Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

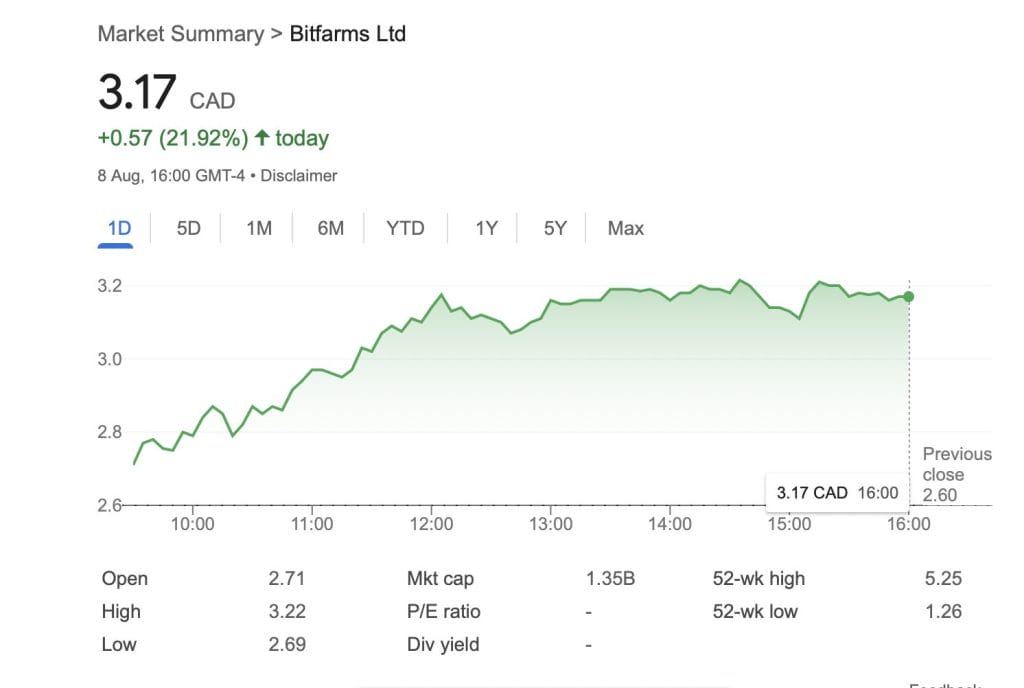

Bitcoin mining company, Bitfarms has experienced a surprising surge in its stock price, rising 20% despite reporting a mixed financial performance for the second quarter.

The company posted revenue of $42 million, which marks a 16% decrease from the previous quarter but a 17% increase compared to the same period last year.

Bitfarm revenue fluctuation follows the Bitcoin halving event on April 19, which halved the rewards miners receive, impacting their profitability.

Bitfarms Expands Capacity

Another factor behind Bitfarms’ stock surge is the company’s expansion efforts. Bitfarms said it has been actively diversifying its operations geographically, adding 220 megawatts (MW) of capacity in Paraguay and Pennsylvania.

This expansion included energizing its largest site to date in Paso Pe, Paraguay. The new site in Sharon, Pennsylvania, is also noteworthy due to its location on the PJM Interconnection, which will provide Bitfarms with long-term access to low-cost U.S. energy and flexible power trading options, said the firm.

The PJM grid is known for its energy supply, which is increasing its renewable capacity and contributing to reducing greenhouse gas emissions.

South America Becomes Bitfarms Largest Site

In South America, Bitfarms reports it has made notable progress by energizing its 70 MW site in Paso Pe, which has become the company’s largest site by both exahash (EH) and MW.

The bitcoin mining company has signed an agreement for an additional 100 MW in Yguazu, which will bring its total contracted power in Paraguay to 280 MW by the first half of 2025, making it the largest miner in the region.

South America remains a strategically important geography for Bitfarms due to favorable power contracts and access to reliable, sustainable energy sources.

The operational strategies show Bitfarms’ commitment to overcoming the financial setbacks caused by the Bitcoin halving event earlier this year.

Following the earnings report, Bitfarms stock rose 21.9%.

The mining firms’ stock performance reflects investor confidence in its expansion and its ability to adapt to the evolving Bitcoin mining landscape. The company’s focus on geographic diversification and sustainable energy positions has benefitted the firm.

In its recent earning report, rival Bitcoin mining firm Riot Platforms reported a total revenue of $70.0 million from the $76.7 million recorded in the same period last year. The drop is also due to the Bitcoin halving event in April.

Riot Platforms recently dropped its proposal to acquire Bitfarms. Following this Bitfarms has implemented a new strategy, or shareholder rights plan, to protect against future “creeping” bids.