Last updated:

Bitcoin (BTC) continued its upward trend, reaching an intra-day high of $68,193, fueled by growing optimism in the cryptocurrency market.

The rally is supported by forecasts of Bitcoin’s price surging toward $70,000, driven by favorable regulatory developments and political backing.

Increased inflation expectations and rising government spending due to geopolitical tensions are also contributing to this bullish outlook.

Adding to this momentum is the anticipation of Donald Trump’s potential election victory, which has further brightened Bitcoin’s future prospects.

His pledge to position the U.S. as a global blockchain leader and remove regulatory barriers, such as ousting SEC Chair Gary Gensler, has strengthened investor confidence, reinforcing Bitcoin’s upward trajectory.

Bitcoin Climbs Toward $70,000 on Political Tailwinds and Geopolitical Unrest

Bitcoin’s upward trend shows no sign of slowing, with predictions pointing toward a potential climb above $70,000 in the near future. Jonathan de Wet, chief investment officer at Zerocap, highlighted a strong technical breakout as a key factor pushing Bitcoin higher, positioning it for further gains.

Political dynamics in the U.S. are also contributing to Bitcoin’s bullish outlook. Former President Donald Trump’s pledge to transform the U.S. into a global crypto hub, advocating for users’ rights to hold their digital assets, has bolstered confidence among investors.

Arthur Hayes, co-founder of BitMEX, added that escalating geopolitical conflicts, particularly in the Middle East, are likely to drive inflation and government spending, which could fuel the next major Bitcoin bull run. However, uncertainties remain, with China’s economic challenges and Middle Eastern tensions posing potential risks to Bitcoin’s continued momentum.

Michael Saylor Urges Apple to Consider a $100 Billion Bitcoin Investment for Growth

Michael Saylor, CEO of MicroStrategy, is advocating for Apple to invest $100 billion in Bitcoin, arguing that such a move could significantly enhance the tech giant’s market value.

Saylor believes this investment could grow to $500 billion over time, potentially adding trillions to Apple’s market capitalization, with 40% of its valuation tied to Bitcoin holdings.

Saylor’s MicroStrategy, the largest corporate Bitcoin holder with over $17 billion in assets, has been a strong proponent of using Bitcoin for corporate growth. He suggests that other companies, especially smaller ones in the S&P 500, could see enhanced performance by adopting Bitcoin investment strategies similar to major tech firms.

As institutional interest in Bitcoin grows, bolstered by endorsements from figures like Saylor, Bitcoin’s price could continue its upward trajectory, with forecasts suggesting it may hit $70,000 and potentially reach $100,000 by the end of the year.

Bitcoin Faces Key Resistance at $68,400 with Potential Downside to $66,625

Bitcoin (BTC/USD) trades around $67,650, supported by a strong upward trendline that has maintained the bullish momentum. This trendline has been a key technical level, preventing significant declines in recent sessions.

However, a break below this upward channel could result in a bearish correction, pushing the price towards the $66,625 support level, with the next critical support at $65,750. Traders should consider these levels as potential points where further downward movement could stall.

On the upside, Bitcoin faces immediate resistance around the $68,400 mark. A break above this resistance could signal the resumption of the bullish trend, pushing prices towards the next resistance level at $69,140 and potentially beyond.

The market is currently neutral, as reflected in the Relative Strength Index (RSI) at 54, indicating there is room for further upward movement.

The 50-day Exponential Moving Average (EMA) is positioned at $66,640, offering solid support near the lower boundary of the current channel.

In summary, Bitcoin remains in a delicate balance between maintaining its upward trend and facing a potential bearish correction.

While immediate resistance is found at $68,400, a break below the upward trendline could see the price testing $66,625 and $65,750 support levels.

–

You might also like

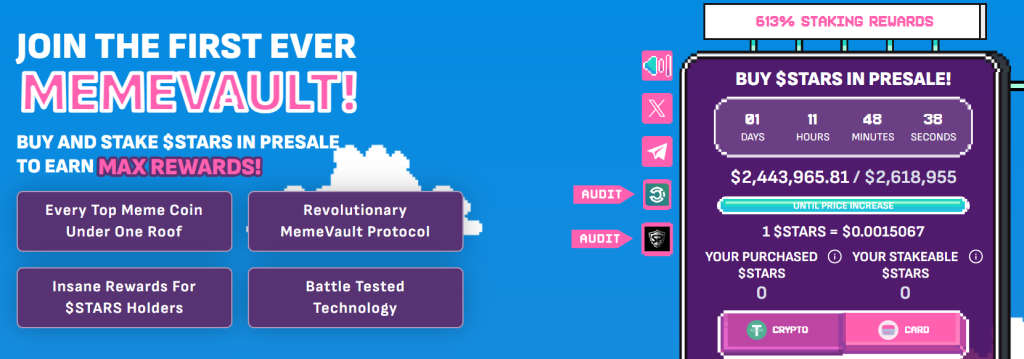

Crypto All-Stars Presale Nears $2.6M as Bitcoin Adoption Drives Investor Momentum

As Bitcoin continues to gain traction globally, Crypto All-Stars is nearing a significant milestone in its presale. With just over a day remaining, the platform has raised $2,443,965 out of its $2,618,955 target.

This strong showing reflects growing investor interest as the presale approaches its final phase, with the current price of 1 $STARS at $0.0015067.

Crypto All-Stars has leveraged Bitcoin’s expanding influence to create a unique platform that combines meme coin staking opportunities with Bitcoin’s established market presence.

The project has seen rapid growth, initially raising $730,000 in just one week and now edging closer to its final goal. With only hours left until the price increases, investors are seizing the opportunity to buy into $STARS before the presale ends.

The platform distinguishes itself from competitors like Sun Wukong through strategic token allocation and long-term growth plans. Investors can purchase $STARS using ETH, USDT, BNB, or by card, with the window quickly closing.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.