Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin price remains a focal point as Scott Bessent, a pro-crypto hedge fund manager, is nominated by President-elect Donald Trump for Treasury Secretary.

Known for advocating cryptocurrency adoption, Bessent supports establishing a national Bitcoin reserve. His “3-3-3” economic strategy, prioritizing growth and fiscal responsibility, aligns with Trump’s vision for a stronger economy.

Bessent’s policies could influence Bitcoin sentiment and broader adoption, positioning cryptocurrency as a critical component of future financial strategies and government-backed initiatives.

Trump’s Pro-Crypto Treasury Nominee: Scott Bessent

Scott Bessent, a pro-crypto hedge fund manager, has been nominated by President-elect Donald Trump as the next Treasury Secretary, pending Senate approval. Bessent advocates for cryptocurrency adoption and supports Trump’s proposal for a national Bitcoin reserve.

He is known for his “3-3-3” plan, emphasizing oil production, deficit reduction, and 3% GDP growth. Trump hailed Bessent as a visionary, with his pro-crypto stance likely to boost Bitcoin sentiment and prices.

Key Points:

- Bessent to oversee national debt, taxes, and crypto legislation.

- His policies aim to encourage confidence in Bitcoin.

LatAm Crypto Insights: Argentina, Milei, and Bitcoin Debt

El Salvador may issue Bitcoin-backed securities, leveraging its $600M Bitcoin reserves, as proposed by Max Keiser, an advisor to President Bukele.

This strategy would avoid using public funds while increasing Bitcoin holdings.

Meanwhile, Trump met with Argentina’s President Javier Milei, who praised stronger U.S.-Argentina ties.

Argentina also leads in Worldcoin registrations, with 2.2M users, despite facing a $200,000 fine for consumer law violations.

Key Points:

- El Salvador’s Bitcoin-backed debt plan could expand reserves.

- Trump and Milei discussed boosting bilateral relations.

Bitcoin Holds Below $100K After Recent Rally

Bitcoin surged to $100K but briefly retraced to $95,776 before recovering to $98,065. Optimism grew with Trump’s pro-crypto stance and Scott Bessent’s nomination, sparking interest in Bitcoin-friendly policies.

Analysts expect short-term consolidation near $100K before a breakout.

Institutional interest is growing, with Cantor Fitzgerald exploring Bitcoin-backed lending, while discussions on a White House crypto policy further support market optimism.

Key Points:

- Bitcoin resistance at $100K; support near $95,776.

- Market sentiment driven by pro-crypto policies and institutional backing.

Bitcoin Near $99,000: Key Levels to Watch for a $100K Breakout

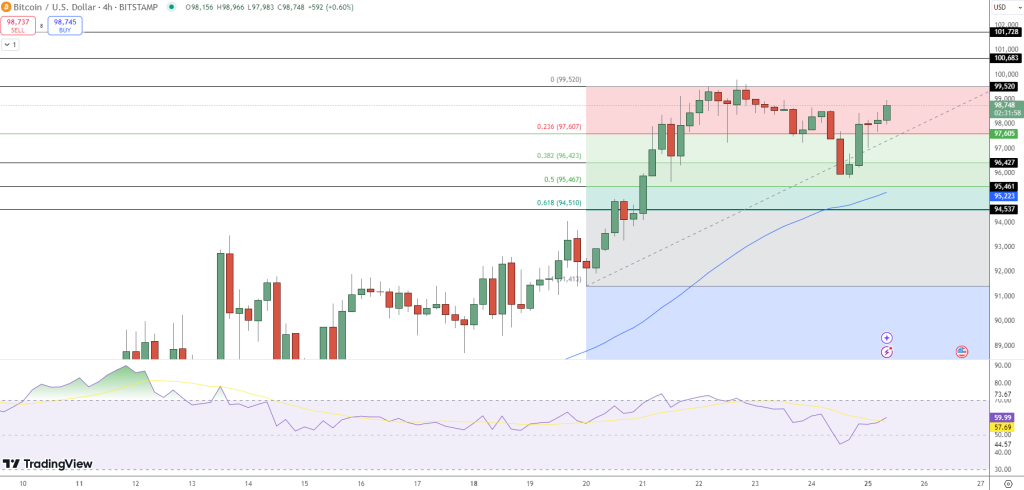

Bitcoin continues to edge higher, trading near $98,745 as bullish momentum pushes prices closer to key resistance levels. On the 4-hour chart, the asset is approaching the $99,520 mark, a significant Fibonacci 0% retracement level.

Immediate support lies at $97,607 (23.6% Fibonacci retracement), with further support around $96,427 and $95,467.

The RSI is trending upwards at 59, indicating moderately strong bullish momentum, though nearing overbought levels. The 50 EMA, currently around $95,223, provides a firm dynamic support zone.

Traders are watching the $99,520 resistance as a breakout above this level could open the path toward the psychological $100,000 barrier.

However, rejection at current levels may lead to consolidation or a pullback toward the $97,600-$96,400 zone. Overall, the bullish structure remains intact, supported by upward-sloping trendlines and robust volume.

–

You might also like

Don’t Miss Out: Pepe Unchained ($PEPU) Presale Nears Its End

Pepe Unchained ($PEPU) is making waves in the crypto market, with its presale raising over $40 million and offering investors a unique opportunity to secure tokens before major exchange listings.

Currently priced at $0.01295, this presale offers early adopters the chance to maximize their returns before the price rises further.

With only 20 days remaining, now is the time to act and take advantage of the following key benefits:

Why Invest in $PEPU?

- 499% APY Staking: Generate passive income through the project’s lucrative staking rewards, making $PEPU a standout in the meme coin market.

- Thoroughly Audited: Security is a priority, with smart contracts audited by Coinsult and SolidProof, ensuring a safe investment opportunity.

- Flexible Payment Options: Purchase $PEPU using ETH, USDT, BNB, or even a credit card, making the process simple and accessible for all investors.

A Secure Investment Opportunity

Pepe Unchained has already attracted significant investor confidence, with over $40 million raised during its presale. Its robust staking feature and transparent security audits make it a compelling addition to any crypto portfolio.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.