Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Key Takeaways:

- Total Bitcoin spot trading volume on crypto exchanges declined from a high of $44 billion on Feb. 3, to $10 billion at the end of Q1.

- Binance’s share of total daily Bitcoin spot trading volume increased from 33% on February 3 to 49% by the end of Q1.

- Bitcoin prices showed increasing volatility, larger spot trading volumes favored Binance over other exchanges.

Bitcoin and altcoin spot trading volumes have experienced a decline as the cryptocurrency market entered into a correction phase over the past two months, an April 7 CryptoQuant Report.

The sharp downturn in prices has impacted the overall trading activity across various exchanges, reflecting a slowdown in investor enthusiasm and market participation.

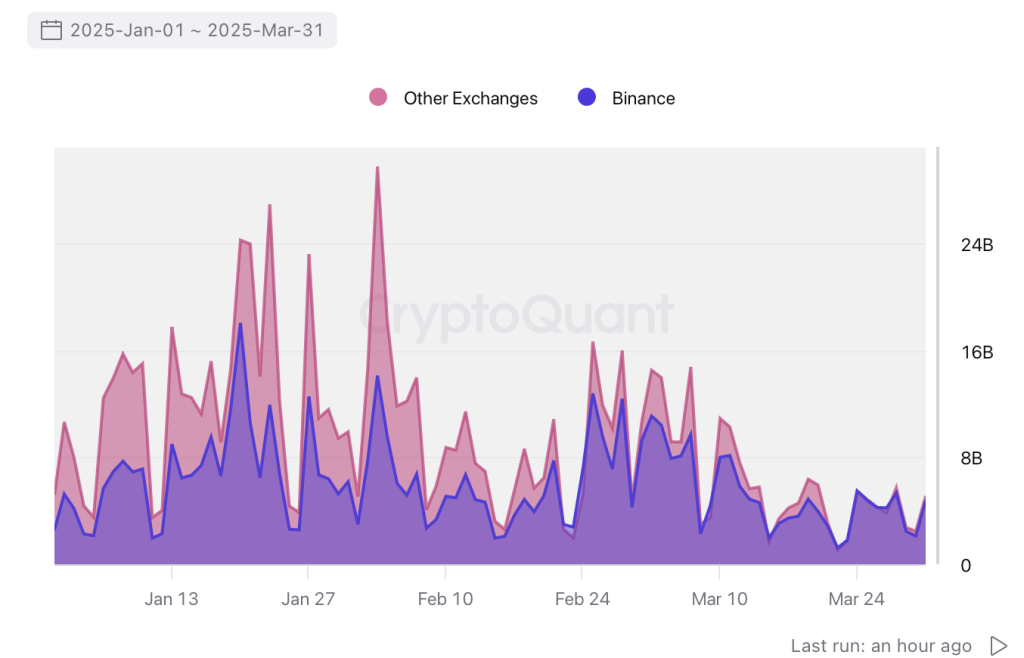

Specifically, Bitcoin’s spot trading volume on crypto exchanges dropped from a high of $44 billion on February 3 to just $10 billion by the end of the first quarter, as reported by CryptoQuant.

Similarly, the total spot trading volume of altcoins saw a considerable decrease, from $122 billion on February 3 to $23 billion by the end of Q1.

Crypto Exchange Binance Sees Spike in Activity: CryptoQuant

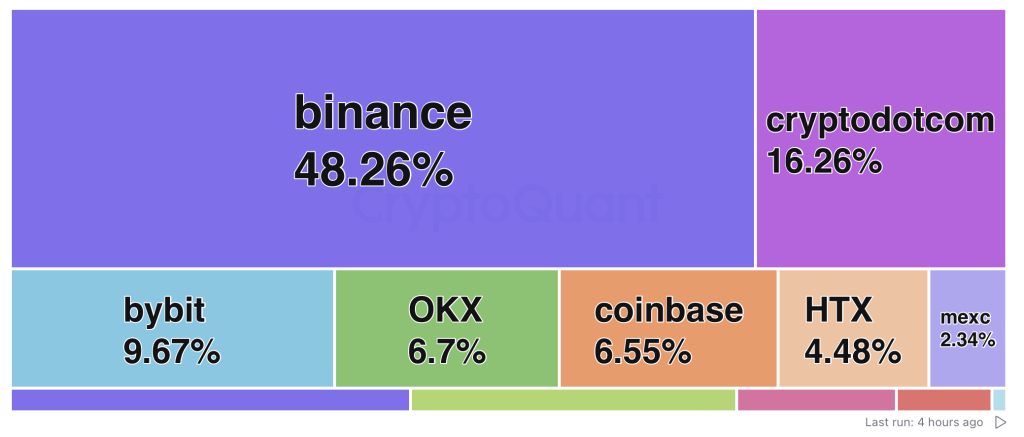

Binance, the largest cryptocurrency exchange by volume, has seen its dominance increase.

Binance’s share of the total daily Bitcoin spot trading volume surged from 33% on February 3 to 49% by the end of Q1.

This rise in Binance’s market share suggests that trading volumes on other exchanges have been shrinking at a faster rate.

The shift shows Binance’s growing role as a liquidity hub, especially during periods of high market volatility.

As the largest exchange, Binance absorbs a larger share of the market.

The increasing dominance of Binance is evident during sharp price fluctuations.

For instance, when Bitcoin’s price plummeted from $96,000 to $90,000 over the course of two days in late February, Binance recorded spot trading volumes that surpassed those of all other exchanges combined.

During this period, Binance’s share of the total altcoin spot trading volume spiked to 64%, reaching an impressive $18 billion, reports CryptoQuant.

This surge in trading volume reflects Binance’s critical role in providing liquidity during periods of heightened volatility, further cementing its position as the go-to exchange for traders during market corrections.

Despite the broader slowdown in crypto trading volumes, certain altcoins have continued to exhibit relatively high levels of activity on Binance.

For example, large altcoins such as Binance Coin (BNB), Toncoin (TON), and EOS have maintained higher trading volumes, even as overall market activity has contracted.

This suggests that while the broader market may be in a downturn, specific assets continue to attract attention and trading interest, particularly on Binance.

The resilience of these altcoins, in terms of trading volume, could indicate a concentration of investor interest in particular tokens, even during broader market corrections.