10x Research CEO Markus Theilin cautioned traders, citing a “low $40,000s” Bitcoin as the best bull market entry for those buying the dip.

Theilin argues that Bitcoin’s price needs to return to levels seen around the launch of spot Bitcoin ETFs for an optimal entry point. Bitcoin was last within this range on February 6th, trading at $42,577. He said:

“To ideally time the next bull market entry, we aim for Bitcoin prices to fall into the low 40,000s.”

This outlook is concurrent with that expressed by other analysts. Notably, in an X post Cane Island Alternative Advisors founder Timothy Peterson cited “$40k and $80k equally likely in the next 60 days.”

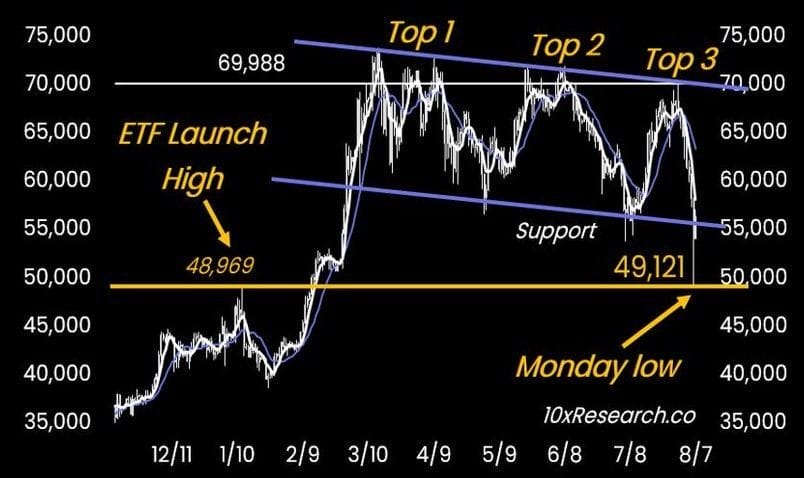

A 10x Research report highlighted a break below the support Bitcoin has established in its downtrend as significant.

Despite Bitcoin’s current recovery attempt, strong resistance from the well-defined downtrend will likely be “more challenging” after the recent support break, the firm added.

Something CryptoSeacom founder CryptoRover cited as a surefire indicator that “$40k is next,” addressing his 808,400 followers on X.

If #Bitcoin breaks this support, $40k is next. pic.twitter.com/nIsdTmr3rS

— Crypto Rover (@rovercrc) August 5, 2024

“I’d love to see Bitcoin drop to $50K, or even $40K. That would be a perfect opportunity to scoop up some more,” Gokhstein Media founder David Gokhstein added.

Thielen Cautions ‘Buying the Dip’ Too Soon

Thielen has also cautioned traders that “buying the dip” on Bitcoin is “too risky” despite signs of stabilizing and potentially recovering.

“Financial markets are like puzzles that need to be reassembled periodically, with new drivers of asset prices emerging,” Markus Thielen said. “This is one of those times.”

Additionally, he highlighted that this dip differs from those in April and June. While sharp declines were offset by increased leverage then, this might not happen now due to the current “slow trading” period.

“August and September are notorious for slow trading. Many institutional players are on vacation, and deploying large amounts of capital is the last thing on their minds,” Thielen added.

As a result, Thielin urges appropriate risk management as “critical” during this slow period.

“Opportunities will likely arise once this period ends,” he said.

ETF inflows remain stagnant

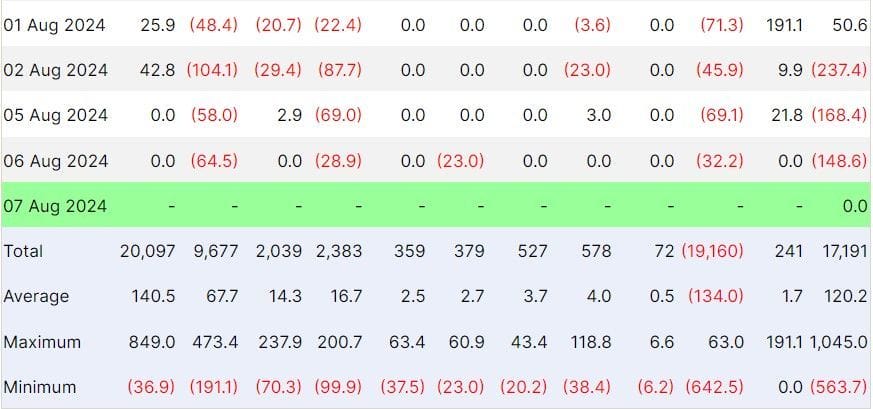

United States-based spot Bitcoin exchange-traded funds (ETFs) have been equally affected by elevated economic concerns, recording three days of consecutive outflows, with $148.6 million on August 6th.

Fidelity Advantage Bitcoin ETF Fund and Grayscale Bitcoin Trust ETF were the main contributors, shedding $64.5 million and $32.2 million, respectively, Farside Investors data shows.

In fact, all 11 Bitcoin ETFs recorded 0 net inflows across the board. Theilin noted this to be significant, serving as an indicator that retail investors are not buying the dip.

“Given Bitcoin’s current downtrend, retail investors, who often follow trends, may hesitate to engage in massive buy-the-dip ETF flows,” he added.

Theilin noted that investors in the Bitcoin ETFs are now “underwater” since the average price is “around $60,000.”