Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) saw a brief pullback but continued its upward momentum, holding steady at around $65,500. This positive trend coincided with the early release of Binance founder Changpeng Zhao (CZ) from California’s Lompoc II detention center.

His release is expected to restore confidence in Binance’s operations and alleviate market uncertainty, contributing to Bitcoin’s recent gains.

Adding to this optimism, spot Bitcoin ETFs recorded a substantial $494 million inflow on September 27, pushing the weekly total above $1 billion.

These developments suggest rising institutional interest, which could propel Bitcoin prices even higher.

Zhao’s Early Release Spurs Market Confidence May Benefit Bitcoin

Binance founder Changpeng Zhao (CZ) was released early from California’s Lompoc II detention center after serving a four-month sentence.

His release, two days ahead of schedule, followed a weekend policy allowing early release when the date falls on a weekend.

Zhao was sentenced for failing to implement adequate anti-money laundering (AML) protocols at Binance.

Following his release, Binance Coin (BNB) saw modest gains. Although CZ resigned as CEO, he agreed to pay a $50 million fine and faces a lifetime ban from returning to the role. However, he remains the majority shareholder of the company.

Zhao’s lenient sentence—initially sought at three years by U.S. prosecutors—was reduced due to his clean record and strong character references.

Despite legal issues, CZ has significant support in the crypto community, with many curious about his future impact on Binance.

Key Points:

- Market Impact: Zhao’s release could stabilize Binance operations and boost trading activity.

- Bitcoin Outlook: Positive sentiment may benefit BTC and broader crypto markets.

Bitcoin ETF Inflows Surge by $1.1B, Signaling Strong Institutional Optimism

Bitcoin ETFs saw a major inflow of $494 million on September 27, bringing the weekly total to over $1.1 billion. The ARK 21Shares ETF led with $203 million, while Fidelity and BlackRock’s Bitcoin ETFs added $124 million and $110.8 million, respectively.

Grayscale’s Bitcoin Trust also gained $26.2 million after a two-week drought.

This surge highlights growing institutional confidence and suggests a potential Bitcoin rally in the fourth quarter.

Global monetary easing, including new measures from the People’s Bank of China, is driving renewed interest in Bitcoin as a hedge against economic uncertainty.

Key Points:

- Strong ETF Inflows: Over $1.1 billion, led by ARK 21Shares, Fidelity, and BlackRock.

- Institutional Optimism: Reflects bullish outlook and potential for a Q4 rally.

- China’s Impact: New liquidity measures boost investor interest in BTC.

Overall, the rise in Bitcoin ETF inflows points to increased institutional demand and sets the stage for a potential price rally in the coming months.

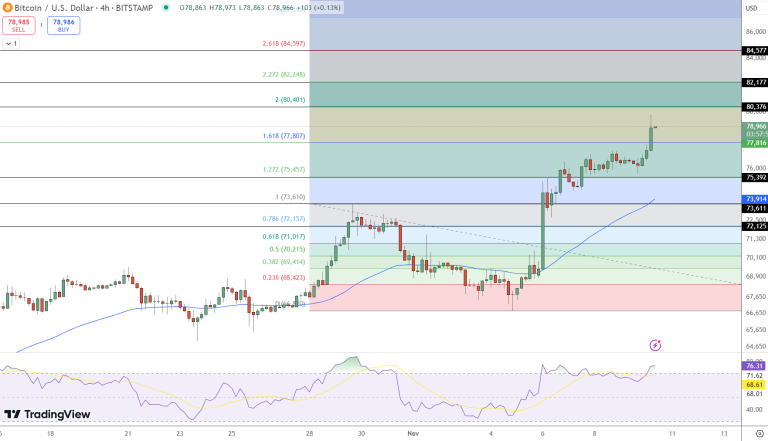

Daily Technical Outlook: Bitcoin (BTC/USD) – September 28

Bitcoin (BTC/USD) is trading at $65,550, down 0.15% in the last 24 hours, showing signs of a potential reversal.

The cryptocurrency faces immediate support at $65,350, which coincides with the 50-day Exponential Moving Average (EMA).

A breakdown below this level could lead to further downside pressure, with the next support targets at $64,790 and $64,170.

The Relative Strength Index (RSI) has slipped below 50, suggesting bearish momentum. On the upside, immediate resistance lies at $66,250, followed by $66,860 and $67,560.

Key Insights:

- Immediate Support at $65,350: A break below could extend losses to $64,790.

- RSI Below 50: Indicates increased selling pressure and a potential bearish trend.

- Resistance at $66,250: Bulls must reclaim this level to regain upward momentum.

Overall, Bitcoin’s movement hinges on its ability to hold above the 50-EMA and maintain support at $65,350. A decisive move below this level could accelerate the bearish trend.

–

You might also like

Why Pepe Unchained ($PEPU) Is a Strong Addition to Your Crypto Portfolio

Presale Advantage

Passive Income Through Staking

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.