Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

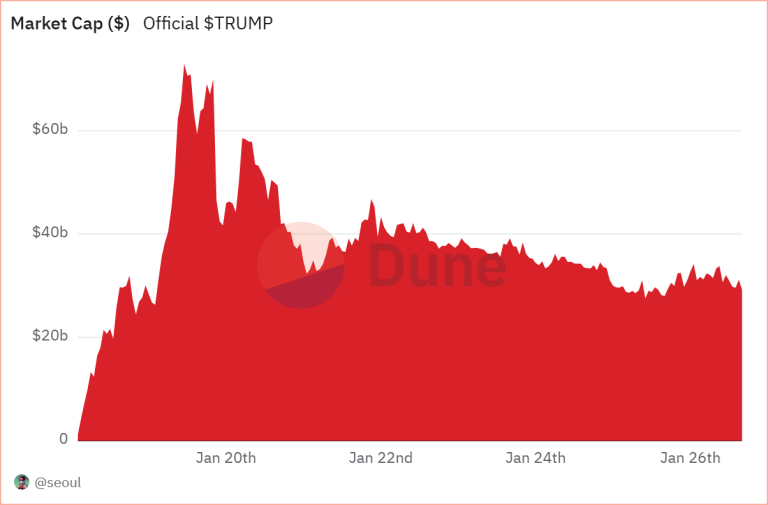

Despite China’s 2021 cryptocurrency ban, the country still maintains significant control over the Bitcoin mining network, with over 55% of the global hashrate.

However, as Bitcoin mining grows in institutional legitimacy, particularly in the U.S., American mining firms are quickly closing the gap.

The U.S. now controls 40% of the global hashrate because of a fundamental shift in mining dynamics as political, regulatory, and economic pressures impact the two countries differently.

China’s Bitcoin Mining: Massive Growth Amid Ban

According to Ki Young Ju, the CEO of CryptoQuant, Chinese mining pools still control 55% of the global Bitcoin mining network. This revelation is startling, given China’s aggressive anti-crypto measures in recent years.

However, Chinese miners have found ways to continue operating, even in the face of government crackdowns.

Before the 2021 ban, China dominated Bitcoin mining, contributing more than 75% of the global hashrate at one point.

At the time, the Chinese government framed the ban as necessary to maintain financial stability and prevent illegal activity.

As a result, many miners were forced to shut down operations, and some relocated to more crypto-friendly jurisdictions like the U.S. and Kazakhstan.

However, Chinese miners have shown remarkable resilience. They have adapted by using smaller, more covert operations to avoid detection, allowing them to maintain a substantial share of the global hashrate.

China’s stance on cryptocurrency regulations could change further as the country plans to amend its Anti-Money Laundering (AML) regulations in 2025.

These amendments are expected to cover cryptocurrency transactions, aiming to curtail illegal activities associated with digital assets.

U.S. Bitcoin Mining Firms on the Rise

While China still holds most of the Bitcoin network’s hashrate, the U.S. controls 40% of the global mining activity.

The growth of Bitcoin mining in the U.S. has been driven by institutional investment and a favorable regulatory environment.

Institutional interest in Bitcoin mining has surged in the U.S. as major investors and firms seek to capitalize on the sector’s profitability and operational leniency compared to China.

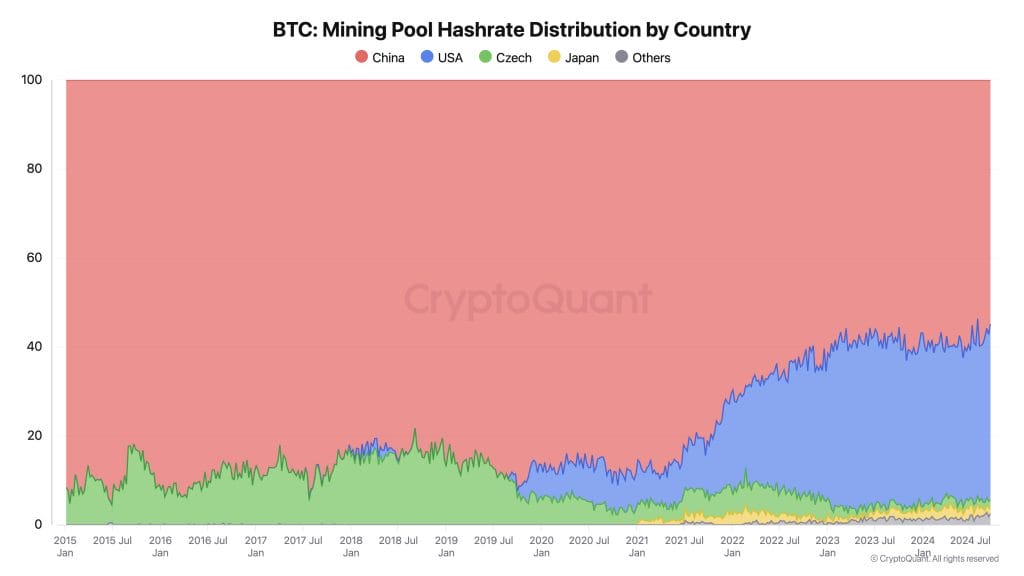

This trend is further supported by the involvement of key political figures, such as former President Donald Trump, who has expressed support for the crypto-mining industry.

In June 2024, Trump met with mining executives in Florida and promised that his administration would ensure the industry’s fair treatment if re-elected.

Even as the U.S. gains more dominance in Bitcoin mining, global miners face significant challenges, particularly regarding profitability.

Bitcoin mining revenue dropped significantly in August 2024, marking the lowest monthly revenue in a year.

Total miner revenue reached $827.56 million in August, down more than 10.5% from July’s $927.35 million. Despite the decline, revenue was still up 5% compared to the same period in 2023.

This revenue also decreased because of the instability and volatility in Bitcoin prices, which hovered around $56,000 throughout August with much market panic.

The combination of fluctuating Bitcoin prices and decreasing mining yields has created an environment where miners are under growing financial pressure, even as demand for Bitcoin remains high.

Miners globally are feeling the squeeze, but the shift in hashrate from China to the U.S. has allowed American mining firms to expand their operations and take advantage of cheaper electricity and more favorable regulatory conditions.