Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Bitcoin (BTC) is trading around $96,000, down nearly 1% in the past 24 hours, with a trading volume of $15.55 billion. The cryptocurrency is struggling to break above the $97,000 resistance level, which aligns with the 50-Day Exponential Moving Average (EMA). This level is crucial for determining Bitcoin’s next move, as a breakout could trigger a bullish rally, while a rejection may lead to a pullback.

Whale activity is painting an interesting picture. Data reveals that large Bitcoin holders ramped up their buying in mid-February, with inflows increasing from 100.77 BTC to 7,460 BTC by February 20. Outflows also peaked mid-month but have since dropped to 920.64 BTC, signaling reduced selling pressure.

The disparity between inflows and outflows suggests aggressive accumulation by whales, which is typically a bullish indicator.

This accumulation phase is happening amid Bitcoin’s price consolidation, reflecting market indecision. If Bitcoin can clear the $97,000 resistance, it could target the next resistance at $98,500, followed by the psychological $100,000 level.

Conversely, failure to break above $97,000 may trigger a pullback to immediate support at $95,000, potentially leading to a retest of $93,500 or even $92,000.

M2 Money Supply Rise Could Boost Bitcoin Liquidity

The global M2 money supply is increasing, signaling higher market liquidity. This is crucial for Bitcoin, as more liquidity often leads to increased investment in digital assets. Analysts believe Bitcoin could mirror this upward trend, especially if central banks adopt looser monetary policies.

Investors are watching for potential rate cuts from the Federal Reserve. If this happens, it could inject more liquidity into financial markets, possibly boosting Bitcoin’s price. Historically, Bitcoin performs well in high-liquidity environments, attracting both institutional and retail investors.

However, market sentiment remains cautious. Bitcoin ETFs are showing negative flows, and exchange activity is at multi-year lows, reflecting regulatory uncertainties and economic pressures. Despite this, large holders are accumulating Bitcoin, hinting at optimism for a bullish reversal once sentiment shifts.

Key Insights:

- Rising M2 money supply boosts liquidity, favorable for Bitcoin.

- Cautious market sentiment due to regulatory and economic concerns.

- Whale accumulation suggests potential bullish reversal.

Technical Analysis: Will Bitcoin Break $97,000?

Bitcoin is currently testing the $97,000 resistance level, which coincides with the 50-Day EMA, acting as dynamic resistance. A successful breakout above this level could push Bitcoin towards the next resistance at $98,500 and potentially $100,000. However, the Relative Strength Index (RSI) is hovering near 50, indicating market indecision.

On the downside, immediate support is at $95,000, with the next support levels at $93,500 and $92,000. A break below $95,000 could intensify selling pressure, potentially driving Bitcoin towards $93,500. The bearish momentum would be confirmed if BTC falls below $92,000, negating the bullish outlook.

Traders should watch the $97,000 resistance and $95,000 support closely, as a breakout or breakdown from these levels will determine Bitcoin’s next move. The bullish sentiment remains intact as long as Bitcoin holds above the $95,000 pivot point

Key Insights:

- Resistance at $97,000: The 50-Day EMA is acting as dynamic resistance. A breakout above this level could target $98,500 and $100,000.

- Support at $95,000: A drop below $95,000 could lead to further declines towards $93,500 and $92,000.

- Whale Accumulation: Large holder inflows indicate aggressive accumulation, suggesting bullish sentiment despite market indecision.

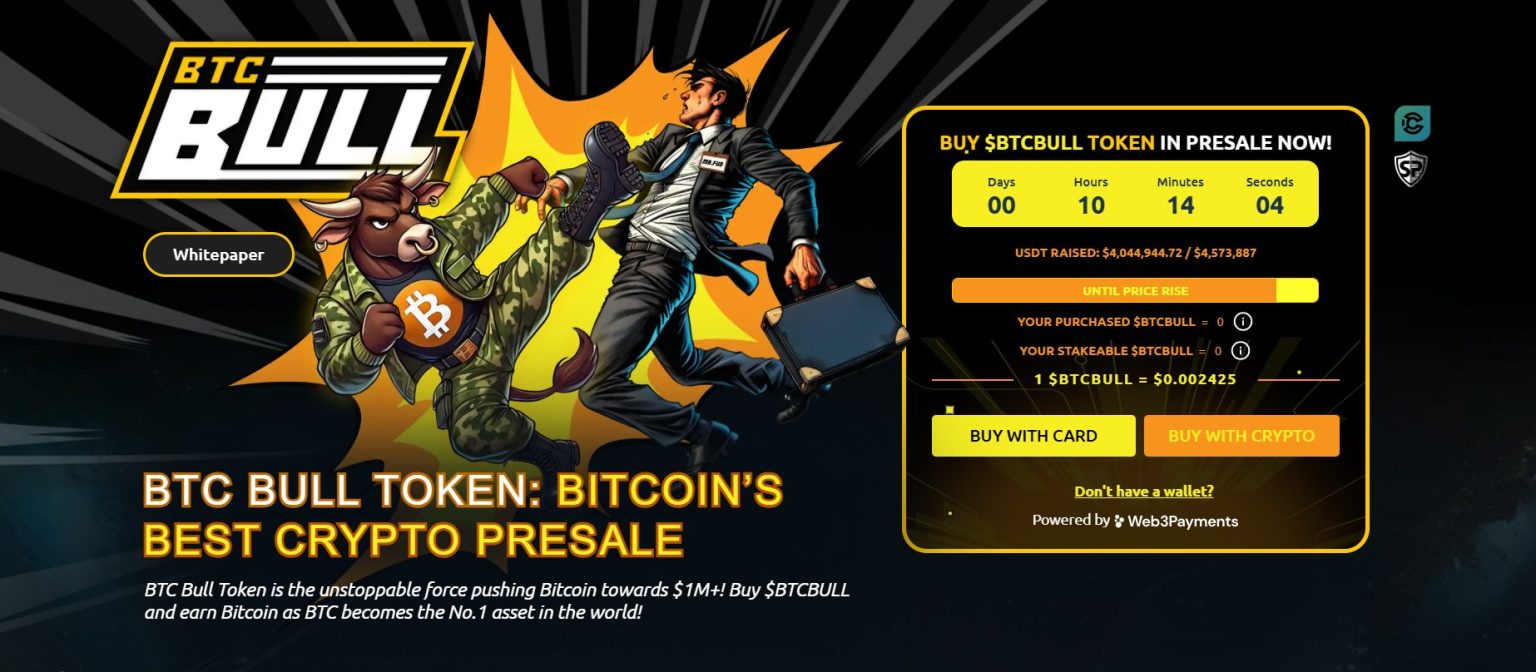

BTC Bull: Earn Real Bitcoin Rewards

BTC Bull ($BTCBULL) is gaining traction as a meme-powered, community-driven token that rewards its holders with real Bitcoin. Unlike traditional tokens, BTC Bull automatically airdrops BTC to holders as Bitcoin hits key price milestones, creating a compelling incentive for early adopters and long-term investors.

The project also offers a staking feature with an attractive 169% annual yield, allowing users to earn passive income while supporting the token’s ecosystem. With a total staking pool of 620,764,851 BTCBULL, the rewards system is designed to maximize investor returns.

Currently, the presale is live with tokens available at $0.00238 each. Over $2.6 million has been raised out of a $3.29 million target. With a price increase on the horizon, now is an opportune time to invest and maximize potential rewards with BTCBULL.