Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin’s price took a dramatic turn, surging to $95,000 before crashing below $83,000 in a matter of days. The initial rally was fueled by former President Donald Trump’s proposal for a U.S. Crypto Strategic Reserve, which aimed to include Bitcoin, Ethereum, and several altcoins.

However, enthusiasm quickly faded as concerns over regulatory approval and implementation surfaced. Additionally, profit-taking and macroeconomic factors triggered a wave of sell-offs, sending BTC tumbling to $82,880. Large investors offloaded 8,400 BTC onto exchanges, amplifying the bearish momentum.

Meanwhile, Trump’s confirmation of a 25% tariff on imports from Canada and Mexico added to market uncertainty, leading to a broader sell-off in risk assets, including Bitcoin.

While optimism around institutional adoption remains, the short-term outlook for BTC remains shaky.

US Crypto Reserve Sparks Debate as Bitcoin Struggles

Trump’s U.S. Crypto Strategic Reserve proposal initially ignited optimism, with many investors seeing it as a major step toward mainstream adoption. Some argued that this could serve as a hedge against financial instability, while others questioned whether Bitcoin’s volatility made it a risky asset for government reserves.

Bitcoin briefly hit $95,000 following the announcement but failed to maintain gains as doubts emerged. Traders worried about potential regulatory hurdles and political opposition, leading to a sell-off that erased all previous gains.

- Trump’s Crypto Reserve plan pushed BTC to $95K before reversal.

- Investors divided over Bitcoin’s role in national reserves.

- Regulatory concerns triggered selling pressure, driving BTC below $83K.

Despite recent price declines, some institutions remain bullish on Bitcoin’s long-term trajectory. Standard Chartered maintains its price targets of $200K by 2025 and $500K by 2028, citing increasing institutional demand.

Meanwhile, Senator Cynthia Lummis continues to push for legislation requiring the U.S. government to accumulate Bitcoin annually.

Bitcoin’s Technical Outlook – Key Levels to Watch

Bitcoin is currently trading at $83,857, struggling to find support after a 9.14% drop in the past 24 hours. The 50-day EMA at $87,322 remains a key resistance level, reinforcing the short-term bearish trend.

- Immediate resistance: $86,841, with stronger levels at $90,184 and $94,941.

- Immediate support: $78,339, with further downside potential toward $75,109 and $71,311.

- Breakout signal: A move above $86,841 could signal a recovery, while failure to hold $83,000 may extend the decline.

With uncertainty surrounding Trump’s Crypto Reserve proposal, macroeconomic concerns, and increased selling pressure, Bitcoin’s near-term direction remains volatile. Traders should watch for a decisive move above resistance or deeper losses if BTC fails to hold support.

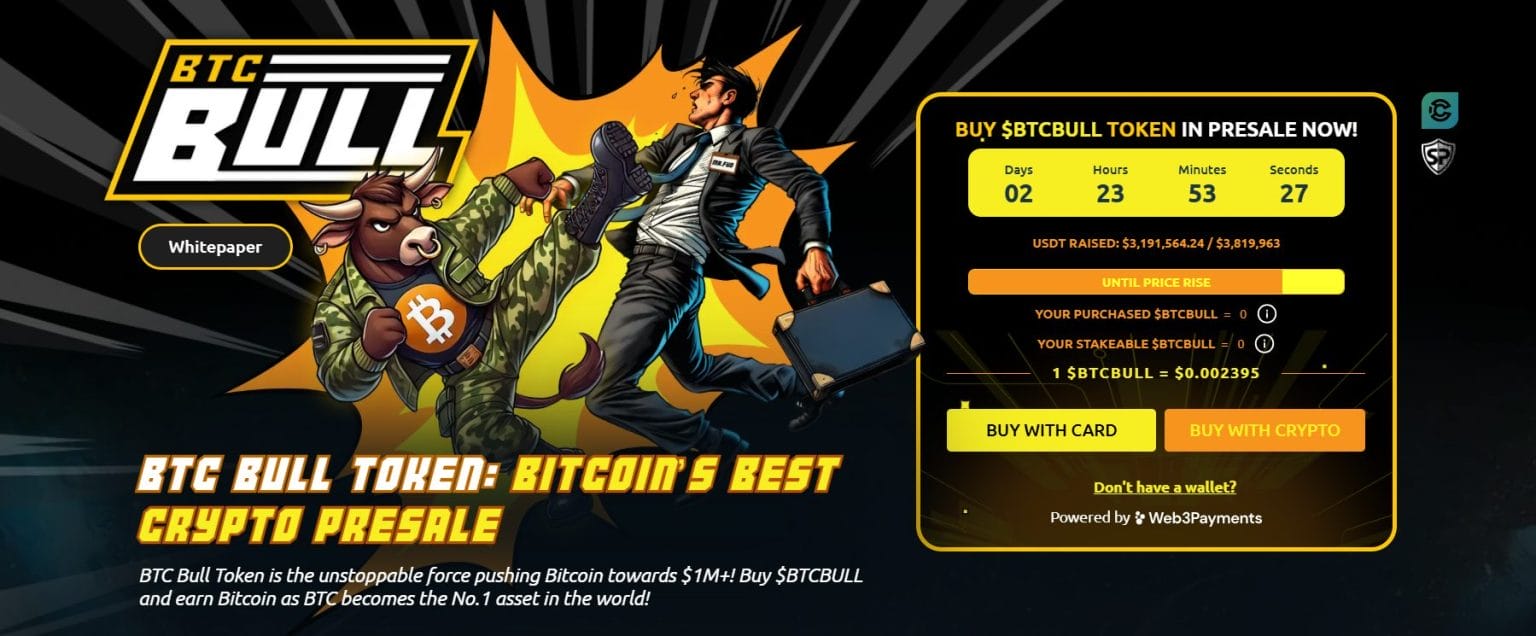

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is gaining traction as a community-driven token that rewards holders with real Bitcoin. Unlike conventional meme tokens, BTCBULL airdrops BTC automatically when Bitcoin reaches key price milestones, offering a strong incentive for long-term investors.

Staking & Passive Income Opportunities

BTC Bull features high-yield staking, allowing users to earn passive income with an impressive 154% APY. This staking system has already seen strong community participation, with millions of BTCBULL tokens staked.

- Current Presale Price: $0.00239 per BTCBULL

- Total Raised: $3.1M / $3.66M target

With investor interest surging, this presale offers an opportunity to secure BTCBULL at early-stage prices before the next price jump.