Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

As historical, technical, and fundamental factors ring bullish, analysts believe the groundwork has been laid for an impending altseason, with some citing its potential to be the “biggest bull run for altcoins since 2017.”

In a September 23rd X post, pseudonymous analyst Moustache observed that TOTAL2, the altcoins’ total market cap excluding Bitcoin, was in the process of breaking out of a descending broadening wedge that has been in play for the past six months.

Moustache explained that the optimistic outlook for altcoins is supported by the RSI breaking out of its downward trend fuelled by recent buying pressure, leading to an impending bullish cross from the moving average convergence divergence indicator (MACD).

He further emphasized that this setup could lead to “a god candle like we haven’t seen for years,” signaling a significant bullish movement in the altcoin market.

With this recent buying pressure, Bitcoin’s dominance has lapsed to 57.48%, down 0.71% over the past week, according to TradingView data.

Analysts have interpreted this sharp decline as a sign that Bitcoin’s dominance is peaking. Investors appear to be selling BTC and rotating their capital into alternative coins, indicating that “altcoins are likely the focus for now.”

The Perfect Storm: Fundamental Catalysts Favour an Altseason

While technical indicators suggest an impending breakout, it is the fundamental catalysts that will sustain a more prolonged altseason. Pseudonymous analyst Tracer outlined this perspective in a September 23rd X thread, highlighting several key factors.

Most notably, the Federal Reserve’s decision to cut interest rates by 50 basis points has fostered a more risk-on attitude among investors, leading them to venture into more speculative investments like cryptocurrency as the cost of borrowing lowers.

Tracer also pointed out the anticipated release of $16 billion from FTX creditors between December 2024 and March 2025, which is expected to inject more capital into the market.

Recent 10x Research reports echo this sentiment, estimating that between $5 billion and $8 billion could re-enter the crypto space, further propelling Bitcoin and Altcoin’s ascent.

Political developments have also significantly bolstered sentiment in the cryptocurrency market, with the upcoming US election emerging as a major catalyst for optimism.

Vice President Kamala Harris’s first public endorsement of digital assets has heightened this bullish outlook. In her recent comments, she affirmed a commitment to supporting crypto and AI to foster innovation.

This endorsement, along with Donald Trump’s open support for cryptocurrency, highlights a growing bipartisan backing that is expected to drive significant momentum in the cryptocurrency space as the push for regulatory clarity intensifies. Tracer summarised:

Everything points to an imminent rise and altseason.

Altcoin Season Isn’t Here Yet, According to Metrics

With this building bullish narrative surrounding altseason, analysts like Tracer forecast a kick-off as soon as 9 days away.

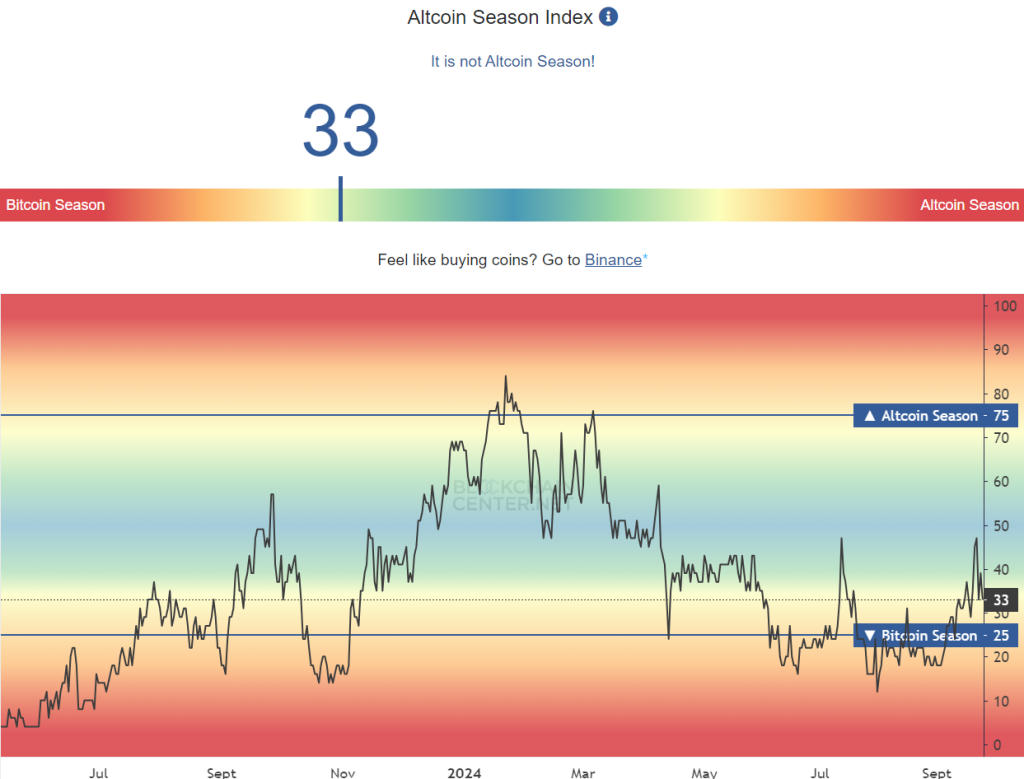

However, it’s not yet time to celebrate, as the altcoin season index by Blockchain Center indicates that “it is not altcoin season.”

According to this index, 75% of the top 50 coins need to outperform Bitcoin over the last season (90 days) for a technical altseason.

Currently, the index shows that just 33% of the leading 50 altcoins have outperformed, a slight step back from its sharp rise to 46% last week.

Therefore, while optimism is high and catalysts are aligning, caution remains as the market waits for a more decisive shift in altcoin performance.

Meanwhile, we remain in an accumulation zone as we approach this critical juncture, presenting a valuable opportunity for investors to reaffirm their positions on the most promising altcoins leading into altseason.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.