Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price is showing strong upward momentum, currently trading at around $68,000, supported by a solid 50-day EMA near $67,500.

This upward channel has strengthened the bullish sentiment, with traders eyeing potential resistance levels around $69,140.

Key factors such as institutional interest and tightening exchange reserves are adding to Bitcoin’s potential for further gains, making it a focal point for investors looking to capitalize on the ongoing price rally.

FBI Arrests Alabama Man for Bitcoin Manipulation in SEC Hack

Eric Council Jr., a man in his mid-20s from Alabama, has been arrested by the FBI for allegedly hacking the SEC’s X (formerly Twitter) account to manipulate bitcoin prices. In January, Council posted false information claiming that bitcoin exchange-traded funds (ETFs) were approved, causing bitcoin to spike by $1,000.

Although the tweet was quickly deleted, it raised concerns about the security of both the SEC and X platforms. Council, who was paid in bitcoin for his actions, now faces charges of fraud and identity theft.

Key Points:

- Bitcoin surged $1,000 following the false ETF claim.

- Eric Council Jr. is charged with fraud and identity theft.

- The incident highlights ongoing security concerns for major platforms.

Grayscale Survey: Majority of U.S. Voters Favor Pro-Crypto Candidates

A recent survey by Grayscale and The Harris Poll reveals that more than half of U.S. voters prefer pro-crypto candidates in the upcoming presidential election.

Craig Salm, Grayscale’s Chief Legal Officer, notes that voter interest in Bitcoin and other cryptocurrencies is higher than in previous elections.

Additionally, 30% of respondents identified inflation as their top concern, with many viewing Bitcoin as a hedge against it.

Growing political support for cryptocurrency-friendly candidates could lead to policies that further boost Bitcoin’s long-term potential.

Key Points:

- Over 50% of voters favor pro-crypto candidates.

- 30% see inflation as the most urgent issue.

- Bitcoin is increasingly seen as an inflation hedge.

Arthur Hayes Predicts Bitcoin Surge Amid Inflation and Middle East Tensions

Arthur Hayes, former CEO of BitMEX, predicts a significant rise in Bitcoin prices due to rising inflation and tensions in the Middle East.

He believes escalating regional conflicts could impact oil production, driving energy prices higher and triggering the issuance of more U.S. dollars, which would boost Bitcoin’s value against fiat currencies.

Hayes views Bitcoin as “stored energy in digital form,” aligning its value with increasing energy costs. While optimistic, he warns of potential volatility in the crypto market, especially for smaller altcoins.

Key Points:

- Bitcoin may surge due to inflation and energy price hikes.

- Middle East tensions could impact global oil supply and fiat currency value.

- Hayes warns of possible volatility for smaller cryptocurrencies.

Bitcoin Exchange Reserves Hit 5-Year Low, Signaling Price Surge Potential

Bitcoin exchange reserves have reached a five-year low, signaling potential price increases due to reduced supply. Fewer reserves mean less Bitcoin is available for immediate purchase, which could boost buying pressure.

Adding to this, 94% of Bitcoin holders are currently profitable, reflecting rising market confidence.

Additionally, Bitcoin recently broke out of a bullish flag formation, a technical signal that often predicts further price gains. As more holders opt to keep their Bitcoin instead of selling, the supply continues to tighten.

Key Points:

- Bitcoin exchange reserves are at a 5-year low.

- 94% of Bitcoin holders are currently in profit.

- Bullish flag breakout hints at potential price surge.

Bitcoin Bullish, Targets $69K in Uptrend

Bitcoin (BTC/USD) is maintaining its bullish momentum, trading within an upward channel at $68,020. The 50-day EMA around $67,490 continues to act as solid support, bolstering the buying trend.

Immediate resistance is seen at $68,400, with further targets at $69,140 and $69,980 if bullish pressure persists.

On the downside, immediate support is positioned at $66,640, followed by key levels at $66,490 and $65,760.

The RSI is currently at 59, indicating moderate bullish conditions without signaling overbought levels. This suggests room for further upward movement.

Conclusion: The upward channel is supporting a buying trend, with potential gains toward $69,140 and beyond.

Key Insights:

- BTC is supported by the 50-day EMA at $67,490.

- Immediate resistance at $68,400, with potential to reach $69,140.

- RSI at 59 suggests moderate bullish momentum.

–

You might also like

Crypto All-Stars Presale Nears $2.6M as Bitcoin Adoption Drives Investor Momentum

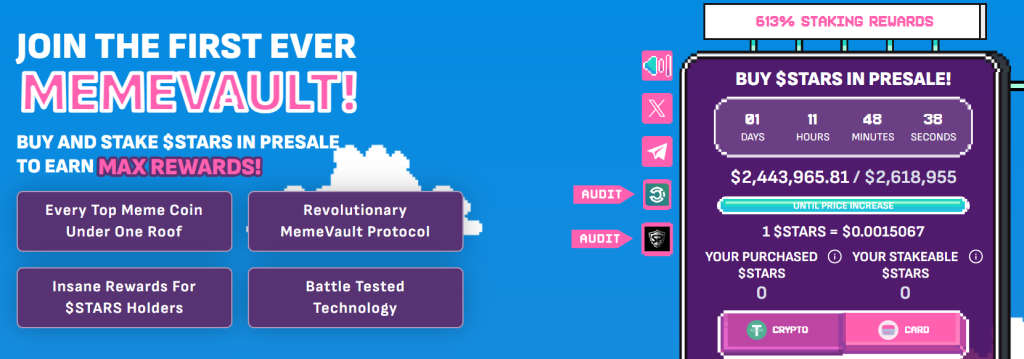

As Bitcoin continues to gain traction globally, Crypto All-Stars is nearing a significant milestone in its presale. With just over a day remaining, the platform has raised $2,443,965 out of its $2,618,955 target.

This strong showing reflects growing investor interest as the presale approaches its final phase, with the current price of 1 $STARS at $0.0015067.

Crypto All-Stars has leveraged Bitcoin’s expanding influence to create a unique platform that combines meme coin staking opportunities with Bitcoin’s established market presence.

The project has seen rapid growth, initially raising $730,000 in just one week and now edging closer to its final goal. With only hours left until the price increases, investors are seizing the opportunity to buy into $STARS before the presale ends.

The platform distinguishes itself from competitors like Sun Wukong through strategic token allocation and long-term growth plans. Investors can purchase $STARS using ETH, USDT, BNB, or by card, with the window quickly closing.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.