Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Based on historical and technical patterns, a $110K Bitcoin remains a possibility. However, some analysts express concerns about a potential retracement to $40K beforehand.

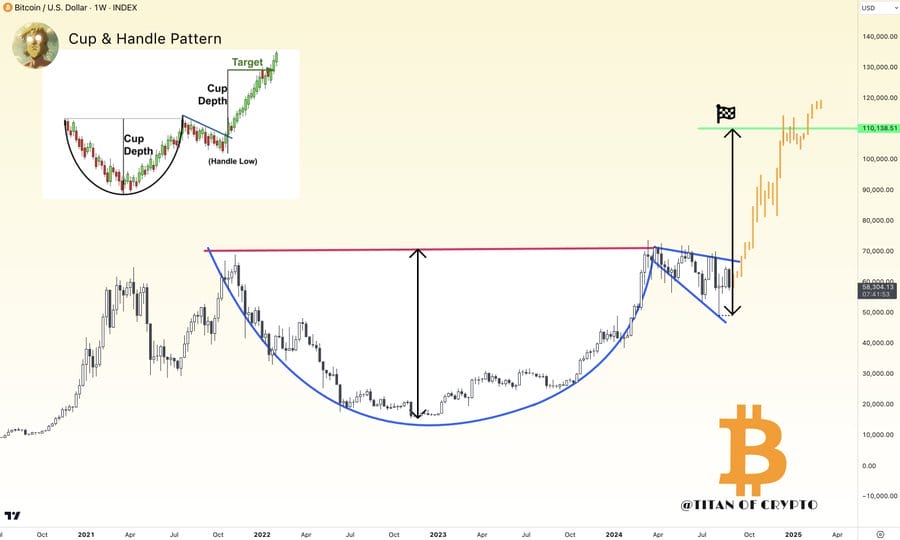

In a September 1st X post, popular crypto analyst Titan of Crypto shared a bullish outlook, citing technical developments on the Bitcoin chart as grounds that $110,000 is “still in play.”

This optimism is largely based on the formation of a Cup and Handle pattern, which suggests that Bitcoin’s uptrend could continue despite its price lapse over the past few months.

If this pattern follows through, it forecasts a Bitcoin price target of around $110K, surpassing its previous all-time high of $73,750.07.

Analysts Eye Q4 2024 for a Bitcoin Breakout

Notably, Titan of Crypto pointed to the final quarter of this year as a potential breakout point, describing it as having “epic” potential—a sentiment echoed by other analysts.

In an August 31st X post to his 683k followers, Elija Boom highlighted developments on the Bitcoin price chart that support the possibility of a new all-time high in Q4.

Elija pointed out the formation of a giant inverse head and shoulders pattern, suggesting that once fully developed, Bitcoin could “shoot above $100K.”

Adding to this optimism, historical patterns lend credibility to a Q4 breakout. In an August 21st X post, CryptoQuant CEO Ki Young Ju noted that past post-halving rallies have typically started in the fourth quarter of each halving year.

Young Ju further emphasized that, in his view, “whales won’t let Q4 be boring with a flat YoY performance,” implying that significant market movements are expected as we approach the end of the year.

These combined technical and historical factors have fueled speculation that Q4 2024 could be a pivotal period for Bitcoin, potentially marking the beginning of a significant upward movement.

Short-Term Pain For Long-Term Gain: Bitcoin Could See $40,000

Despite these optimistic forecasts, not all analysts agree that Bitcoin’s path to $110,000 will be smooth. Some foresee a sharp correction before reaching new highs.

In a September 1st X post, Bitcoin analyst Magoo PhD suggested that Bitcoin could risk a correction below $40,000 before surging to new heights.

This view is consistent with past analysis from 10x Research, which identified the low 40,000s zone as an optimal entry point for the next bull market.

However, not all analysts agree on the severity of the potential correction. Popular crypto analyst Moustache believes that the market bottom could be around $57,000, citing historical fractal patterns used to identify key support and resistance levels and potential trend reversals.

Bitcoin currently has significant support at $57,000. However, a possible move below would liquidate over $860 million worth of cumulative leveraged short positions, according to CoinGlass data.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.