Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Traders have locked in $365 million in Bitcoin options expiring four days after the November 4th US presidential election.

The so-called election expiry options, due for settlement on November 8th, began trading on Deribit a month ago.

Since, the notional open interest, or the total dollar value of active options contracts, stands at 364.065 million, according to Debribit data.

This significant accumulation is fueled by speculation on how the impending US election might affect the digital assets industry, hoping to capitalize on the “valuable opportunities” the significant news event brings.

Traders Target New Bitcoin All-Time High Post-Election

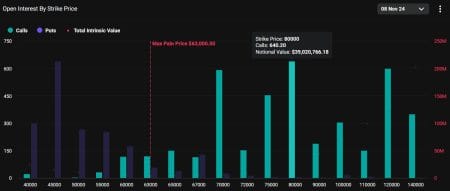

Call options, which offer unlimited upside potential with limited downside risk, account for 67% of the total open interest, while put options, which provide protection against price drops, make up the remaining 33%.

This results in a put-call ratio of less than 0.50, indicating that twice as many calls are open compared to puts. This distribution reflects a generally bullish outlook among traders, suggesting that they are betting on significant price increases following the election.

Broadly speaking, open interest is concentrated in higher strike calls, ranging from $70,000 to $140,000. Traders are positioning for a potential new Bitcoin all-time high – surpassing its previous peak of $73,750.07.

The most anticipated of which is a strike price of $80,000, boasting an open interest of over $39 million. However, traders show similar confidence that we will exceed this mark, with $36.5 million backing a strike price of $120,000.

Conversely, there is also $39 million locked into the $45,000 put option, indicating that some remain cautious, betting on a potential downturn.

This division in sentiment reflects the market’s uncertainty about Bitcoin’s price trajectory during this critical period.

Candidates’ Crypto Stances Drive Market Speculation

This indecision is largely driven by the contrasting approaches of leading candidates Kamala Harris and Donald Trump towards cryptocurrency.

Donald Trump has undergone a notable shift in his position on crypto. Despite previously labeling Bitcoin a “scam,” he has recently changed his tune.

On June 14, he declared that he would end the Biden administration’s “war on crypto” if elected president.

Trump had also previously criticized Biden for his harsh stance on cryptocurrencies, emphasizing that the United States should strive to be a leader in the crypto industry.

In contrast, Kamala Harris’s stance on cryptocurrency remains ambiguous. Her campaign has largely avoided the topic, leaving her position unclear.

Meanwhile, sources have cited both advancements towards a favorable crypto stance and a continuation of the Biden administration’s rigorous regulatory stance.

A survey conducted by the Harris Poll has revealed that one in three voters in the US consider a candidate’s position on cryptocurrencies before making their voting decision.

Another survey conducted by leading crypto venture capital firm Paradigm reveals that Trump’s poll numbers for the 2024 US Presidential Election enjoy significant support from the crypto community.

However, Polymarket bettors appear to have shifted slightly in favor of a Kamala Harris win, although the margin remains narrow. According to Polymarket data, 50% of bettors are forecasting a Harris victory, while 48% are backing Donald Trump.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.