Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- Market sentiment is softening as technical indicators shift.

- Accumulation patterns and ETF moves signal broader hesitance.

- Indicators suggest this isn’t a routine pullback but a deeper recalibration.

- Underlying vulnerabilities may reshape long-term trends.

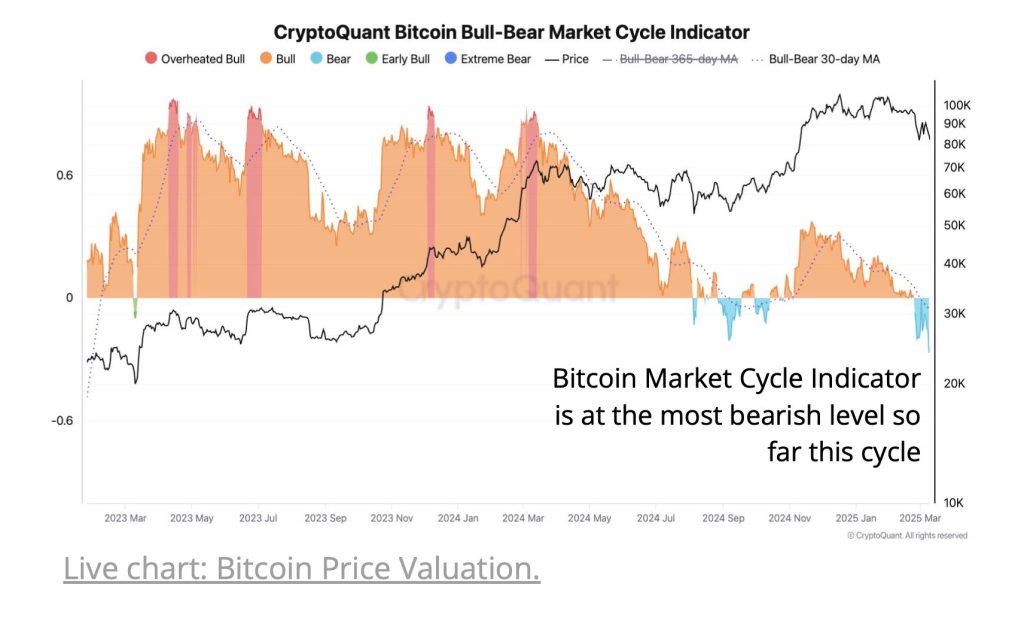

Bitcoin’s valuation metrics are pointing to bearish territory, and according to a CryptoQuant analyst, the market may be teetering between deep value levels and the onset of a bear market.

Whales accumulated over 65,000 BTC

“Despite the continued correction in bitcoin, whales have accumulated more than 65 thousand bitcoins in the last 30 days, indicating high buying pressure from large network participants.” – By @caueconomy

Read more ⤵️https://t.co/Hw72K0h47B pic.twitter.com/3RG7s0iR1j

— CryptoQuant.com (@cryptoquant_com) March 11, 2025

ryptoQuant’s analysis, published on March 11, reveals that nearly every major indicator now signals caution.

The Bitcoin Bull-Bear Market Cycle Indicator is currently at its most bearish level this cycle—a level that, in previous cycles, has either preceded a sharp correction or marked the beginning of a downturn.

In parallel, the MVRV Ratio Z-score has fallen below its 365-day moving average, suggesting that Bitcoin’s previously sustained upward momentum has markedly dissipated.

This shift in sentiment can be seen by the noticeable contraction in Bitcoin demand.

Recently, the apparent demand growth for Bitcoin dropped by 103,000 BTC in a single week, representing the fastest pace of contraction observed since July 2024.

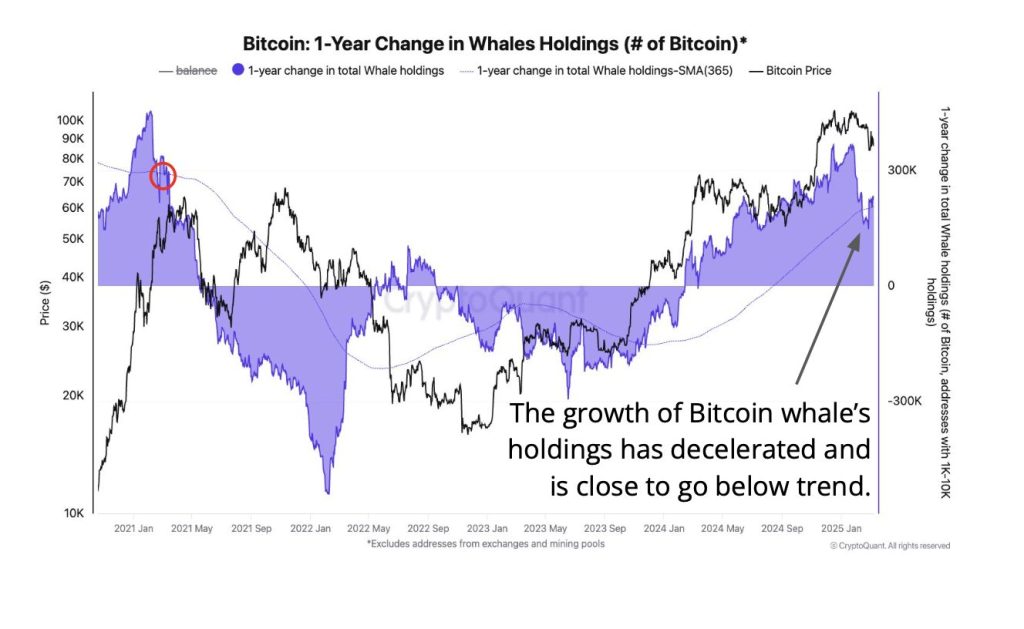

Bitcoin Whales Slow Accumulation, Signaling Reduced Demand

This steep decline indicates clear buyer hesitation and weakening market support.

Major whales, who have traditionally played a role in driving market movements through their huge accumulations, have also slowed their rate of Bitcoin acquisition.

U.S.-based spot ETFs have transitioned into net sellers of Bitcoin this year, further adding downward pressure on prices.

While Bitcoin’s current 22% price drawdown might seem in line with corrections experienced during previous bull market cycles, the valuation metrics paint a more concerning picture.

The metrics indicate that this is not a typical pullback but rather a deeper, more fundamental correction.

Bitcoin is trading around $81,000 as of writing—a range slightly below the trader’s on-chain realized price lower band, a key support level.

This precarious position was compounded Tuesday as the broader crypto market shed 6% amid investor anxiety triggered by President Donald Trump’s latest trade policies.

Heightened tensions over tariffs targeting major U.S. trading partners—Canada, Mexico, and China—have rattled markets, prompting a wave of sell-offs across risk assets

Should Bitcoin fail to maintain this support, its next major target is around $63,000.

This level corresponds with the Trader’s minimum on-chain realized price band, a threshold that has historically acted as the ultimate safety net during severe price corrections.

The insights provided by the CryptoQuant analyst highlight a convergence of factors that are amplifying market uncertainty.

Given the bearish signals, reduced demand, slowing whale accumulation, and ETFs becoming net sellers, Bitcoin’s market stands at a critical juncture.

Investors face an essential question: Are these indicators simply short-term anomalies, or do they signify deeper, structural vulnerabilities in the Bitcoin market?

How stakeholders interpret these signals in the coming weeks could determine whether Bitcoin rebounds strongly or slips further into bearish territory.

Frequently Asked Questions (FAQs)

A deeper correction may signal a market reset, exposing underlying vulnerabilities while offering strategic entry points. This phase can recalibrate inflated valuations and potentially foster a more robust, sustainable long-term Bitcoin trend.

Shifts in institutional behavior, like changes in ETF strategies and slower accumulation, can drive broader market sentiment. Their actions affect liquidity and may shape Bitcoin’s price trajectory significantly.

Wider economic shifts, like political unrest and changes in trade rules, can make markets more unpredictable. These external pressures often make Bitcoin more reactive to investor moods, speeding up price changes.