Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin’s bullish run continues, recently hitting a two-month high of $68,900. On October 20, 2024, Bitcoin (BTC) traded at $68,388, marking a 9% gain over the past week.

This surge has fueled optimism that Bitcoin could soon reach new all-time highs, driven by favorable factors such as the outcome of the U.S. election and growing inflows into spot Bitcoin ETFs.

Short-Term Investors May Slow Bitcoin’s Rise

Despite the bullish momentum, short-term Bitcoin holders—those who typically hold BTC for one to three months—could influence the path to $75,000.

Data from CryptoQuant reveals that these holders began selling as Bitcoin approached $69,000, engaging in profit-taking behavior.

This activity could create resistance around this price level, potentially hindering Bitcoin’s climb.

Key Resistance Levels Amid Break-Even Selling

Notably, around 1.9 million Bitcoin addresses bought BTC between $66,900 and $69,200. As these investors are now at break-even, there’s a likelihood that many could sell once Bitcoin turns a profit, adding further resistance around the $69,000 mark.

Market Sentiment and Technical Indicators Remain Positive

Despite potential selling pressure, market sentiment remains optimistic. Technical indicators, including a Relative Strength Index (RSI) of 68, suggest continued momentum.

On-Balance Volume (OBV) data also indicates strong buying activity, hinting at potential further gains.

Key Insights:

- Bitcoin resistance at $69,000 could delay a rally to $75,250.

- Short-term holders are selling, which might trigger a price dip.

- Market sentiment remains bullish with strong technical support.

If Bitcoin breaks past $69,000, it could surge to $75,250. However, continued selling from short-term holders may result in a retracement toward $65,130.

Bitcoin Price Eyes $70K as Bullish Momentum Holds Above Key $68K Support

The current Bitcoin (BTC) price is $68,440, up 0.11% over the past 24 hours. Trading volume for the period reached $14.09 billion, with Bitcoin maintaining its top position with a market capitalization of $1.35 trillion.

Bitcoin’s supply remains constrained, with 19,770,243 BTC circulating out of a maximum supply of 21 million.

Bitcoin continues to trade within an upward price channel, holding steady above the key $68,000 support level.

This triple-bottom formation suggests strong support at this level, reinforcing bullish sentiment.

Immediate resistance is noted at $69,045, while further gains could lead Bitcoin to challenge the next resistance levels at $69,935 and $70,621.

Technical indicators highlight mixed signals. The Relative Strength Index (RSI) hovers at 57.67, indicating mild buying pressure, but not yet entering overbought territory. The 50-day Exponential Moving Average (EMA) at $67,619 acts as a significant support, aligning with the channel’s lower boundary.

Conclusion: As long as Bitcoin maintains support above $68,000, the upward channel remains intact. A sustained push above $69,045 could ignite further gains toward the psychological $70,000 mark.

Key Insights:

- Bitcoin maintains bullish momentum above $68,000 key support.

- RSI indicates mild buying interest, not yet overbought.

- Break above $69,045 could target the $70,000 level.

–

You might also like

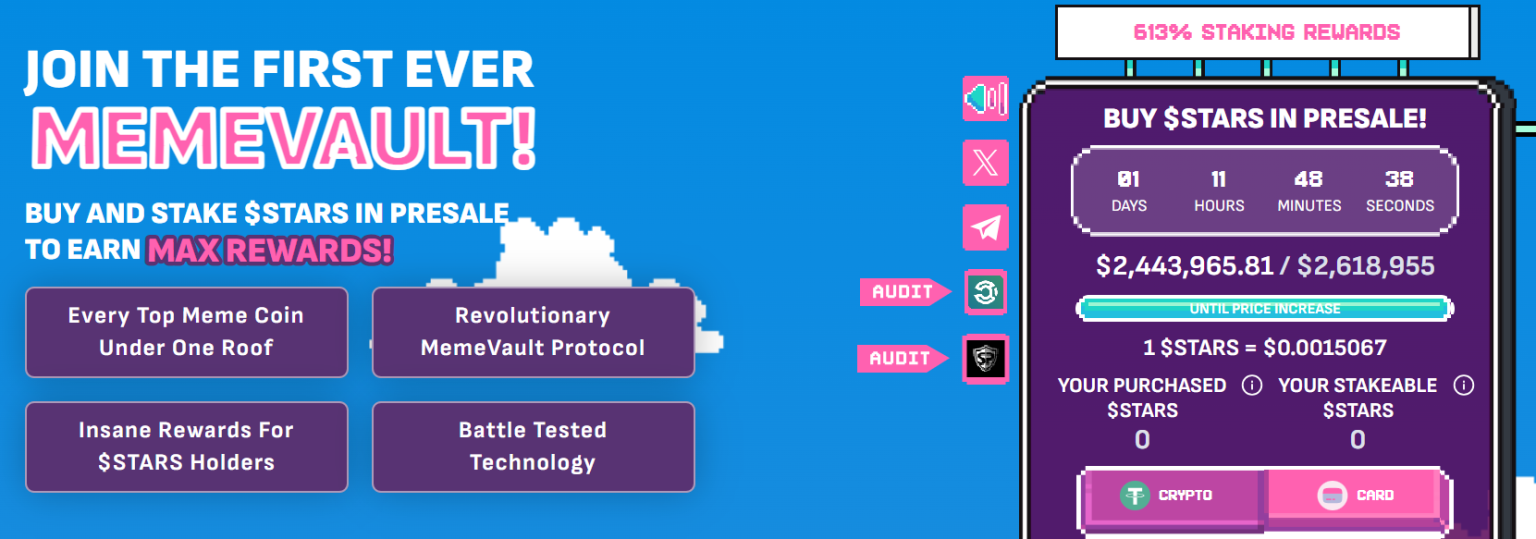

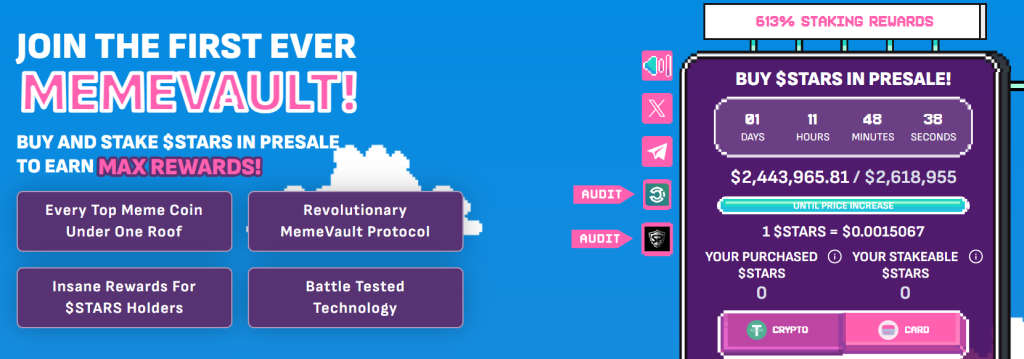

Crypto All-Stars Presale Nears $2.6M as Bitcoin Adoption Drives Investor Momentum

As Bitcoin continues to gain traction globally, Crypto All-Stars is nearing a significant milestone in its presale. With just over a day remaining, the platform has raised $2,443,965 out of its $2,618,955 target.

This strong showing reflects growing investor interest as the presale approaches its final phase, with the current price of 1 $STARS at $0.0015067.

Crypto All-Stars has leveraged Bitcoin’s expanding influence to create a unique platform that combines meme coin staking opportunities with Bitcoin’s established market presence.

The project has seen rapid growth, initially raising $730,000 in just one week and now edging closer to its final goal. With only hours left until the price increases, investors are seizing the opportunity to buy into $STARS before the presale ends.

The platform distinguishes itself from competitors like Sun Wukong through strategic token allocation and long-term growth plans. Investors can purchase $STARS using ETH, USDT, BNB, or by card, with the window quickly closing.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.