Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Once dismissed as internet jokes, meme coins like Dogecoin (DOGE) and Pepe (PEPE) have exploded in popularity, propelling the sector to become the fourth most valuable in crypto. Yet, beneath the hype, lies a volatile and risky market.

A new report “State of Memecoin 2024” conducted by Chainplay, a hub for GameFi market data, paints a bleak picture of the current meme coin industry. The research, published on Aug. 13, analyzed over 30,000 meme coin projects across Ethereum (ETH), Solana (SOL), and Base.

A Short and Volatile Life of Meme Coins

The average lifespan of a meme coin is a mere year, compared to three years for other crypto projects. Moreover, 97% of all meme coins have already failed, with over 2,000 disappearing monthly. This high turnover rate reflects the speculative nature of these assets, as nearly 60% of investors view them as short-term bets.

🚨 State of Memecoin 2024: High Risk, High Reward 🚨

Memecoins: A rollercoaster of fortunes or a financial minefield? Our latest study of 30,000 projects unveils the shocking realities behind the hype.

Key findings:

⚰️97% of memecoins have died since 2024

⏳Average lifespan:… pic.twitter.com/rOvHreXq8X— ChainPlay.GG (@Chainplaygg) August 6, 2024

Moreover, the study found that 2020 meme coin projects are dying at a rate of 20 per month, largely because new projects struggle to gain traction and survive.

Chainplay identified dead meme coins based on four factors: 24-hour volume under $1,000, no Twitter updates in three months, liquidity pool below $50,000, or deleted Twitter account.

Malicious Actors Prevalent in the Meme Coin Sector

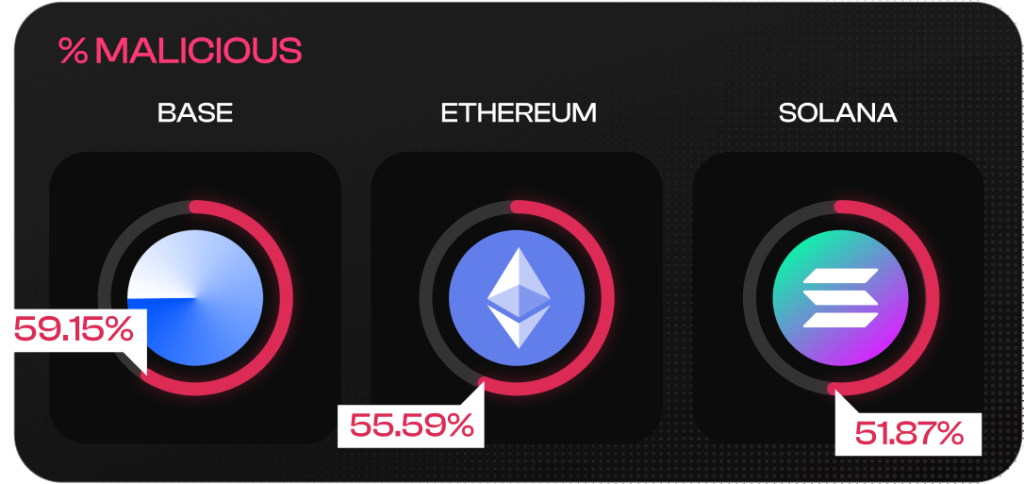

The research also revealed the alarming prevalence of scam activity within the meme coin market. More than half (55.24%) of all meme coins analyzed were classified as “malicious”. Base tops the list with the highest rate of malicious meme coins at 59.15%, followed by Ethereum at 55.59% and Solana at 51.87%.

The report also highlights the financial risks associated with these digital assets. Nearly one-third of investors (28%) surveyed reported falling victim to meme coin scams. However, audit reports can be effective in identifying fraudulent projects, with an 81% success rate.

Meme Coins Are Still Popular With Investors

Despite high risks and volatility, meme coins continue to attract a significant investor base. Two-thirds of cryptocurrency investors (58%) have ventured into the meme coin market, driven by the allure of potentially high returns.

However, the study reveals a divergence in investor sentiment based on experience. While newer investors (those in the market for less than six months) are more likely to view meme coins as essential portfolio holdings, long-term investors adopt a more cautious approach.

Media coverage of meme coins is predominantly skeptical, with only 13.77% of news reports expressing bullish sentiment. This reflects the overall cautious view of the industry and its potential risks.

Pump.fun Rakes in Record Revenue

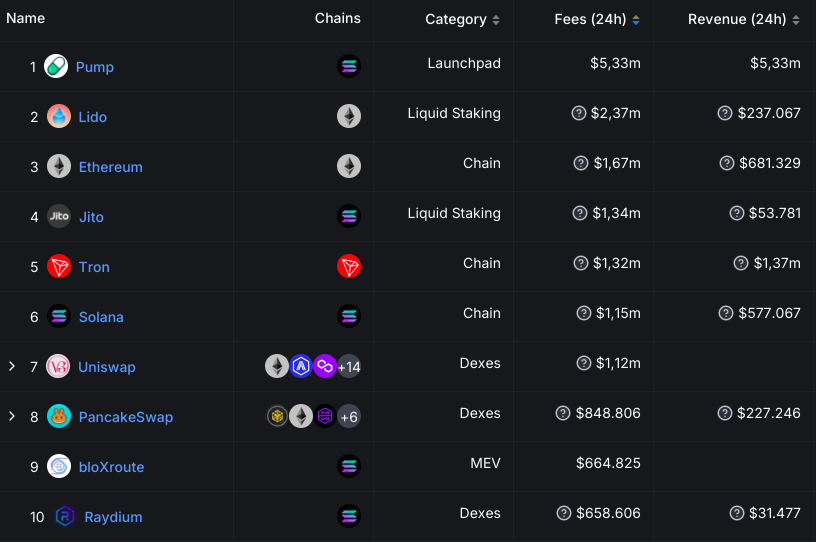

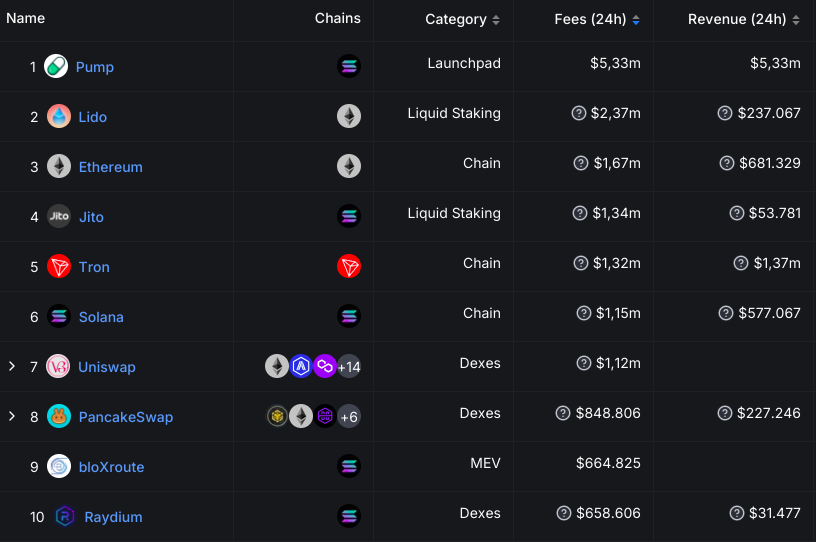

Despite the high failure rate of meme coins, interest in these crypto assets remains high. Pump.fun, a Solana-based deployer of meme coins, generated over $5.3 million in revenue in 24 hours, according to DefiLlama data.

Pump.fun’s revenue impressively dwarfs that of established blockchain networks such as Ethereum and Solana, which had combined revenue and fees of $2.35 million and $1.72 million, respectively.