Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

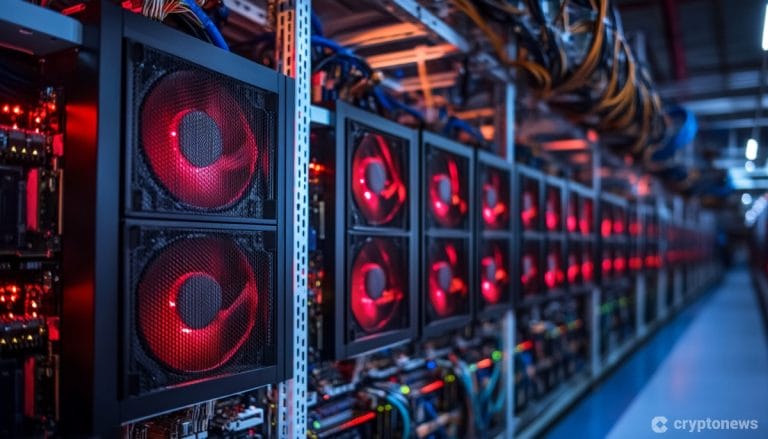

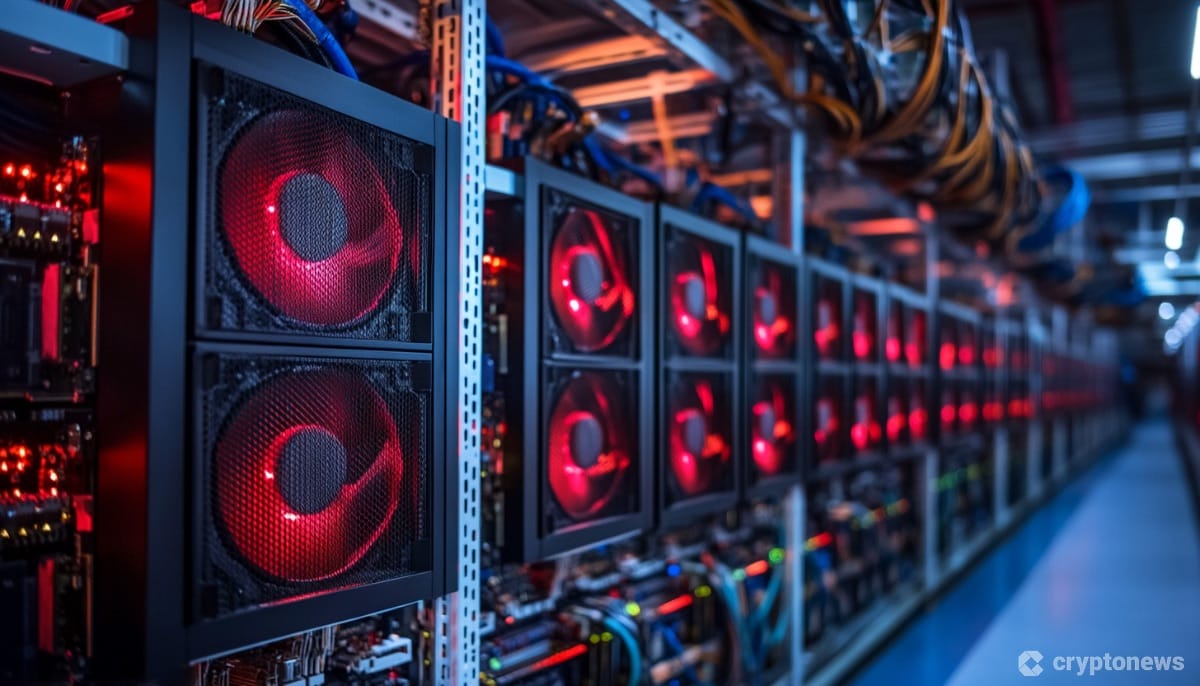

Bitcoin miner Terawulf has sold its 25% stake to partner firm Talen Energy in a transaction valued at $92 million. The proceeds will be reinvested in enhancing AI and Bitcoin mining operations, the official release said.

Terawulf has been planning to expand its operational infrastructure capacity since paying off all debts in July. In line with that, the miner plans to build a 20-megawatt facility, dedicated to high-performance computing (HPC) and AI data centres.

Dubbed CB-1, the facility will be located at its flagship Lake Mariner site in New York for its low-cost power.

Furthermore, the sale of 25% equity interest in Nautilus, a subsidiary of Talen Energy Corp., allows Terawulf to achieve a 3.4x return on its investment.

The $92 million includes $85 million in cash and 30,000 Talen-contributed Bitcoin miners and equipment valued at $7 million.

Paul Prager, CEO of TeraWulf, called the transaction “highly advantageous,” allowing the company to capture a significant premium for investment.

TeraWulf also aims to complete the construction of the mining building 5, “MB-5,” alongside CB-1. With the construction of the mining building, it intends to enhance the efficiency of mining fleet to achieve 18.2 J/TH.

“Together, these actions are expected to bring CB-1 online in Q1 2025, significantly enhance our mining fleet’s efficiency, reduce our cost-to-mine, and improve overall profitability, all while maintaining our commitment to utilising predominantly zero-carbon energy.”

Compared to other miners, TeraWulf and Core Scientific have outperformed by moving into AI hosting. Meanwhile, the largest miners by computing power, Marathon Digital and Riot Blockchain, witnessed their stocks decline this year due to profitability.

Following the news of the sale of 25% stake, TeraWulf (WULF) stock plunged 2.6% on Thursday, per Seekingalpha data.