Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) has maintained stability around the $67,000 level, bolstered by positive sentiment from billionaire investor Paul Tudor Jones II. Recently, Jones expressed his belief in Bitcoin as a solid hedge against inflation, a view that has caught the attention of institutional investors. His endorsement could lead to heightened interest from larger market participants, potentially driving Bitcoin’s price higher.

As of today, the global cryptocurrency market cap stands at $2.31 trillion, with Bitcoin exhibiting notable volatility. The cryptocurrency has been testing its $67,000 support level, moving between bullish and bearish trends. A sustained break above the upper trendline could indicate renewed bullish momentum, encouraging more market activity. However, low trading volumes are tempering expectations of a significant rebound in the near term.

Despite the uncertainty, the broader cryptocurrency market is showing resilience. Over the past week, Ethereum and Bitcoin ETFs saw an influx of $2.2 billion, signaling strong institutional interest. This inflow highlights growing confidence among investors, suggesting that bullish trends could be on the horizon for Bitcoin and other major cryptocurrencies.

Paul Tudor Jones II Supports Gold and Bitcoin as Inflation Hedges

As we mentioned, billionaire hedge fund manager Paul Tudor Jones II is investing heavily in gold and Bitcoin (BTC) because he thinks inflation will keep rising, no matter who wins the 2024 U.S. presidential election. In a recent interview on CNBC’s “Squawk Box,” he said, “I think all roads lead to inflation,” and explained that he is preparing his investments for higher prices.

He is optimistic about both gold and Bitcoin, pointing out that many people have not invested enough in commodities like these. Jones also praised Bitcoin for performing well during tough economic times.

Jones is worried about U.S. debt and believes the government might try to pay it off by increasing inflation, like other countries have done in the past. He mentioned that the U.S. might see its deficits rise to $2.8 trillion by 2034, which would add to inflation and cause interest rates to go up. Because of this, he does not want to hold fixed-income assets, saying, “I am clearly not going to own any fixed income.” Instead, he plans to bet against long-term bonds, as he thinks they are priced too high.

Paul Tudor Jones II’s strong support for Bitcoin, combined with his concerns about inflation and U.S. debt, could boost investor confidence and demand for BTC. This optimism may lead to an upward trend in Bitcoin’s price as more investors seek inflation hedges.

Moreover, central banks are increasingly worried about Bitcoin because they believe it threatens their control over money and the economy. Officials from institutions like the European Central Bank (ECB) and the U.S. Federal Reserve (Fed) have voiced concerns that Bitcoin makes it harder for them to manage things like interest rates.

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, called Bitcoin “a useless piece of paper” and claimed it “impoverishes” the financial system. These statements show how frustrated they are with Bitcoin’s growing popularity.

Central banks have been increasing the money supply, which has led to rising inflation and greater economic inequality. This means that wealthy banks and individuals benefit the most, while regular people suffer, a situation known as the Cantillon Effect. Bitcoin offers a different option because it is decentralized and has a fixed supply, making it less affected by inflation.

Despite the negative views from central banks, Bitcoin is becoming more accepted in the financial world and is now seen as a permanent part of it. The real worry for central bankers is that Bitcoin takes away their power and profits from managing money while putting the burden of inflation on regular people.

Bitcoin Breaks Above $67,250 EMA, Eyes Further Gains Toward $68,500

Bitcoin is gaining strength, trading at $67,160 after bouncing off key support at $65,230. The recent bullish momentum has allowed BTC to break above the 50-day Exponential Moving Average (EMA) at $67,250, a critical resistance level.

This move suggests the potential for continued upward movement. Immediate resistance is now set at $67,900, and if Bitcoin surpasses this level, further gains toward $68,580 and $69,540 are possible.

However, if bearish pressure returns, immediate support is located at $65,230, with a deeper support level at $63,760. The Relative Strength Index (RSI) currently stands at 52, indicating neutral conditions but leaving room for additional buying interest should momentum pick up.

The breakout above the 50 EMA at $67,250 could fuel further bullish momentum. If Bitcoin manages to push beyond $67,900, it may signal a more sustained uptrend. However, traders should watch for support at $65,230, which could be tested if the market turns bearish.

–

You might also like

Crypto All-Stars Presale Nears $2.6M as Bitcoin Adoption Drives Investor Momentum

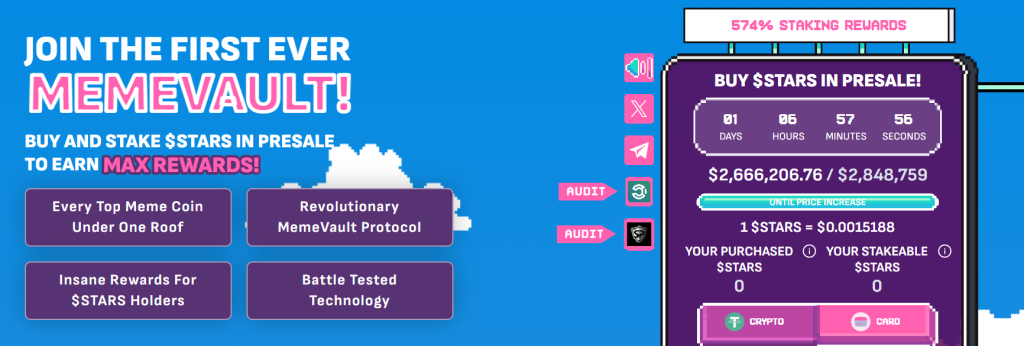

As Bitcoin continues to gain traction globally, Crypto All-Stars is nearing a significant milestone in its presale. With just over a day remaining, the platform has raised $2,666,206 out of its $2,848,759 target.

This strong showing reflects growing investor interest as the presale approaches its final phase, with the current price of 1 $STARS at $0.0015188.

Crypto All-Stars has leveraged Bitcoin’s expanding influence to create a unique platform that combines meme coin staking opportunities with Bitcoin’s established market presence.

The project has seen rapid growth, initially raising $730,000 in just one week and now edging closer to its final goal. With only hours left until the price increases, investors are seizing the opportunity to buy into $STARS before the presale ends.

The platform distinguishes itself from competitors like Sun Wukong through strategic token allocation and long-term growth plans. Investors can purchase $STARS using ETH, USDT, BNB, or by card, with the window quickly closing.

Follow them on social media – X (Twitter) | Telegram to stay up-to-date on all their development plans.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.