Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin’s price has been on an upward trajectory following the announcement that the bankrupt crypto exchange Mt. Gox will delay repayments to its creditors by another year. This has led to speculation about reduced selling pressure in the market and a potential buying opportunity for investors.

The Mt. Gox Delay and Its Impact on Bitcoin

Mt. Gox, once the largest Bitcoin exchange in the world, collapsed in 2014 after losing 850,000 Bitcoins due to a series of security breaches.

In 2021, a rehabilitation plan was approved to pay back creditors a portion of their funds. Recently, however, the deadline for full repayments has been extended to October 31, 2025.

The delay means that creditors, who had been expecting payouts soon, will have to wait another year before receiving their Bitcoin.

As a result, the market has reacted positively, as billions of dollars worth of BTC will not be cashed out immediately, reducing the risk of a price dump.

On the day of the announcement, Bitcoin rose 5.48%, hitting $62,960, a substantial recovery from the previous day’s low of $59,000.

Could This Delay Signal a Buying Opportunity?

Historically, the Mt. Gox case has been a point of concern for Bitcoin investors due to the fear of selling pressure from creditors cashing out their recovered Bitcoin. However, the new delay has shifted market sentiment.

Traders now speculate that this extension will lead to sustained lower selling pressure over the next year, potentially driving the price higher.

Key indicators suggest that the delay could be a buying signal for investors:

- Reduced Selling Pressure: With billions of BTC locked until late 2025, selling pressure is expected to remain subdued in the near term.

- Strong Market Response: Bitcoin’s price rebounded sharply following the delay, reflecting market confidence in the cryptocurrency’s stability.

- Institutional Investment Interest: Institutions have been steadily increasing their exposure to Bitcoin, which could further strengthen bullish sentiment.

What’s Next for Bitcoin?

While the delay in Mt. Gox repayments offers some relief, uncertainty remains in the long term. The market is still recovering from a turbulent period, and other macroeconomic factors, such as interest rate hikes and regulatory challenges, could impact Bitcoin’s performance.

However, with Bitcoin climbing back above $62,000 and showing resilience, the delay may provide a rare window for investors to enter the market at favorable prices.

Traders should monitor the market closely for further developments, including any updates on the repayment process.

In summary, Bitcoin’s recent price surge is directly tied to the Mt. Gox repayment delay, which has lessened immediate selling concerns.

As long as the delay holds, it could present an opportunity for investors seeking to capitalize on Bitcoin’s bullish momentum.

Bitcoin Price Analysis – October 13, 2024

Bitcoin is trading at $62,823, finding resistance near the descending trendline at $63,444. The cryptocurrency has struggled to break above this level, and the downward trendline remains a formidable obstacle.

Should Bitcoin manage a breakout above this resistance, it could push towards the next target of $64,385, followed by a stronger resistance at $65,287.

However, the failure to break the trendline may lead to further downside, potentially retesting the immediate support level of $62,251, which is closely aligned with the 50-day exponential moving average (EMA).

From a technical perspective, the Relative Strength Index (RSI) is currently sitting at 56, signalling a slight bullish bias. However, the momentum is not strong enough to confirm a breakout, and the market remains at a critical juncture.

The 50 EMA, at $62,251, is providing solid support, preventing any sharp declines for the time being. A drop below this level could open the door to the next support at $61,266, with further downside possible towards $60,279.

In conclusion, Bitcoin is trapped between its downward trendline and the 50 EMA. Traders should watch for a decisive move either above $63,444 for potential bullish momentum or below $62,251 for a bearish continuation.

The RSI remains relatively neutral, indicating that the market could swing in either direction in the short term.

Bitcoin Adoption Surges as Crypto All-Stars Nears $2.4M in Presale

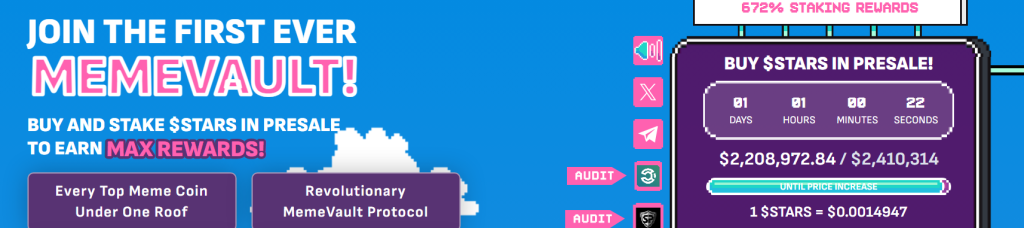

As Bitcoin’s adoption accelerates globally, the innovative platform Crypto All-Stars is gaining massive traction in its ongoing presale. With just over a day left, Crypto All-Stars has impressively raised $2,208,972.84 out of its $2,410,314 target, signalling growing investor interest.

The presale is nearing completion. The current price is 1 $STARS = $0.0014947, and a price increase is expected soon.

Crypto All-Stars is leveraging Bitcoin’s growing influence to create unique staking opportunities, integrating popular meme coins with BTC’s market power.

Since its launch, the platform has seen rapid growth, initially raising $730,000 in just a week and now approaching its final target. Investors looking to capitalize on meme coins and Bitcoin staking have found a compelling opportunity in Crypto All-Stars.

With strategic token allocation and long-term growth plans, Crypto All-Stars is setting itself apart as a competitive alternative to projects like Sun Wukong. Interested investors can still purchase $STARS using ETH, USDT, BNB, or by card before the presale ends.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.