Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Gemini, the prominent cryptocurrency exchange, made history by setting a Guinness World Record with a 1,000-drone Bitcoin display in Austin, Texas. The March 13 spectacle showcased a massive BTC logo in the night sky, marking the US Strategic Bitcoin Reserve program.

The event featured:

- A Bitcoin logo formation, emphasizing Bitcoin’s growing influence.

- A rocket launch and lunar landing, symbolizing Bitcoin’s mission to revolutionize finance.

- The phrase “Go where dollars won’t”, highlighting BTC’s role as a global, borderless currency.

Gemini received an official Guinness certificate for the world’s largest airborne display of a monetary sign.

Impact on Bitcoin:

- Increased public awareness, reinforcing mainstream adoption.

- Potential institutional interest, as high-profile events build credibility.

- Price stability above $84,270, suggesting market confidence despite recent volatility.

As BTC adoption grows, events like these reinforce its legitimacy and long-term investment potential.

Uber Angel Investor Sparks Bitcoin Debate

Jason Calacanis, an early Uber investor, ignited controversy by stating that Bitcoin will be replaced by a superior alternative. He argued that, like all technologies, BTC must evolve or risk obsolescence.

However, industry leaders strongly disagreed:

- Brady Swenson (Swan Bitcoin Co-founder): Winning protocols evolve but don’t get replaced.

- David Marcus (Lightspark): Layer-2 solutions enhance Bitcoin’s capabilities instead of replacing it.

- Matt Cole (Strive Funds CEO): Dismissing Bitcoin’s resilience is shortsighted.

Despite the debate, Bitcoin remains dominant, trading above $84,300. Investors continue to see it as the gold standard of digital assets.

Why Bitcoin’s Supremacy Remains Unchallenged

- Network security: BTC has the highest level of decentralization.

- Growing institutional adoption: BlackRock, Fidelity, and other financial giants are backing BTC.

- Layer-2 scaling solutions: Enhancing Bitcoin without replacing its core protocol.

Bitcoin’s first-mover advantage and network effect make it extremely difficult to replace.

UK Crypto Rules Drive Companies Offshore

One year after the UK’s Financial Conduct Authority (FCA) introduced strict crypto marketing regulations, the industry is feeling the strain. The financial promotion (finprom) rules require crypto firms to seek approval before advertising, leading to:

- High compliance costs, limiting small startups.

- A 24-hour waiting period for new users, pushing traders to offshore exchanges.

- Strict guidelines for bloggers and influencers, restricting crypto-related content.

Impact of FCA Rules on the Crypto Industry

- Many startups have left the UK, opting for friendlier jurisdictions.

- Increased risk of scams, as users turn to unregulated platforms.

- Reduced consumer choice, with only large firms able to comply.

Despite these hurdles, BTC adoption remains strong globally. Regulatory restrictions signal Bitcoin’s growing significance, reinforcing its long-term legitimacy.

Bitcoin Price Analysis: Bulls Target $86K Breakout

Bitcoin (BTC/USD) is consolidating around $84,250, struggling to break above a key resistance zone near $84,500-$86,000. The 50-period EMA at $83,550 is providing support, reinforcing the uptrend from $79,900.

A breakout above $86,000 could trigger a bullish move toward $89,600, followed by $92,700 if momentum sustains. However, failure to clear resistance may result in a pullback to $83,500, with stronger support at $79,900.

The ascending trendline suggests buyers remain in control, but a higher volume breakout is needed to confirm a rally. Traders should watch for a clear move above $86,000 for further upside confirmation, while a drop below $83,500 could shift momentum bearish.

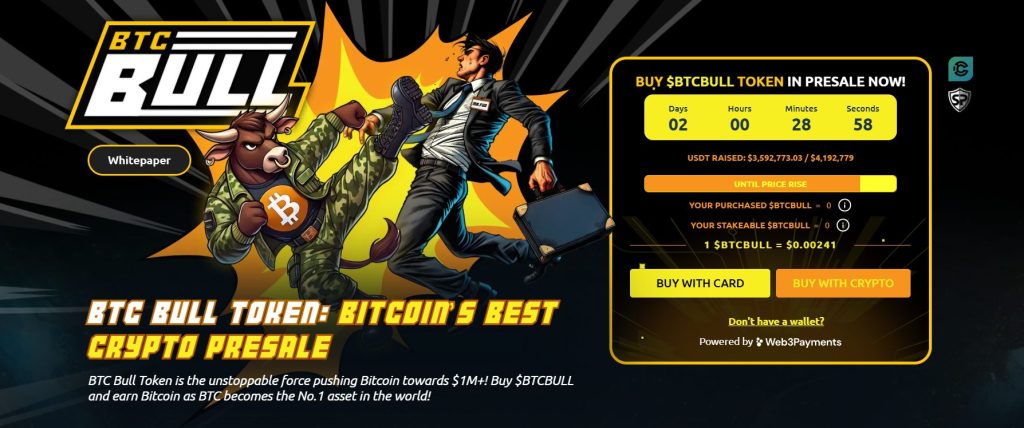

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.00241 per BTCBULL

- Total Raised: $3.5M / $4.1M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.