Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin owner behavior is shifting back to HODLing, according to the latest report by analytics firm Glassnode.

Naturally, the HODLing state is accompanied by accumulation.

This shift follows several months of relatively heavy distribution pressures.

Notably, the market went through its largest downtrend of this cycle and is currently “digesting” it.

And while there is indecision amongst digital asset investors, metrics nonetheless point to a renewed rotation to HODLing and accumulation, the report argued.

Preference for HODLing Emerges

The crypto market went through another sell-off last week, but it’s now showing signs of recovery.

As it typically happens, uncertainty and investor indecision levels are notable at this stage.

“Nevertheless,” said Glassnode analysts, “when analyzing the onchain response of investors to these choppy market conditions, a trend of a preference for HODLing is beginning to emerge.”

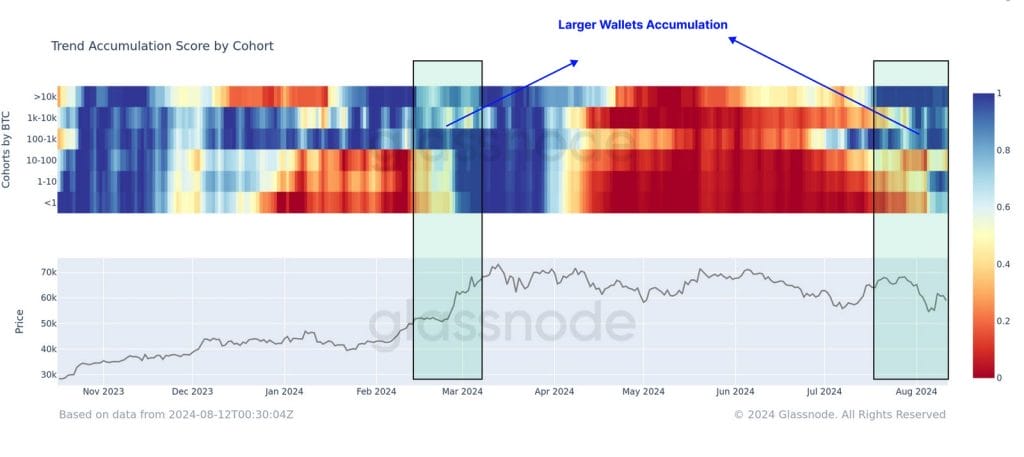

Bitcoin recorded an all-time high of $73,737 in March this year. The market saw an extensive period of supply distribution since, with participation by wallets of all sizes.

That said, the analysts found “early signs” over the last few weeks that this trend is reversing.

This is especially true for the largest wallet sizes, often associated with exchange-traded funds (ETFs).

“These large wallets appear to be returning to a regime of accumulation,” the report argued.

Moreover, the analysts looked at the metric called the Accumulation Trend Score (ATS). It assesses a weighted balance change across the market.

The ATS also suggests a return to the accumulation-dominant behavior.

What’s more, the ATS hit its highest possible value, “suggesting significant accumulation throughout the last month.”

Long-Term Investors Are Accumulating Wealth

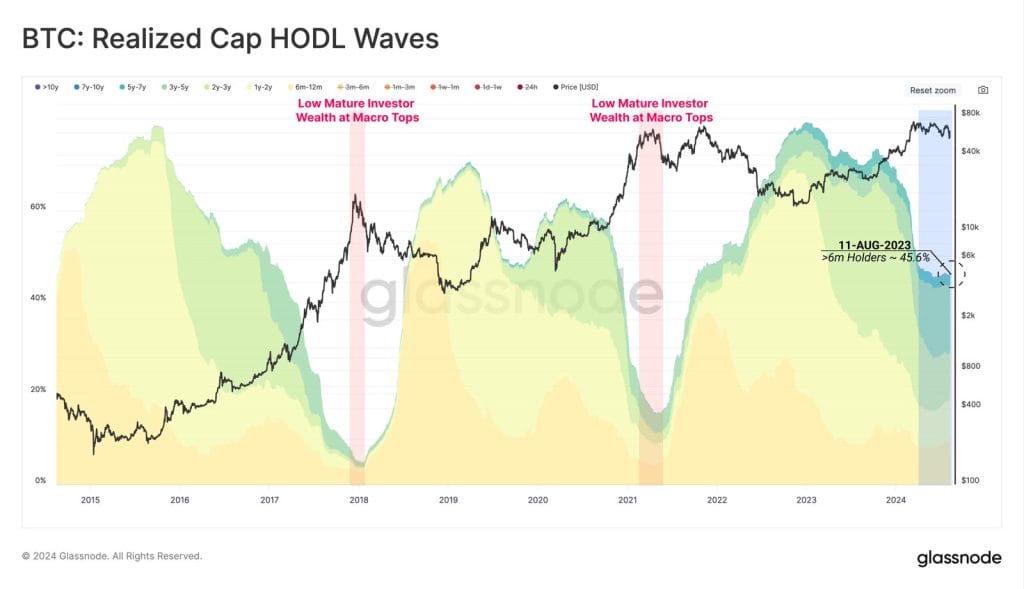

Moving towards the all-time high, Long-Term Holders (LTH) heavily divested, but are now noticeably shifting to HODLing.

374,000 BTC moved into the LTH status over the last three months.

“From this, we can infer that the propensity for investors to hold onto their coins is now a larger force relative to their spending pressures,” the analysts remarked.

The report noted “choppy sideways price action” seen in recent months as the motivation for a slow-down in the distribution pressure by LTHs.

Therefore, their wealth percentage first stabilized and then started growing again.

Furthermore, this wealth “remains historically elevated” compared to previous all-time high breakouts, the report said.

Also, even when trading sideways or downwards, LTHs are “increasingly unwilling to part ways with their coins at lower prices.”

These findings, said the analysts, suggest a more patient and resilient holder base, adding:

“Despite challenging and choppy market conditions, Long-Term Bitcoin Holders (LTH) remain remarkably steadfast in their conviction, with evidence they are ramping up accumulation behaviour.”

Additionally, the LTH Sell-Side Risk ratio stands at a lower level compared to previous all-time high breaks.

This suggests that the profit size the LTHs took is comparatively small relative to previous market cycles.

Also, a potential for further divestment pressure by this group is noticeable, should the BTC price appreciate. LTHs are likely waiting for higher prices.

Bitcoin Returns to the $60K Level

At the time of writing on Wednesday morning (UTC), BTC has climbed above $60,000 again.

Over the past day, it appreciated 2.6% to $60,795.

Source: coingecko.com

In the past seven days, the coin’s price increased by 6.9%, while it’s down 3.1% in a month.

Overall, BTC is up 107% in a year.

As noted above, it saw its last all-time high of $73,737 in March this year, falling 17.5% since.