Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

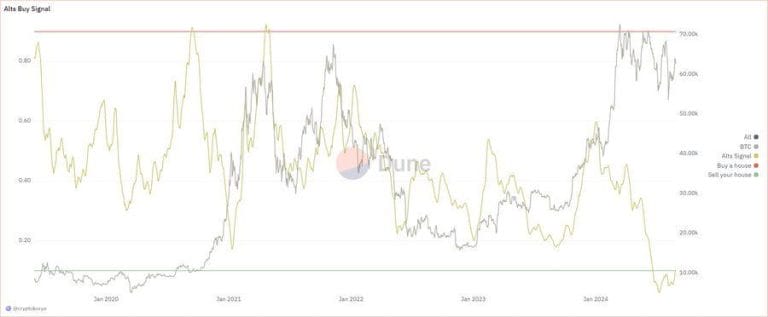

Prominent crypto trader Luke Martin believes altcoins might be in a prime accumulation phase amidst a brewing altcoin season, pointing out a buy signal that hasn’t triggered so low in over three years.

In an August 28th X post, Martin highlighted a significant development on the “alts buy signal” chart, which indicates buy signals for the overall altcoin market based on historical data.

Martin said that when Bitcoin was at this level in the summer of 2020, the price “went vertical” in a sixfold surge which saw bitcoin go from $10k to 60k in the latter half of the year.

He cites this historical precedent as a strong indicator that altcoins might currently be at a “sell your house to buy more” level, suggesting a potential opportunity for traders to capitalize on undervalued altcoins before a possible market upturn.

Are Altcoins Really About To Surge?

While an altcoin season might appear unlikely given the current flood of negative sentiment in the market, other indicators lend credibility to the potential for an altcoin rally.

In an X post on the same day, pseudonymous crypto trader Mags highlighted a significant technical development: the altcoin market cap chart has formed a falling wedge pattern.

Mags described this formation as a “bullish continuation pattern,” indicating a potential continuation or reversal of the prevailing trend once the price breaks out of the wedge.

For the altcoin market, the falling wedge pattern implies that a bullish breakout could be on the horizon. This aligns with other experts’ opinions suggesting that the altcoin market might be setting up for a significant rally.

MN Consultancy founder Michael van de Poppe highlighted the magnitude of the opportunity, citing there to be “so much on the tables to be made in the coming period” as we still remain 47% down from previous highs.

When Is Altcoin Season Coming?

The timing of the next altcoin season remains a hot topic in the crypto community, especially given current market conditions.

The Fear & Greed Index, a widely followed sentiment indicator, currently sits at a score of 29, indicating a period of “fear.” This is a notable drop of 10 points from last week, according to alternative.me data, reflecting caution among investors.

Notably, the Bitcoin halving could serve as a benchmark for predicting the next altcoin surge. In an August 21st X post, CryptoQuant CEO Ki Young Ju noted that past post-halving rallies have typically started in the fourth quarter (Q4) of each halving year.

Young Ju further emphasized that, in his view, “whales won’t let Q4 be boring with a flat YoY performance,” implying that significant market movements are expected as we approach the end of the year.

As Bitcoin’s price action often sets the stage for the broader crypto market, these developments could pave the way for an altcoin season as investors seek opportunities beyond Bitcoin.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.