Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ark invests cautions “make or break moment” for the Bitcoin price as it faces crucial support levels weighed down by stacking risk factors.

In the latest monthly report, US investment management firm ARK Invest scrutinized Bitcoin’s “most important price supports” of $52,000 and $46,000.

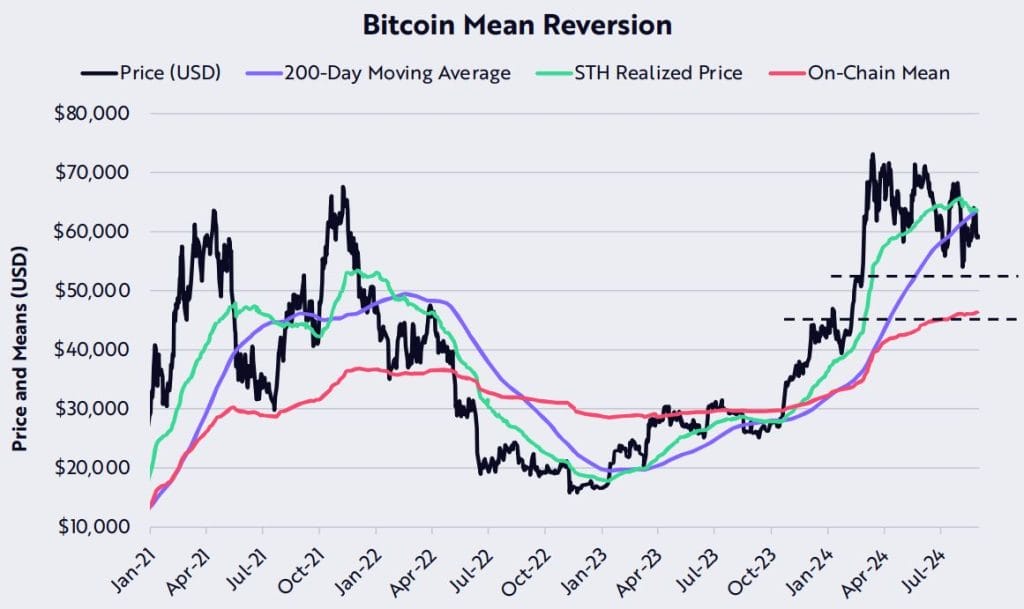

The report notes that Bitcoin price movement no longer respects classic bull market support levels, such as the 200-day moving average and short-term holder cost basis, defined as $63,693 and $63,245, respectively.

Mean reversion levels suggest that the on-chain reversion level near $46,000 could serve as a last chance, with ARK defining its overall stance as “bearish.”

“Currently, bitcoin’s most important price supports are at $52,000 and $46,000, the latter confirmed by its on-chain mean, the red line on the chart,” accompanying commentary confirms.

Bring in the Bears: Staking Risk Factors Threaten Key Support

A recent Glassnode report pointed to a potential “source of risk” as short-term Bitcoin holders grapple with unrealized losses, raising concerns of potential sell-off pressure.

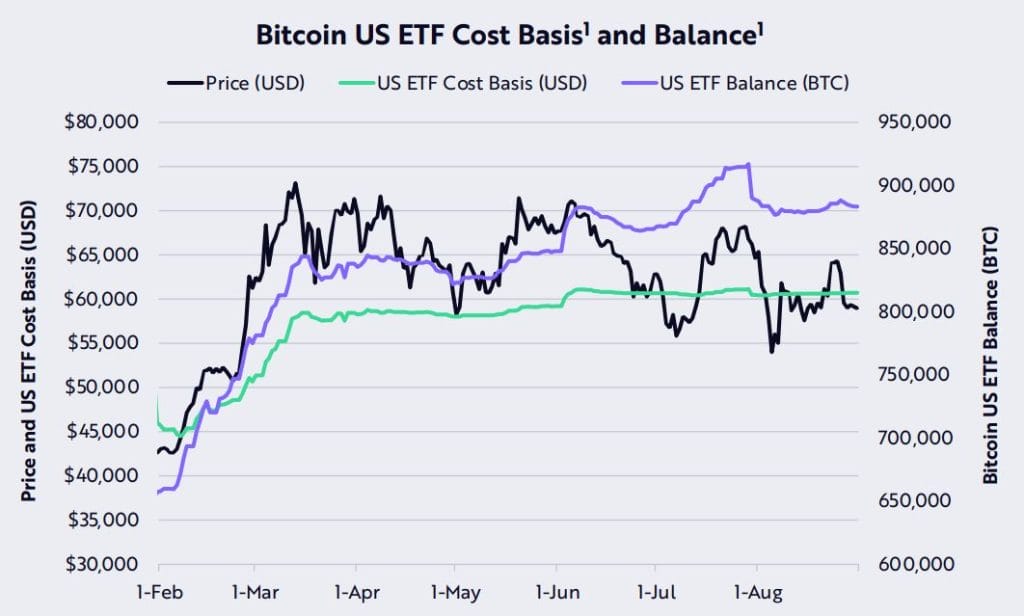

Similarly, ARK Invest noted that institutional investors also face unrealized losses. Holders of US spot Bitcoin exchange-traded funds (ETFs) could risk being in the red eight months after their launch.

The report noted that at the end of August, the estimated cost basis of US spot ETF participants was higher than bitcoin’s price, something which spikes concerns that “the average ETF investor may be at a loss.”

Meanwhile, the report also noted “broad macroeconomic weakness” as a risk factor, citing declines in the dollar, employment, and inflation.

This concern has become paramount among other analysts who view these building macroeconomic issues as indicators of a potential recession. The culmination is the upcoming September 18th US Federal Reserve interest rate decision.

While a 25 basis point cut is seen as the more favorable outcome, possibly leading to “lead to long-term price appreciation for Bitcoin as liquidity increases and recession fears ease,” the report cautioned that a more aggressive cut could have the opposite effect.

A 25 basis point cut is seen as the more favorable outcome, possibly leading to long-term price appreciation for Bitcoin as the jitters about a slowing US economy and the prospects of a recession ease.

Conversely, a more aggressive rate cut could have a negative effect, heightening recession fears and potentially leading to a significant Bitcoin retracement, with some anticipating a 20% drop.

Currently, traders assign a 27% probability to a 50 basis point cut, according to CME’s FedWatch tool. However, 10x Research warns that this contrasts with their view of the “prevailing consensus,” leaning towards aggressive cuts.

Guiding Light: ARK Remains Optimistic On Bitcoin

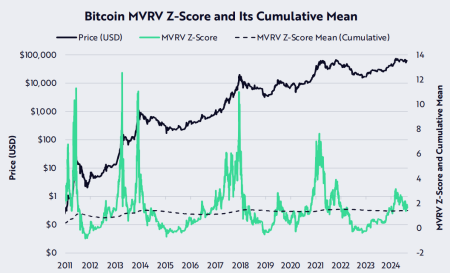

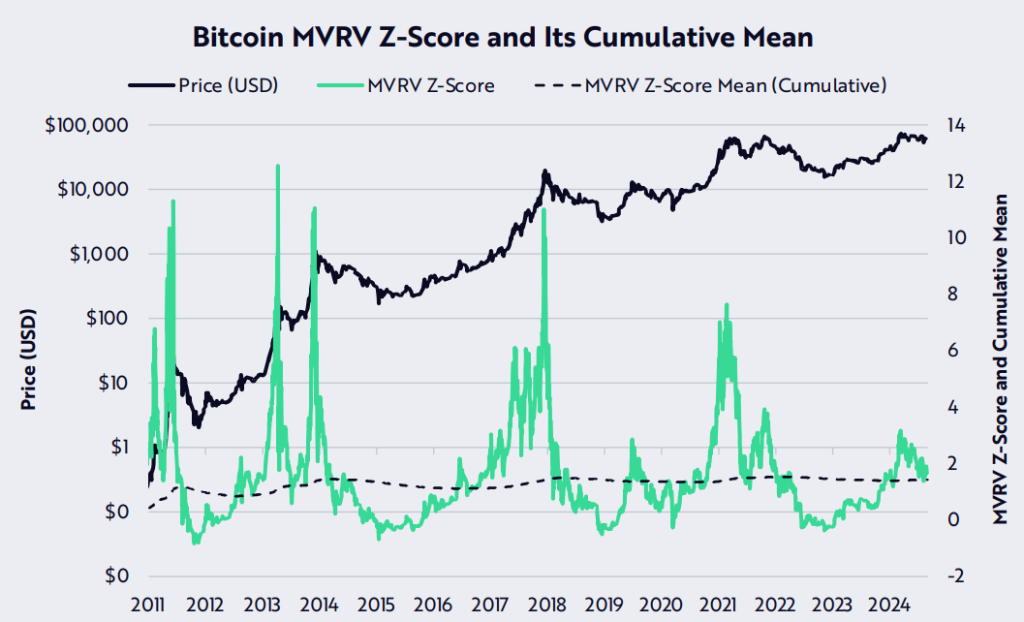

Despite these bearish indicators, ARK Invest maintains a bullish outlook for Bitcoin, citing historical data supporting the current bull market. The Bitcoin MVRV Z-score, which compares market cap to its cost basis, remains in “bull market territory.”

At the end of August, the MVRV Z-score was 1.6, while the mean score was 1.42. The mean value of the MVRV Z-score acts as a dividing line: scores above the mean indicate a bull market, while scores below suggest a potential bear market.

While it still remains entirely credible that we may approach these supports, it may be an accumulation opportunity rather than a prelude to a bear market.

This sentiment is echoed by a past 10x Research report, which cited the optimal bull market entry in the low $40,000 range.

Additionally, other analysts support this view, pointing to historical and technical patterns as grounds that the final quarter of this year could be a potential breakout point, with a six-figure Bitcoin “still in play” as we move toward 2025.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.