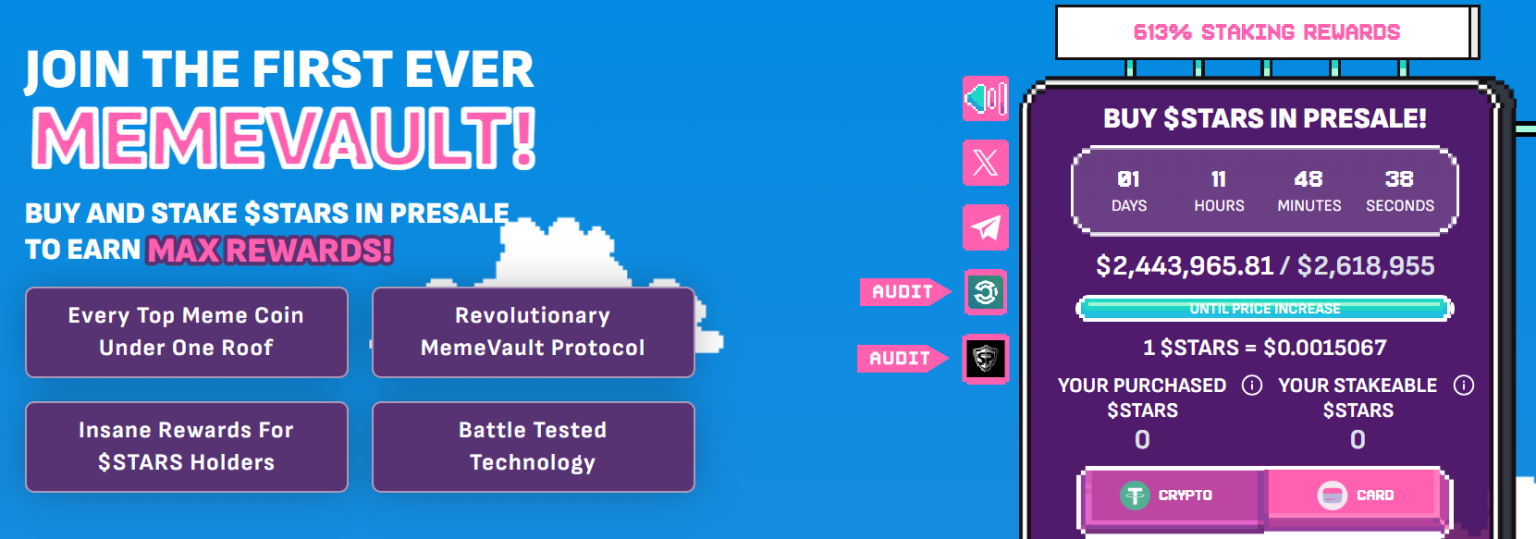

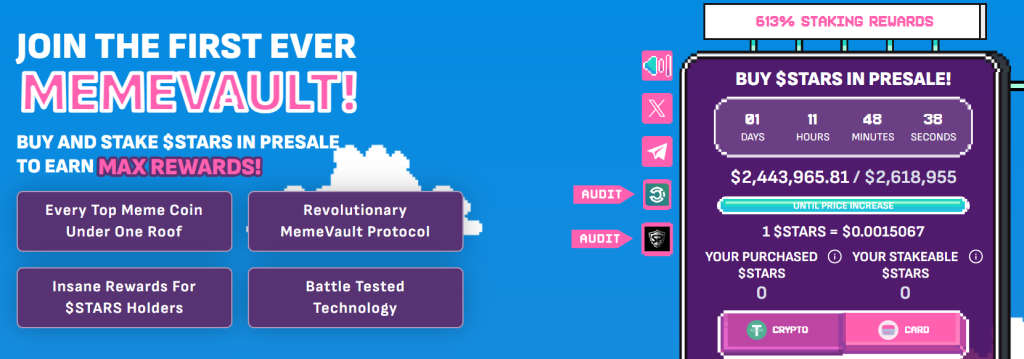

Crypto All-Stars Presale Nears $2.6M as Bitcoin Adoption Drives Investor Momentum

As Bitcoin continues to gain traction globally, Crypto All-Stars is nearing a significant milestone in its presale. With just over a day remaining, the platform has raised $2,443,965 out of its $2,618,955 target.

This strong showing reflects growing investor interest as the presale approaches its final phase, with the current price of 1 $STARS at $0.0015067.

Crypto All-Stars has leveraged Bitcoin’s expanding influence to create a unique platform that combines meme coin staking opportunities with Bitcoin’s established market presence.

The project has seen rapid growth, initially raising $730,000 in just one week and now edging closer to its final goal. With only hours left until the price increases, investors are seizing the opportunity to buy into $STARS before the presale ends.

The platform distinguishes itself from competitors like Sun Wukong through strategic token allocation and long-term growth plans. Investors can purchase $STARS using ETH, USDT, BNB, or by card, with the window quickly closing.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.